Earnings summaries and quarterly performance for IAC.

Executive leadership at IAC.

Board of directors at IAC.

Alan G. Spoon

Director

Alexander von Furstenberg

Director

Bonnie S. Hammer

Director

Bryan Lourd

Director

Chelsea Clinton

Director

David Rosenblatt

Director

Maria Seferian

Director

Michael D. Eisner

Director

Richard F. Zannino

Director

Research analysts who have asked questions during IAC earnings calls.

John Blackledge

TD Cowen

9 questions for IAC

Eric Sheridan

Goldman Sachs

8 questions for IAC

Jason Helfstein

Oppenheimer & Co. Inc.

8 questions for IAC

Ross Sandler

Barclays

8 questions for IAC

James Heaney

Jefferies

7 questions for IAC

Youssef Squali

Truist Securities

6 questions for IAC

Cory Carpenter

JPMorgan Chase & Co.

4 questions for IAC

Justin Patterson

KeyBanc Capital Markets

4 questions for IAC

Daniel Kurnos

The Benchmark Company, LLC

3 questions for IAC

Thomas Champion

Piper Sandler

3 questions for IAC

Ygal Arounian

Citigroup

3 questions for IAC

Corey Carpenter

JPMorgan

2 questions for IAC

Dan Karnos

The Benchmark Company

2 questions for IAC

Matt Condon

Citizens Financial Group, Inc.

2 questions for IAC

Nick Jones

JMP Securities

2 questions for IAC

Steven Zhu

UBS Group AG

2 questions for IAC

Brent Thill

Jefferies

1 question for IAC

Daniel Pfeiffer

JPMorgan Chase & Co.

1 question for IAC

Dan Kernos

Benchmark Company

1 question for IAC

James Kenny

Jefferies

1 question for IAC

Matthew Condon

Not Specified in Transcript

1 question for IAC

Nicholas Jones

Citizens JMP

1 question for IAC

Stephen Ju

UBS Group AG

1 question for IAC

Recent press releases and 8-K filings for IAC.

- Amerigo Resources Ltd. reported strong 2025 financial results, including net income of $35.4 million, EBITDA of $89.8 million, free cash flow to equity of $37.1 million, and basic EPS of $0.22.

- In 2025, the company returned $20.4 million to shareholders through dividends and share buybacks and became debt-free in October 2025 after repaying $11.5 million in debt.

- Amerigo declared an 18th quarterly dividend of Cdn$0.04 per share, payable on March 20, 2026, and management remains bullish on copper prices due to strong market fundamentals.

- Operational highlights for 2025 included 62.2 million pounds of copper production from MVC, $40.3 million in cash and cash equivalents, and $10.9 million in working capital at year-end.

- Net earnings for Dotdash Meredith Inc. (now People Inc.) significantly improved to $62,548 thousand for the year ended December 31, 2025, reversing net losses of $(12,041) thousand in 2024 and $(207,381) thousand in 2023.

- The company, a wholly-owned subsidiary of IAC Inc., rebranded from Dotdash Meredith Inc. to "People Inc." on July 31, 2025, and is identified as one of the largest digital and print publishers in America.

- Revenue for the year ended December 31, 2025, was $1,762,073 thousand, a slight decrease from $1,777,229 thousand in 2024.

- Net cash provided by operating activities was $120,048 thousand for the year ended December 31, 2025.

- On October 1, 2025, the company completed the acquisition of Feedfeed, a social-first food media publisher, which resulted in an addition of $5,624 thousand to goodwill.

