Earnings summaries and quarterly performance for Capri Holdings.

Executive leadership at Capri Holdings.

Board of directors at Capri Holdings.

Research analysts who have asked questions during Capri Holdings earnings calls.

Brooke Roach

Goldman Sachs Group, Inc.

7 questions for CPRI

Simeon Siegel

BMO Capital Markets

5 questions for CPRI

Aneesha Sherman

AllianceBernstein

4 questions for CPRI

Jay Sole

UBS

4 questions for CPRI

Oliver Chen

TD Cowen

4 questions for CPRI

Paul Lejuez

Citigroup

4 questions for CPRI

Matthew Boss

JPMorgan Chase & Co.

3 questions for CPRI

Rick Patel

Raymond James Financial

3 questions for CPRI

Adrienne Yih-Tennant

Barclays

2 questions for CPRI

Bob Drbul

Guggenheim Securities

2 questions for CPRI

Dana Telsey

Telsey Advisory Group

2 questions for CPRI

Ike Boruchow

Wells Fargo

2 questions for CPRI

Kathryn Hallberg

TD Cowen

2 questions for CPRI

Anisha Sherman

Sanford C. Bernstein & Co., LLC

1 question for CPRI

Irwin Boruchow

Wells Fargo Securities

1 question for CPRI

Matt Boss

JPMorgan Chase & Co.

1 question for CPRI

Robert Drbul

Guggenheim Securities

1 question for CPRI

Recent press releases and 8-K filings for CPRI.

- Capri Holdings Limited has appointed Tyler Reddien as its new Chief Financial Officer and Chief Operating Officer, effective March 30th.

- This appointment is intended to strengthen the leadership team, enhance operational excellence, and position the company for future growth across its portfolio of luxury brands.

- Mr. Reddien is a seasoned global finance and operations executive, having most recently served as CFO of The Body Shop and held senior leadership positions at Natura &Co Holding, Hertz, and United Airlines.

