Earnings summaries and quarterly performance for F5.

Executive leadership at F5.

François Locoh-Donou

President and Chief Executive Officer

Chad Whalen

Chief Revenue Officer

Frank Pelzer

Executive Vice President and Chief Financial Officer

Kara Sprague

Executive Vice President and Chief Product Officer

Michael F. Montoya

Chief Technology Operations Officer

Tom Fountain

Chief Operating Officer

Board of directors at F5.

Alan J. Higginson

Chair of the Board

Elizabeth L. Buse

Director

Julie M. Gonzalez

Director

Marianne N. Budnik

Director

Maya McReynolds

Director

Michael L. Dreyer

Director

Michel Combes

Director

Nikhil Mehta

Director

Tami Erwin

Director

Research analysts who have asked questions during F5 earnings calls.

Michael Ng

Goldman Sachs

8 questions for FFIV

Samik Chatterjee

JPMorgan Chase & Co.

8 questions for FFIV

Meta Marshall

Morgan Stanley

7 questions for FFIV

Ryan Koontz

Needham & Company, LLC

7 questions for FFIV

Amit Daryanani

Evercore

6 questions for FFIV

James Fish

Piper Sandler Companies

6 questions for FFIV

Simon Leopold

Raymond James

6 questions for FFIV

George Notter

Jefferies

5 questions for FFIV

Tim Long

Barclays

5 questions for FFIV

Tal Liani

Bank of America

4 questions for FFIV

Tomer Zilberman

Bank of America

3 questions for FFIV

Matt Dezort

William Blair & Company

2 questions for FFIV

Matt Hedberg

RBC

2 questions for FFIV

Matthew Hedberg

RBC Capital Markets

2 questions for FFIV

Timothy Long

Barclays

2 questions for FFIV

Brent Bracelin

Piper Sandler Companies

1 question for FFIV

Maryanne Sarfati

Morgan Stanley

1 question for FFIV

Matt Desert

Needham & Company, LLC

1 question for FFIV

Michael Richards

RBC Capital Markets

1 question for FFIV

Mike Ng

Goldman Sachs

1 question for FFIV

Priyanka Thapa

J.P. Morgan

1 question for FFIV

Sebastien Cyrus Naji

William Blair & Company, L.L.C.

1 question for FFIV

Sebastien Naji

William Blair

1 question for FFIV

W. Chiu

Raymond James

1 question for FFIV

Recent press releases and 8-K filings for FFIV.

- Hagens Berman has issued notice to investors in F5, Inc. (NASDAQ: FFIV) regarding the February 17, 2026 lead plaintiff deadline in a pending securities class action alleging executives misled the market about BIG-IP security vulnerabilities.

- The lawsuit claims a nation-state actor maintained persistent access to F5 systems, exfiltrating source code from the BIG-IP product development environment—disclosures in October 2025 triggered share price declines and a fiscal 2026 guidance cut.

- Investors who purchased FFIV shares between October 28, 2024 and October 27, 2025 and suffered losses are urged to contact Hagens Berman before the deadline.

- A class action lawsuit was filed on behalf of shareholders who bought F5 securities between October 28, 2024 and October 27, 2025, alleging the company concealed a significant breach in its BIG-IP development environment discovered in August 2025.

- The complaint claims a nation-state actor maintained “long-term, persistent” access, potentially compromising source code and vulnerability data.

- Following public disclosure, F5 reportedly saw reduced sales and renewals, elongated sales cycles, and increased remediation costs, prompting a revision of its fiscal 2026 revenue guidance to 0–4% growth, down from mid-single digits.

- Applications to serve as lead plaintiff must be filed by February 17, 2026.

- Faruqi & Faruqi is investigating claims that F5 executives made false or misleading statements by failing to disclose a significant security breach affecting its BIG-IP product.

- The proposed class covers investors who purchased F5 securities between October 28, 2024 and October 27, 2025.

- On October 27, 2025, F5 reported Q4 FY2025 results and lowered fiscal 2026 guidance due to the breach, and its share price fell 10.9% to $258.76 by October 29, 2025.

- The deadline to seek lead plaintiff status in the federal securities class action is February 17, 2026.