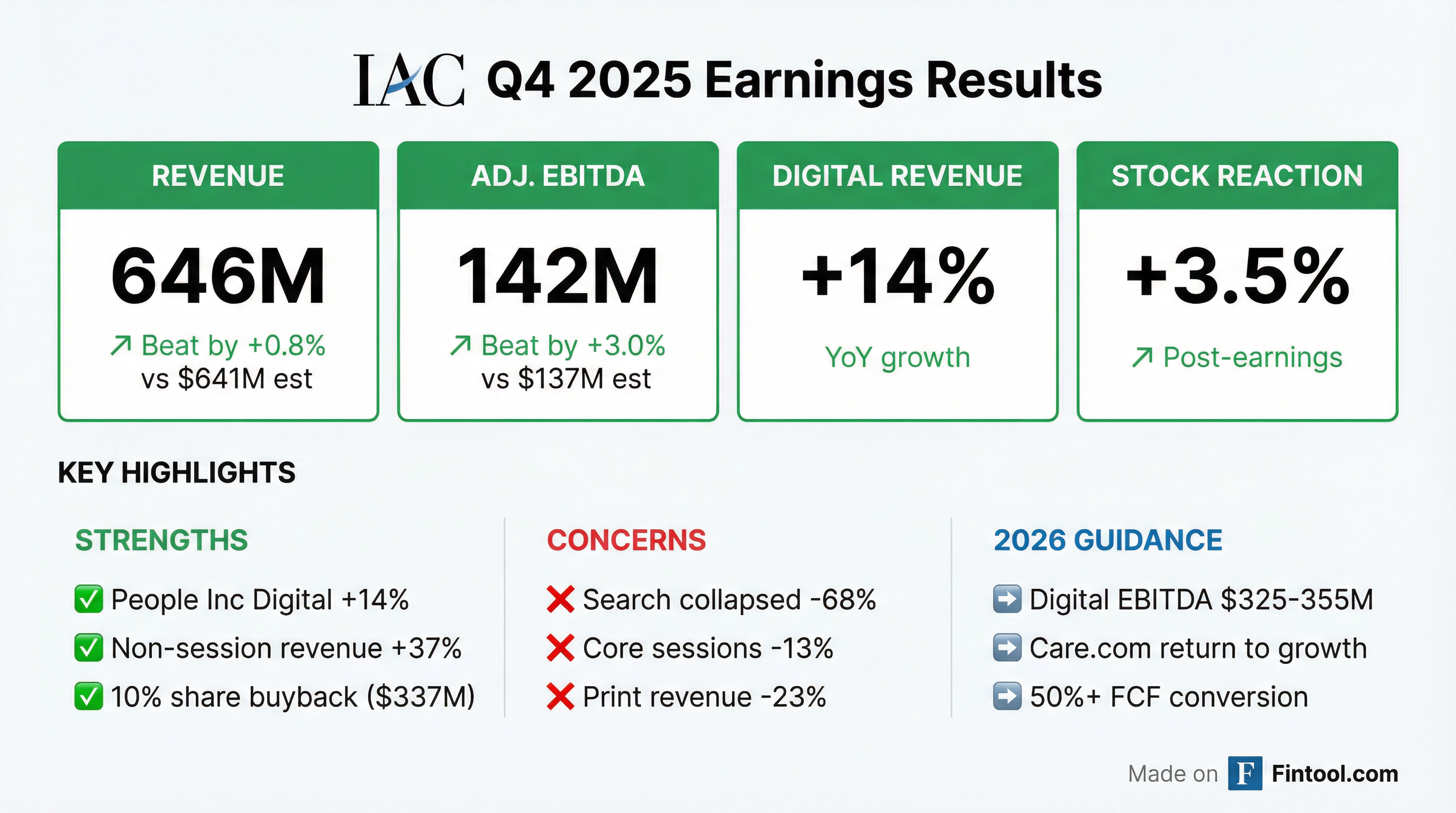

- People Inc. reported Q4 2025 Total Revenue of $512 million, a 2% decrease year-over-year, driven by a 14% increase in Digital revenue to $355 million and a 23% decrease in Print revenue to $168 million. Total Adjusted EBITDA excluding Certain Items for Q4 2025 was $142 million, a 1% decrease year-over-year.

- For the full year 2025, People Inc. achieved $1.1 billion in Digital revenue (up 10% year-over-year) and $331 million in Total Adjusted EBITDA excluding Certain Items. Care.com reported $347 million in revenue and $47 million in Adjusted EBITDA for the twelve months ended December 31, 2025.

- IAC repurchased $337 million of its shares since the beginning of 2025, including $37 million since Q3 earnings, reducing shares outstanding from 85 million to 78 million, representing 10% of equity repurchased. Additionally, IAC purchased 1 million shares of MGM shares for $40 million in Q4 2025.

- For fiscal year 2026, IAC provided guidance for Total Adjusted EBITDA between $260 million and $335 million, with People Inc. Adjusted EBITDA expected to be $310-$340 million and Care.com Adjusted EBITDA between $45-$55 million.

- IAC's People Inc. segment reported 14% digital revenue growth in Q4 2025, primarily driven by a 37% year-over-year increase in non-session-based revenue, which now constitutes 38% of total digital revenue.

- The company announced a shift from quarterly to annual guidance, with People Inc. digital revenue and digital adjusted EBITDA both expected to grow mid to high single digits for the year 2026.

- For 2026, People Inc. is forecasting total adjusted EBITDA between $310 million and $340 million, with digital adjusted EBITDA projected at $325 million to $355 million.

- The Care segment experienced a 9% revenue decline in Q4 2025, but consumer revenue is anticipated to return to top-line growth by mid-year 2026, and Care's core adjusted EBITDA is expected to be $45 million to $55 million for the year.