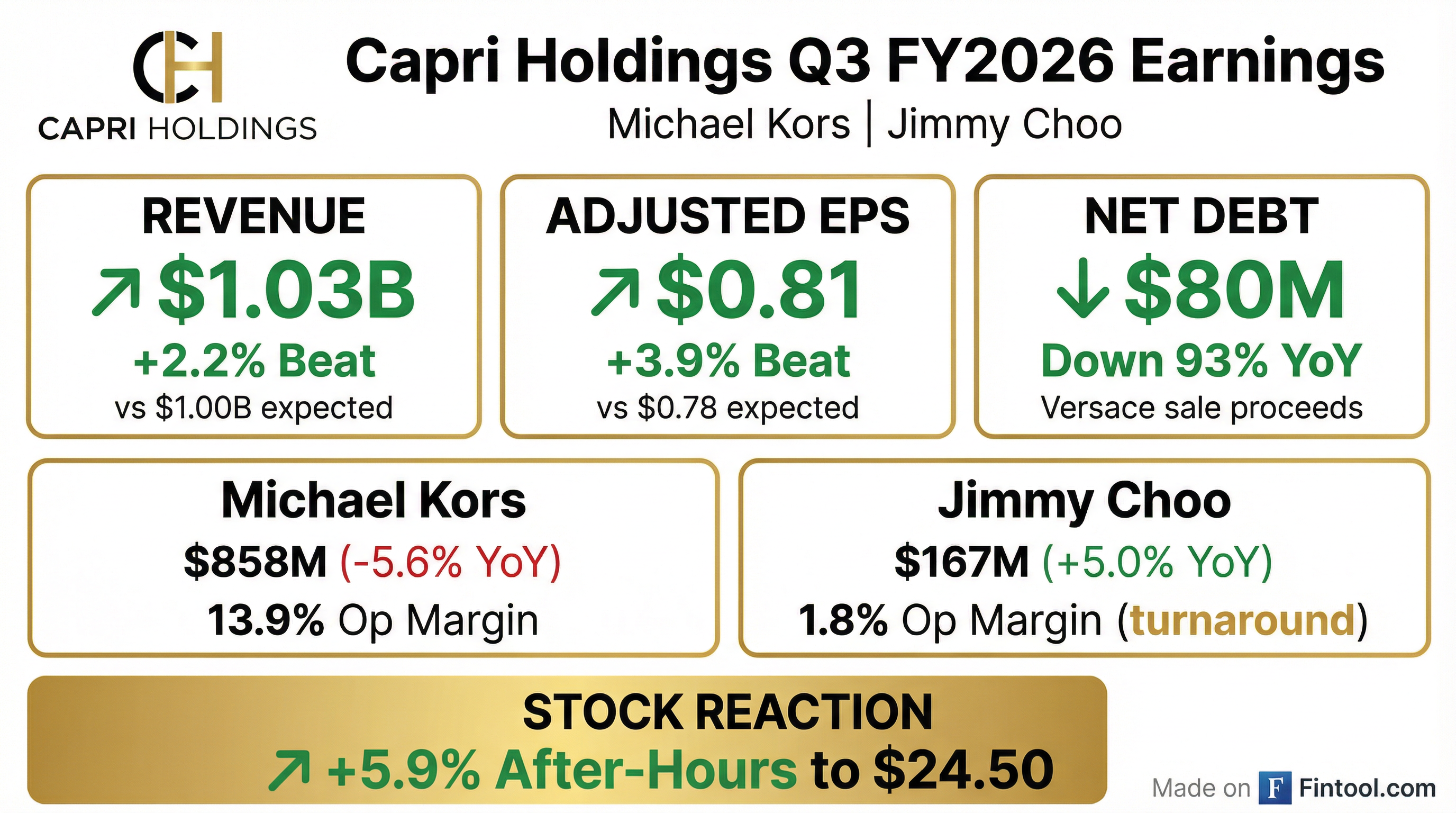

- Capri Holdings reported Q3 2026 revenue of $1.025 billion, a 4% decrease year-over-year, but exceeded expectations, with earnings per share increasing approximately 30% to $0.81.

- The company significantly reduced its net debt to $80 million at quarter-end, down from $1.6 billion in Q2, by using proceeds from the sale of Versace.

- For fiscal year 2026, the company narrowed its guidance, expecting total revenue between $3.45 billion and $3.475 billion and diluted earnings per share between $1.30 and $1.40.

- Management expressed confidence in a return to revenue and earnings growth in fiscal 2027, supported by strategic initiatives and anticipated gross margin expansion.

- Capri Holdings Limited (CPRI) reported Q3 Fiscal Year 2026 results, with revenue decreasing 4.0% and adjusted EPS increasing ~30% to $0.81, both exceeding expectations.

- The company achieved a gross margin of 60.8% and an adjusted operating margin of 7.7% for Q3 2026.

- Net debt was significantly reduced to ~$80M at the end of Q3 2026, following proceeds from the Versace sale.

- For Fiscal Year 2026, CPRI provided guidance for revenue between ~$3.45 - $3.475 billion and diluted earnings per share (continuing operations) between ~$1.30 - $1.40.

- Capri Holdings reported Q3 2026 revenue of $1.025 billion, a 4% decrease versus the prior year, exceeding expectations, with earnings per share increasing approximately 30% to $0.81.

- The company significantly reduced its net debt to $80 million at quarter-end, down from $1.6 billion at the end of Q2, following the completion of the sale of Versace.

- For fiscal 2026, Capri Holdings narrowed its revenue guidance to between $3.45 billion-$3.475 billion and diluted EPS guidance to between $1.30-$1.40.

- Management anticipates a return to both revenue and earnings growth in fiscal 2027 and has authorized a $1 billion share repurchase program to commence in FY27.

- Capri Holdings reported Q3 fiscal 2026 revenue of $1.025 billion, a 4% decrease year-over-year, but exceeded expectations, with earnings per share increasing approximately 30% to $0.81.

- The company completed the sale of Versace, utilizing the proceeds to significantly reduce debt, ending the quarter with $80 million of net debt.

- Jimmy Choo's revenue increased 5% compared to the prior year, driven by strong brand momentum, while Michael Kors' revenue decreased 5.6%.