- The Portnoy Law Firm advises investors who bought F5 securities from Oct 28, 2024 to Oct 27, 2025 to join a class action, with a lead plaintiff motion deadline of Feb 17, 2026.

- On Oct 15, 2025, F5 disclosed that a nation-state threat actor gained unauthorized access in early August, exfiltrating portions of its BIG-IP source code and undisclosed vulnerability data.

- Following the disclosure, F5’s share price dropped $35.40 (approx. 10.7%) from $330.75 to $295.35 on Oct 16, 2025.

- Hagens Berman notified F5 investors of the February 17, 2026 lead plaintiff deadline in a pending securities class action against F5 and certain executives.

- The lawsuit, spanning October 28, 2024 – October 27, 2025, alleges F5 concealed an August 2025 breach of its BIG-IP systems by a nation-state actor that exfiltrated source code.

- F5 shares plunged nearly 14% over two days after the breach disclosure and fell another 7% following a 2026 revenue guidance cut, wiping out over $2 billion in market value.

- Affected investors are urged to contact Hagens Berman partner Reed Kathrein by the deadline to participate in the action.

- Hagens Berman has set a February 17, 2026 lead plaintiff deadline in a pending securities class action against F5, Inc. (FFIV) and certain executives.

- The suit alleges F5 misled the market about the security of its BIG-IP products; in August 2025, a nation-state actor allegedly gained long-term access and exfiltrated source code, revealed on October 15, 2025.

- The October 15 breach disclosure drove shares down ~14% over two days; on October 27, 2025 F5’s Q4 FY25 results and FY26 guidance cut led to a $22.83 (–7%) drop and wiped out $2 billion in market value.

- The Class Period runs October 28, 2024 – October 27, 2025; investors who purchased during this window must file by the February 17, 2026 deadline.

- Hagens Berman issues notice to F5 investors regarding a February 17, 2026 lead plaintiff deadline in a proposed securities class action alleging F5 executives concealed a major breach of BIG-IP source code.

- The lawsuit claims a nation-state actor maintained persistent access to F5 systems from August 2025, exfiltrating sensitive source code and prompting an October 2025 guidance cut that wiped out over $2 billion in market value.

- On October 27, 2025, F5 reported disappointing 4Q FY25 results and lowered FY26 revenue expectations, attributing the shortfall to the breach’s impact on sales, renewals, and remediation costs.

- The class period spans October 28, 2024 – October 27, 2025, and investors and whistleblowers with relevant information are urged to contact Reed Kathrein or consider the SEC Whistleblower program.

- Faruqi & Faruqi, LLP is probing potential class claims against F5 for making misleading statements and failing to disclose a significant security breach of its BIG-IP product, F5’s highest‐revenue offering.

- On October 27, 2025, F5 reported Q4 FY2025 results and issued below-market growth guidance for FY2026, attributing reduced sales, elongated sales cycles and higher remediation costs to the breach.

- Following the disclosure, F5’s share price fell from $290.41 on October 27, 2025 to $258.76 on October 29, 2025, a 10.9% drop.

- Investors who acquired F5 securities between October 28, 2024 and October 27, 2025 have until February 17, 2026 to seek lead plaintiff status in the suit.

