Earnings summaries and quarterly performance for AMAZON COM.

Executive leadership at AMAZON COM.

Andrew Jassy

Chief Executive Officer

Brian Olsavsky

Senior Vice President and Chief Financial Officer

David Zapolsky

Senior Vice President, Chief Global Affairs & Legal Officer

Douglas Herrington

Chief Executive Officer, Worldwide Amazon Stores

Jeff Bezos

Executive Chair

Matthew Garman

Chief Executive Officer, Amazon Web Services

Board of directors at AMAZON COM.

Andrew Ng

Director

Brad Smith

Director

Daniel Huttenlocher

Director

Edith Cooper

Director

Indra Nooyi

Director

Jamie Gorelick

Lead Independent Director

Jonathan Rubinstein

Director

Keith Alexander

Director

Patricia Stonesifer

Director

Wendell Weeks

Director

Research analysts who have asked questions during AMAZON COM earnings calls.

Brian Nowak

Morgan Stanley

9 questions for AMZN

Douglas Anmuth

JPMorgan Chase & Co.

7 questions for AMZN

Eric Sheridan

Goldman Sachs

7 questions for AMZN

Mark Mahaney

Evercore ISI

7 questions for AMZN

Justin Post

Bank of America Corporation

6 questions for AMZN

Colin Sebastian

Baird

5 questions for AMZN

John Blackledge

TD Cowen

3 questions for AMZN

Michael Morton

MoffettNathanson

3 questions for AMZN

Ross Sandler

Barclays

3 questions for AMZN

Doug Anmuth

J.P. Morgan

2 questions for AMZN

Ronald Josey

Citigroup Inc.

2 questions for AMZN

Brent Thill

Jefferies

1 question for AMZN

Recent press releases and 8-K filings for AMZN.