- IAC anticipates $15 million in litigation expenses in 2026 related to its Google AdTech lawsuit, through which it aims to recover hundreds of millions of dollars in damages.

- IAC's People segment achieved strong Q4 2025 digital revenue growth of 14%, with advertising up 9%, performance marketing up 17%, and licensing up 36%, despite a 13% decline in core sessions. For the full year 2025, People's digital revenue reached $1.1 billion, growing 10%.

- The company is strategically shifting People's focus towards non-session-based revenue streams, which constituted 38% of total digital revenue and grew 37% year-over-year in Q4 2025, through new product development and off-platform audience engagement.

- IAC increased its ownership in MGM to 25% and repurchased $337 million of its own stock in Q4 2025, with plans to continue opportunistic buybacks in 2026.

- For 2026, IAC expects People Inc. digital revenue and digital adjusted EBITDA to grow mid to high single digits, with total adjusted EBITDA guided between $310 million-$340 million, which includes an anticipated $15 million in Google AdTech litigation expenses. The company also projects 50%+ EBITDA to free cash flow conversion across IAC in 2026.

- IAC's People Inc. segment reported strong Q4 2025 results, with digital revenue growing 14% and full-year digital revenue increasing 10% to $1.1 billion.

- For 2026, the company expects People Inc. digital revenue and digital adjusted EBITDA to grow mid to high single digits, with total adjusted EBITDA for People Inc. projected between $310 million and $340 million.

- IAC repurchased $337 million of its stock in the quarter and increased its ownership in MGM to 25%.

- Strategic initiatives include People Inc.'s expansion into new consumer product businesses and a focus on off-platform audiences, which saw non-session-based revenue grow 37% year-over-year in Q4 2025.

- Care's revenue declined 9% in Q4 2025, but consumer revenue is anticipated to return to growth by mid-2026, and IAC expects 50%+ EBITDA to free cash flow conversion in 2026.

- IAC reported Q4 2025 revenue of $646.0 million, a 10% decrease year-over-year, with a net loss of $(76.8) million, but Adjusted EBITDA increased 29% to $141.6 million.

- People Inc. Digital revenue grew 14% to $355 million in Q4 2025, its highest growth in five quarters, contributing to $1.1 billion in full-year Digital revenue. Conversely, Care.com recorded a $(191.1) million operating loss due to a $207.5 million non-cash goodwill impairment.

- The company repurchased 1.0 million common shares for $37 million in Q4 2025 and expanded its strategic investment in MGM by purchasing an additional 1.0 million shares for $40 million, now holding 65.8 million shares.

- For the full year 2026, IAC projects Total Adjusted EBITDA between $260 million and $335 million and announced it will no longer provide quarterly outlooks.

- Vivian Health, a subsidiary of IAC, announced a leadership transition, appointing Bill Kong as CEO, succeeding co-founder Parth Bhakta, who will transition to Executive Chairman.

- Adam Greenberg, previously CFO, will take on an expanded role as President & CFO.

- These changes are effective immediately and are intended to prepare the company for its next phase of growth, focusing on accelerating product innovation and AI-driven scaling.

- Vivian Health has achieved profitability and 50x revenue growth since IAC's acquisition, now supporting 2.7 million clinicians and facilitating over $1.5 billion in healthcare labor spend annually.

- IAC's operating business, People Inc., announced a multi-year strategic content partnership with Meta on December 5, 2025.

- This agreement positions People Inc. as the first lifestyle publisher to secure an AI commercial deal with Meta, providing Meta AI users with content from brands such as PEOPLE, Better Homes & Gardens, and Investopedia.

- The partnership, which follows similar agreements with OpenAI and Microsoft, aims to accelerate People Inc.'s AI partner strategy, though the financial terms were not publicly disclosed.

- IAC is narrowing its strategic focus to People Inc. and its investment in MGM, planning to divest non-core assets, reduce overhead, and opportunistically increase MGM ownership or repurchase shares.

- People Inc. reported 9% digital revenue growth and $75 million in pro forma adjusted EBITDA for Q3 2025, but lowered its full-year adjusted EBITDA guidance to $325 million-$340 million due to ongoing Google Search disruptions and increased legal expenses.

- The company is pursuing ad tech litigation against Google, expecting $4 million in legal expenses for Q4, with the aim of recovering hundreds of millions in damages.

- IAC notes that despite MGM's strong operational performance and significant share buybacks, its share price has declined 29% since early 2022, with its core business trading at a low multiple.

Quarterly earnings call transcripts for IAC.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more