Earnings summaries and quarterly performance for Paylocity Holding.

Executive leadership at Paylocity Holding.

Toby Williams

Chief Executive Officer

Andrew Cappotelli

Senior Vice President of Operations

Joshua Scutt

Senior Vice President of Sales

Melissa King

Senior Vice President of Product and Technology

Nicholas Rost

Chief Accounting Officer and Treasurer

Ryan Glenn

Chief Financial Officer

Steven Beauchamp

Executive Chairman

Board of directors at Paylocity Holding.

Research analysts who have asked questions during Paylocity Holding earnings calls.

Daniel Jester

BMO Capital Markets

7 questions for PCTY

Jared Levine

TD Cowen

7 questions for PCTY

Mark Marcon

Baird

7 questions for PCTY

Jason Celino

KeyBanc Capital Markets

6 questions for PCTY

Brad Reback

Stifel

5 questions for PCTY

Scott Berg

Needham & Company, LLC

5 questions for PCTY

Alex Zukin

Wolfe Research LLC

4 questions for PCTY

Jake Roberge

William Blair & Company, L.L.C

4 questions for PCTY

Samad Samana

Jefferies

4 questions for PCTY

Sheldon McMeans

Barclays

4 questions for PCTY

Siti Panigrahi

Mizuho Securities

4 questions for PCTY

Zachary Gunn

Financial Technology Partners

4 questions for PCTY

Austin Cole

Citizens JMP Securities, LLC

3 questions for PCTY

Jacob Smith

Guggenheim Securities

3 questions for PCTY

Matt Vanvliet

Cantor Fitzgerald

3 questions for PCTY

Steve Enders

Citigroup

3 questions for PCTY

Terrell Tillman

Truist Securities

3 questions for PCTY

Arvind Ramnani

Piper Sandler

2 questions for PCTY

Brian Peterson

Raymond James Financial

2 questions for PCTY

Connor Passarella

Truist Securities, Inc.

2 questions for PCTY

George Kurosawa

Citigroup Inc.

2 questions for PCTY

Ian Black

Needham & Company

2 questions for PCTY

Jacob Roberge

William Blair

2 questions for PCTY

Jessica

Raymond James & Associates

2 questions for PCTY

Jordan Barrett

Jefferies

2 questions for PCTY

Kincaid

Citizens Bank

2 questions for PCTY

Madeline Brooks

Bank of America

2 questions for PCTY

Raimo Lenschow

Barclays

2 questions for PCTY

Aleksandr Zukin

Wolfe Research

1 question for PCTY

Allan Verkhovski

Scotiabank

1 question for PCTY

Dominique Manansala

Truist Securities

1 question for PCTY

Jessica Wang

Raymond James & Associates, Inc.

1 question for PCTY

Johnathan McCary

Raymond James

1 question for PCTY

John Messina

Raymond James

1 question for PCTY

Kevin McVeigh

Credit Suisse Group AG

1 question for PCTY

Kincaid LaCorte

Citizen JMP

1 question for PCTY

Phillip Leytes

Mizuho

1 question for PCTY

Robert Dee

Truist Securities

1 question for PCTY

Sean McMahon

Barclays

1 question for PCTY

Sitikantha Panigrahi

Mizuho

1 question for PCTY

Steven Enders

Citigroup Inc.

1 question for PCTY

Zane Meehan

KeyBanc Capital Markets Inc.

1 question for PCTY

Recent press releases and 8-K filings for PCTY.