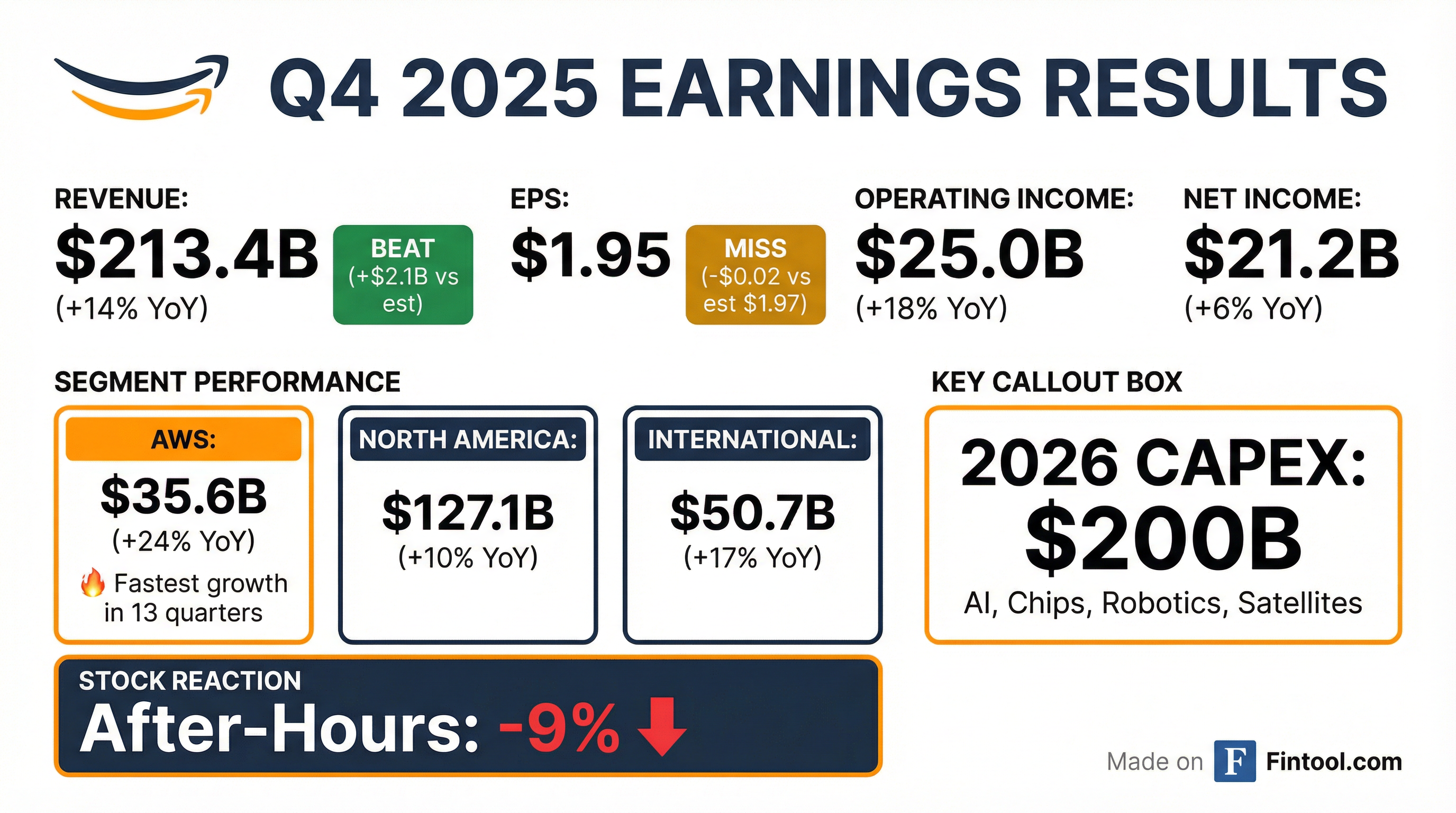

- Amazon posted $213.4 billion in Q4 revenue, up 12% year-over-year (ex-FX), and $25 billion in operating income after $2.4 billion of special charges.

- AWS revenue grew 24% y/y to $35.6 billion, achieving a $142 billion annualized run rate, with operating income of $12.5 billion.

- North America revenue was $127.1 billion (+10% y/y) with a 9% operating margin; International revenue was $50.7 billion (+11% y/y ex-FX) with a 2.1% margin.

- Full-year 2025 operating cash flow rose 20% to $39.5 billion; Q1 2026 guidance calls for $173.5–178.5 billion in net sales and $16.5–21.5 billion in operating income.

- Amazon plans $200 billion of capital expenditures—mostly in AWS to fuel AI and core workloads—and added 3.99 GW of power capacity in 2025, aiming to double by end-2027.

- Amazon reported Q4 2025 revenue of $213.4 billion, up 12% yoy, and operating income of $25 billion (including $2.4 billion of special charges).

- AWS revenue reached $35.6 billion, grew 24% yoy with an annualized run rate of $142 billion, and operating income of $12.5 billion.

- Full-year operating cash flow rose 20% yoy to $39.5 billion, and trailing twelve-month free cash flow was $11.2 billion.

- Q1 2026 guidance: net sales of $173.5 billion to $178.5 billion (≈180 bps FX tailwind) and operating income of $16.5 billion to $21.5 billion.

- The company plans approximately $200 billion in 2026 capital expenditures, predominantly in AWS capacity to support AI and core cloud demand.

- Q4 revenue of $213.4 billion (+12% y/y excluding FX) and operating income of $25 billion; trailing twelve-month free cash flow of $11.2 billion

- AWS revenue reached $35.6 billion (+24% y/y), driving an annualized run rate of $142 billion and operating income of $12.5 billion

- Retail performance: North America revenue of $127.1 billion (+10% y/y) and International revenue of $50.7 billion (+11% y/y); Amazon Ads revenue was $21.3 billion (+22% y/y)

- Amazon plans ~$200 billion in capital expenditures—predominantly in AWS to support core and AI growth—and expects Q1 2026 net sales of $173.5–178.5 billion with operating income of $16.5–21.5 billion

- Net sales rose 14% year-over-year to $213.4 billion in Q4 2025 (+12% ex-FX)

- North America sales reached $127.1 billion (+10%), International sales were $50.7 billion (+17%; +11% ex-FX), and AWS sales grew 24% to $35.6 billion

- Operating income increased to $25.0 billion from $21.2 billion; excluding $2.44 billion of special charges, it would have been $27.4 billion

- Net income rose to $21.2 billion, or $1.95 per diluted share, from $20.0 billion, or $1.86 per share

- Net sales in Q4 2025 rose 14% to $213.4 billion, driven by 10% growth in North America to $127.1 billion, 17% growth internationally to $50.7 billion, and 24% growth at AWS to $35.6 billion.

- Operating income climbed to $25.0 billion from $21.2 billion, including $2.44 billion in special charges; excluding these charges, operating income would have been $27.4 billion.

- Net income reached $21.2 billion ($1.95 per diluted share), up from $20.0 billion ($1.86 per diluted share) in Q4 2024.

- Q1 2026 guidance forecasts net sales of $173.5 billion to $178.5 billion (up 11–15% YoY) and operating income of $16.5 billion to $21.5 billion, versus $18.4 billion in Q1 2025.