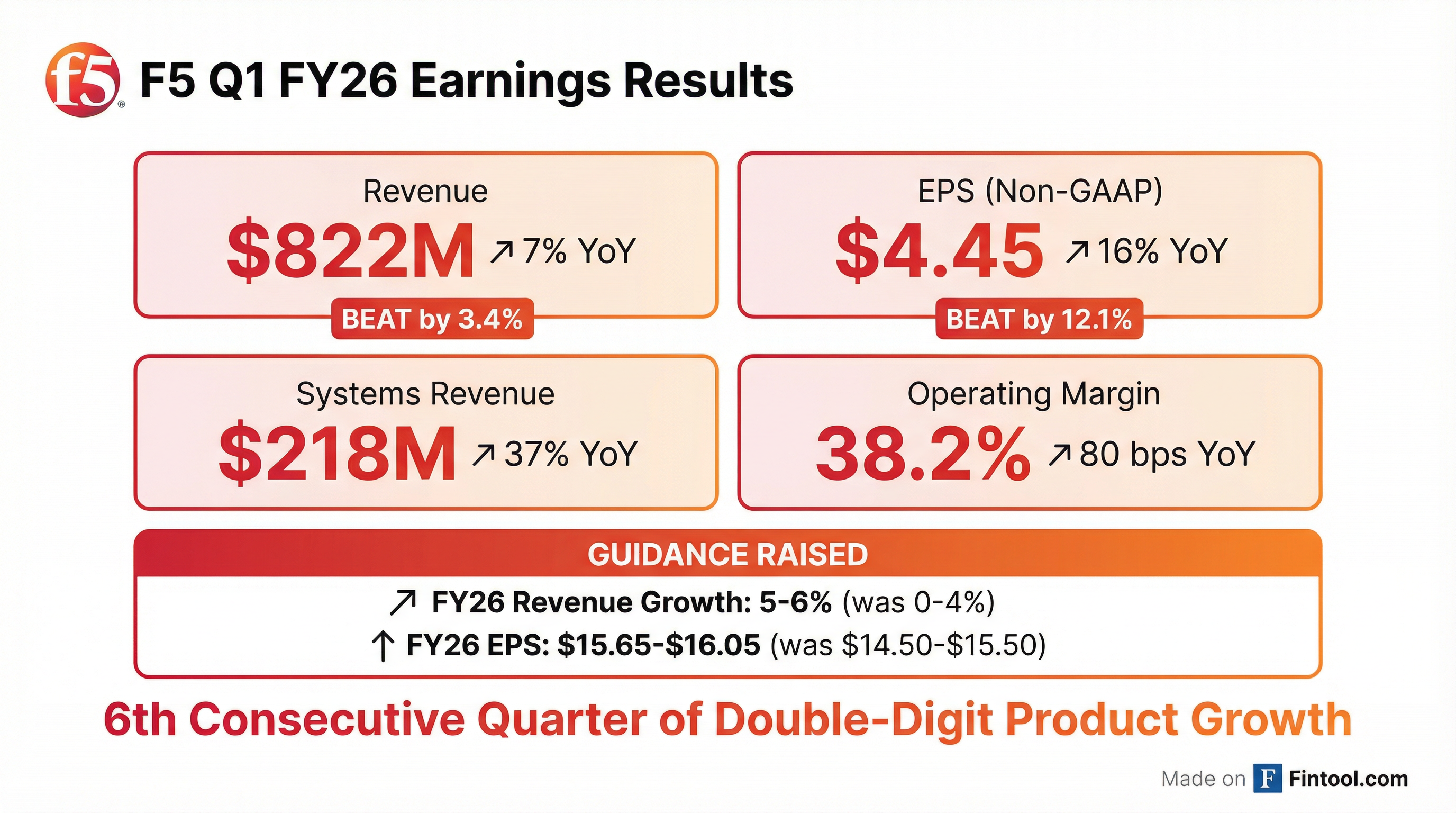

- F5 reported Q1 FY26 revenue of $822 million (up ~7%), GAAP net income of $180 million, and non-GAAP EPS of $4.45, topping analyst estimates.

- Systems revenue jumped 37% and product revenue rose 11% in the quarter, while software revenue declined and services saw modest growth.

- Management raised FY26 guidance to 5–6% revenue growth, non-GAAP operating margin of 34–35%, and EPS of $15.65–$16.05, and set Q2 revenue target at $770–$790 million.

- Shares climbed roughly 10–12% in after-hours trading, with the stock closing at $270.43 and market cap of $15.54 billion.

- F5 Networks delivered $822 M in Q1 FY26 revenue, up 7% year-over-year (GAAP).

- Non-GAAP EPS were $4.45, a 16% increase year-over-year.

- Product revenue grew 11% year-over-year, marking the sixth consecutive quarter of double-digit product growth.

- Updated FY26 outlook: total revenue growth now expected at 5–6% (from 0–4%), and non-GAAP EPS guided to $15.65–$16.05.

- Returned capital: repurchased $300 M of shares in Q1, using 201% of free cash flow.

Fintool News

In-depth analysis and coverage of F5.

Quarterly earnings call transcripts for F5.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more