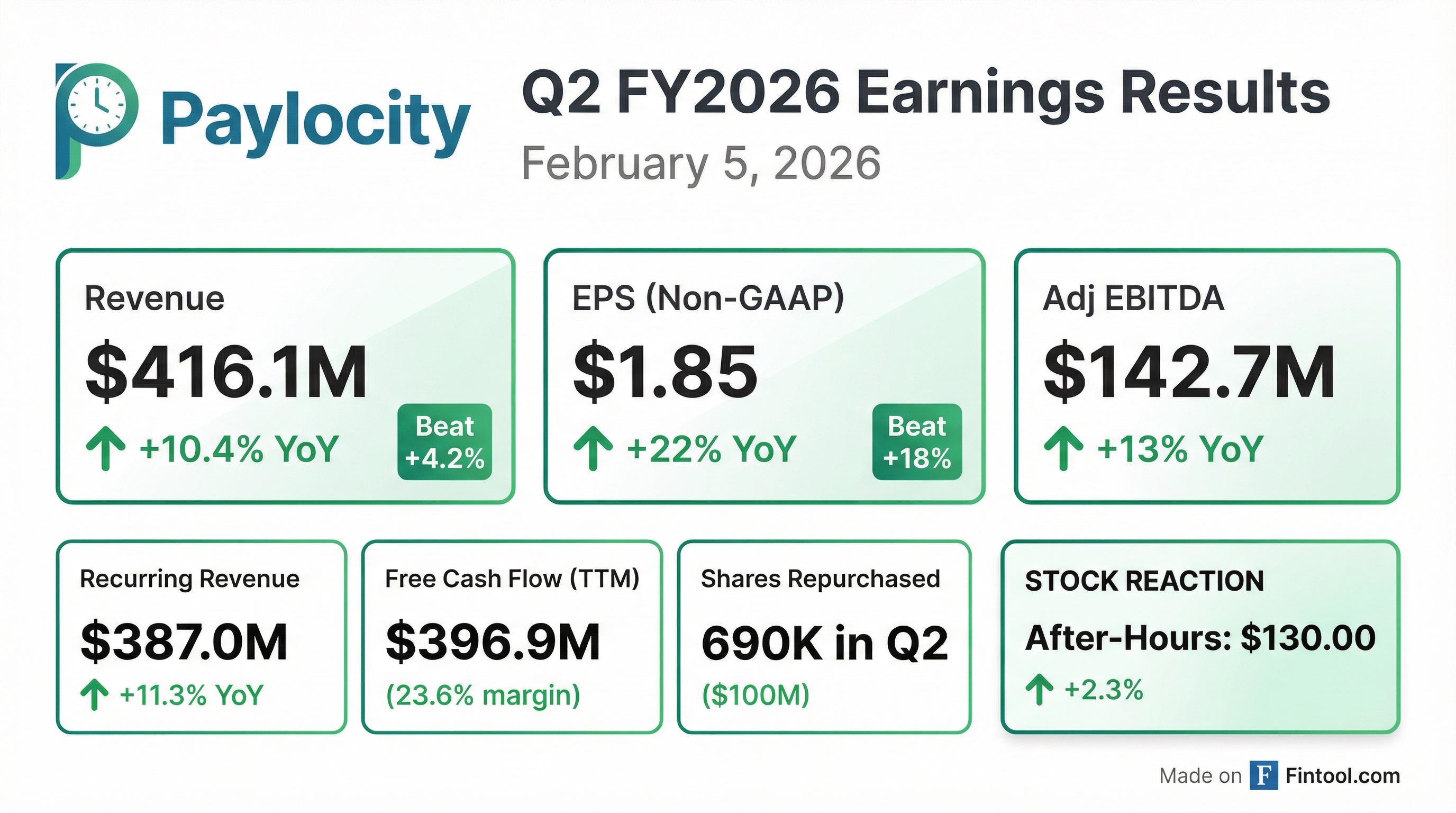

- Paylocity reported strong Q2 fiscal 2026 results, with total revenue of $416.1 million, representing 10% growth over the prior year, and adjusted EBITDA of $142.7 million or a 34.3% margin.

- The company increased its fiscal 2026 guidance, with total revenue now expected to be in the range of $1.732 billion-$1.742 billion and adjusted EBITDA in the range of $622.5 million-$630.5 million.

- Paylocity repurchased approximately 690,000 shares of common stock for about $100 million in Q2 fiscal 2026, and over 1.8 million shares for approximately $300 million fiscal year to date, with $400 million remaining in the program.

- The company highlighted continued product innovation, including new HCM offerings and expanded AI capabilities, with the average monthly usage of its AI Assistant increasing over 100% quarter-over-quarter.

- Paylocity Holding reported Q2 2026 total revenue of $416.1 million, a 10% increase year-over-year, with recurring and other revenue growing 11% to $387 million.

- The company increased its fiscal 2026 guidance, with total revenue now expected to be in the range of $1.732 billion - $1.742 billion (approximately 9% growth) and Adjusted EBITDA in the range of $622.5 million - $630.5 million.

- Product innovation, including expanded AI capabilities and new HCM offerings like Reward and Recognition, contributed to strong results, with the average monthly usage of its AI assistant increasing over 100% quarter-over-quarter.

- Paylocity maintained client retention rates consistently above 92% for over a decade and repurchased approximately 690,000 shares of common stock for $100 million in Q2 2026.

- Paylocity Holding reported strong Q2 fiscal 2026 results, with total revenue reaching $416.1 million, a 10% increase year-over-year, and recurring and other revenue growing by 11%.

- The company's adjusted EBITDA was $142.7 million, achieving a 34.3% margin, which exceeded the top end of guidance by $7.2 million.

- Due to strong performance, Paylocity raised its fiscal year guidance and margin guidance for fiscal 2026.

- In Q2, the company repurchased approximately 690,000 shares for $100 million, contributing to over 1.8 million shares repurchased year-to-date for $300 million, resulting in a more than 2% reduction in diluted shares outstanding.

- Continued investment in R&D and AI capabilities, including new HCM offerings like Reward and Recognition, fueled growth, with average monthly usage of the AI assistant increasing over 100% quarter-over-quarter.

- Paylocity Holding Corporation reported Q2 FY 2026 total revenue of $416.1 million, an increase of 10.4% year-over-year, with GAAP net income of $50.2 million or $0.92 per share.

- The company repurchased $100 million (or 690,000 shares) in Q2 2026, contributing to $600 million (or 3.7 million shares) repurchased since May 2024.

- For Q3 FY 2026, Paylocity expects total revenue between $487.0 million and $492.0 million, and Adjusted EBITDA between $200.0 million and $204.0 million.

- The company projects fiscal year 2026 total revenue in the range of $1.732 billion to $1.742 billion, and Adjusted EBITDA between $622.5 million and $630.5 million.