- AWS stressed the need to define clear success metrics for AI proofs-of-concept—highlighting a hospital use case where ambient‐listening AI reduced doctor attrition rather than cutting costs as originally expected.

- AWS underscored its proprietary Trainium silicon strategy to improve AI workload price-performance, aiming to lower customer costs and fuel a growth flywheel through high-margin chip offerings.

- AWS detailed global infrastructure scaling hurdles, including data center build-outs, power commitments, and hardware lifecycle planning—noting it remains sold out of and has never retired its A100 servers due to ongoing demand.

- In response to rising data sovereignty concerns, AWS launched the EU Sovereign Cloud, a separate EU-incorporated entity with independent governance ensuring all customer data and metadata remain within EU jurisdiction.

- AWS advised CIOs to deploy AI agents with embedded guardrails—for example, using Agent Core—to mitigate security and operational risks and safely accelerate internal AI adoption.

- AWS will integrate AI into every application via the new Bedrock platform, offering native model choice, security, and ecosystem integration on AWS infrastructure.

- AWS expects to improve cost performance through its custom Trainium chips—targeting better price/performance and potentially lower customer prices despite high GPU margins.

- AWS added just under 4 GW of data center capacity in the past year, with a planning horizon spanning 20–30 year amortization for facilities and multi-year server lifecycles.

- AWS launched the EU Sovereign Cloud, a fully separate EU-incorporated subsidiary with on-shore data, metadata, and governance to meet regional data sovereignty requirements.

- AWS CEO Matt Garman stressed the importance of defining clear success metrics for AI deployments to transition from proofs of concept to production, illustrating with healthcare examples where AI reduced clinician attrition even if cost savings were initially unclear.

- AWS is embedding AI and inference throughout its infrastructure via the Bedrock platform, offering customers broad model choice, VPC-level security, and integration with the wider AWS partner ecosystem.

- AWS’s in-house Trainium chips aim to deliver superior price-performance versus NVIDIA GPUs, with AWS likely to pass cost savings to customers and fuel further demand growth.

- Due to sustained demand and specific use-case requirements for high precision, AWS has never retired an NVIDIA A100 server and remains sold out of A100 capacity.

- AWS launched the EU Sovereign Cloud, a fully EU-incorporated subsidiary with independent governance to ensure all data and metadata reside within EU borders, addressing national infrastructure sovereignty concerns.

- Amazon requested a 24-month extension to deploy roughly half of its planned ~3,236-satellite Amazon Leo constellation, moving the July 2026 milestone to July 2028 due to launch-vehicle shortages and manufacturing delays.

- The company has spent over $10 billion, produced hundreds of satellites, and can manufacture about 30 per week, but has scaled back output amid launch manifest delays.

- Amazon has launched an estimated 150–180 satellites so far and expects about 700 in orbit by July 30, reserving over 100 launch slots and purchasing rides from SpaceX and Blue Origin.

- The filing underscores persistent technical and logistical bottlenecks as Amazon Leo competes with Starlink’s 5,000+ satellites and 2 million+ customers.

- Austria’s B2C ecommerce market reached €10.6 billion in online retail sales in 2024, posting a 9.5% CAGR from 2020–2024 and is forecast to grow to US$19.22 billion by 2025 at a 6.6% annual rate.

- Amazon (via its German operations) ranks as the highest-traffic online retailer in Austria, alongside Zalando, Universal.at and Eduscho, while Temu and Shein are gaining traction among younger consumers.

- Cross-border platforms account for over 50% of Austrian online spend, with the top retail segments in 2024 being clothing (€2.4 billion), consumer electronics (€1.3 billion) and furniture (€0.9 billion).

- Amazon has bolstered its local infrastructure, operating four logistics hubs and an R&D office in Austria to support expanding demand.

Fintool News

In-depth analysis and coverage of AMAZON COM.

Amazon's $200 Billion AI Bet Spooks Wall Street Despite Record AWS Growth

Amazon Stuns Wall Street With $200 Billion AI Bet—Largest Corporate Capex in History

Anthropic's $350 Billion Tender Offer Marks Stunning Valuation Leap as AI Race Intensifies

AWS CEO Matt Garman: Teams Achieving 10x–100x Coding Speedup With AI, 'Write No Line of Code'

Amazon's $50 Billion OpenAI Gambit: Why the Anthropic Backer Is Hedging Both Sides of the AI Race

SpaceX Posts $8 Billion Profit as Banks Eye $1.5 Trillion IPO Valuation

Quarterly earnings call transcripts for AMAZON COM.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more