- Capri Holdings anticipates fiscal 2026 diluted earnings per share between $1.30 and $1.40 and expects to return to both revenue and earnings growth in fiscal 2027.

- Capri Holdings Limited announced Q3 Fiscal 2026 results with revenue of $1.025 billion, a 4.0% decrease on a reported basis, and adjusted diluted earnings per share of $0.81, exceeding expectations from continuing operations for the quarter ended December 27, 2025.

- The company significantly reduced its net debt to $80 million as of December 27, 2025, primarily due to the completion of the Versace business sale on December 2, 2025.

- For Fiscal Year 2026, Capri Holdings provided an outlook for total revenue of approximately $3.45 to $3.475 billion and diluted earnings per share of approximately $1.30 to $1.40 from continuing operations.

- Brand performance for Q3 Fiscal 2026 saw Michael Kors revenue decrease 5.6% to $858 million, while Jimmy Choo revenue increased 5.0% to $167 million.

- Capri Holdings Limited reported third quarter Fiscal 2026 revenue of $1.025 billion, a 4.0% decrease, and adjusted diluted earnings per share of $0.81, exceeding expectations.

- The company significantly reduced its net debt to $80 million as of December 27, 2025, following the sale of its Versace business on December 2, 2025.

- For Fiscal Year 2026, Capri Holdings provides guidance for total revenue of approximately $3.45 to $3.475 billion and diluted earnings per share of approximately $1.30 to $1.40.

- Capri Holdings completed the sale of Versace for approximately $1.4 billion, which provides significant financial flexibility and allows the company to focus on its core Michael Kors and Jimmy Choo brands.

- Jimmy Choo is considered core to the business and is not for sale, with expectations to grow from $600 million to approximately $800 million in sales over the next few years, achieving low to mid double-digit operating earnings.

- Michael Kors is undergoing a strategic transformation, including re-engaging with its "jet set" image, modernizing marketing, resetting pricing architecture, and planning to renovate over 50% of its global store fleet over the next three years.

- The company anticipates sales to turn positive in its next fiscal year (beginning April 1), with a significant inflection point expected around August of next year (Q3 fiscal). Long-term operating margin targets are low 20% for Michael Kors and low double-digit for Jimmy Choo. A $1 billion share repurchase program has been approved, set to begin in FY 2027.

- Capri Holdings completed the sale of Versace for approximately $1.4 billion, which will provide significant financial flexibility, reduce debt, and allow for a greater focus on the Michael Kors and Jimmy Choo brands.

- The company anticipates sales to turn positive in the next fiscal year (beginning April 1), with a notable inflection point expected by Q3 of that fiscal year for both Michael Kors and Jimmy Choo.

- Management is confident in achieving low 20% operating margins for Michael Kors and low double-digit operating margins for Jimmy Choo in the future, supported by strategic initiatives like higher full-price sell-throughs, tariff mitigation, and expense leverage.

- Capri Holdings plans to renovate over 50% of its Michael Kors store fleet globally over the next three years and has a $1 billion share repurchase program approved, slated to commence in FY27.

- Long-term goals include returning Michael Kors to $4 billion in sales and growing Jimmy Choo to approximately $800 million over the next three to five years.

- Capri Holdings completed the sale of Versace yesterday, generating approximately $1.4 billion, which will provide significant financial flexibility and reduce company debt.

- The company will now focus on Michael Kors and Jimmy Choo, aiming to return Michael Kors to $4 billion in sales and grow Jimmy Choo from $600 million to approximately $800 million over the next few years.

- Sales are expected to turn positive in the next fiscal year (starting April 1, 2026), with a significant inflection for Michael Kors by Q3 FY2027, supported by strategic initiatives like store renovations and product focus.

- Long-term operating margin targets are low 20% for Michael Kors and low double-digit for Jimmy Choo, with overall company margin expansion anticipated next year.

- Capital allocation priorities include investing in stores, digital, and IT, paying down debt, and a $1 billion share repurchase program approved to begin in FY 2027.

Fintool News

In-depth analysis and coverage of Capri Holdings.

Quarterly earnings call transcripts for Capri Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more