- Paylocity (PCTY) reported strong Q1 fiscal year 2026 results, with 14% recurring revenue growth and 12% total revenue growth, leading to raised guidance for revenue and profitability. The company also increased its long-term financial targets, citing significant progress in EBITDA and free cash flow leverage, and expanding gross margins.

- PCTY continues to gain market share in the Human Capital Management (HCM) space, driven by unit growth and increasing average revenue per client through an expanded product suite. The company is also successfully moving upmarket, with its enterprise team focusing on the 500-plus employee segment and expanding its target market up to 5,000 employees.

- Paylocity has embedded AI into all its products, seeing a significant year-over-year increase in adoption of its AI assistant, which enhances client and employee efficiency. The integration of the Airbase acquisition for Paylocity for Finance is ahead of schedule, targeting 10-20% adoption among its 40,000+ clients over multiple years.

- PCTY has been active with share repurchases, buying back $500 million since May 2024, with another $500 million remaining under authorization, and plans to continue buybacks to offset dilution. The company anticipates continued margin expansion, driven by AI automation, scale, and pricing power, while managing the business "ex-float" despite expected interest rate cuts.

- Paylocity reported strong Q1 fiscal year 2026 results, with 14% recurring revenue growth and 12% total revenue growth, leading to a raised full-year guidance for revenue and profitability.

- The company increased its long-term financial targets due to significant progress in EBITDA and free cash flow leverage, gross margin expansion, and early benefits from AI and automation.

- Paylocity has been active with share repurchases, buying back $500 million of stock since May 2024, with $500 million remaining under current authorization, and plans to continue being active.

- Investments in AI and automation are embedded across products, driving increased client adoption and usage of the AI Assistant, and contributing to the defensibility of its complex HCM offerings, particularly in payroll compliance.

- The integration of the Airbase acquisition (Paylocity for Finance) is ahead of schedule, realizing cost synergies, and early adoption is trending as expected, with a multi-year target of 10%-20% adoption among existing clients.

- Paylocity announced strong Q1 fiscal year 2026 results, with 14% recurring revenue growth and 12% total revenue growth, and subsequently raised its guidance for revenue and profitability.

- The company introduced new long-term financial targets, citing significant progress in EBITDA and free cash flow leverage, adjusted gross margin expansion, and durable revenue growth, with early benefits from AI and automation contributing to efficiencies.

- Management observed a stable macro and demand environment, with client workforce levels slightly up year-over-year, and continues to gain market share in the HCM payroll space.

- Paylocity has been actively engaged in share repurchases, buying back $500 million of stock since May 2024, with $500 million remaining under current authorization, and plans to continue these activities.

- The integration of the Airbase acquisition is ahead of schedule, and the company has seen a significant year-over-year increase in the adoption and usage of its AI assistant by clients.

- Paylocity reported strong Q1 fiscal 2026 financial results, with total revenue of $408.2 million, a 12% increase year-over-year, and Adjusted EBITDA of $146.4 million, representing a 35.9% margin.

- The company raised its fiscal 2026 guidance, with total revenue now expected to be in the range of $1.715 billion-$1.730 billion and Adjusted EBITDA between $615 million-$625 million.

- Paylocity also increased its long-term financial targets, raising the revenue target from $2 billion to $3 billion and the Adjusted EBITDA margin target from 35%-40% to 40%-45%. These updates are driven by the success of Paylocity for Finance, expansion into IT, and a differentiated AI strategy.

- In Q1, the company repurchased nearly 1.2 million shares for $200 million, with $500 million remaining under the current repurchase program.

- Paylocity reported Q1 Fiscal 2026 total revenue of $408.0 million, a 16% year-over-year increase, with diluted earnings per share of $0.75, up 19% from Q1 Fiscal 2025.

- For Fiscal 2026, the company projects total revenue between $1.723 billion and $1.733 billion and an Adjusted EBITDA margin of 35-36%.

- Q2 Fiscal 2026 guidance includes total revenue of $415 million to $420 million and recurring revenue growth of 16-17%.

- Since May 2024, Paylocity has repurchased approximately 3.0 million shares for $500 million, with ~$500 million remaining under its current repurchase program.

- Paylocity (PCTY) started Fiscal 2026 with strong financial results, reporting total revenue of $408.2 million, a 12% increase over Q1 of last year, and recurring and other revenue growth of 14%.

- The company's Adjusted EBITDA for the first quarter was $146.4 million, achieving a 35.9% margin and exceeding the top end of its guidance.

- Paylocity increased all aspects of its Fiscal 2026 guidance and raised its long-term financial targets, including a revenue target increase from $2 billion to $3 billion and an Adjusted EBITDA margin target increase from 35%-40% to 40%-45%.

- In Q1, Paylocity repurchased nearly 1.2 million shares of common stock for $200 million at an average price of $173.30 per share, with $500 million remaining under the current repurchase program.

- The company highlighted its AI-driven platform and the recent launch of Paylocity for Finance, which expanded its market-leading workforce platform into the office of the CFO and IT, contributing to strong results and increased confidence.

Quarterly earnings call transcripts for Paylocity Holding.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more