Earnings summaries and quarterly performance for Walt Disney.

Executive leadership at Walt Disney.

Robert Iger

Chief Executive Officer

Horacio Gutierrez

Senior Executive Vice President, Chief Legal and Global Affairs Officer

Hugh Johnston

Senior Executive Vice President and Chief Financial Officer

Kristina Schake

Senior Executive Vice President and Chief Communications Officer

Sonia Coleman

Senior Executive Vice President and Chief People Officer

Board of directors at Walt Disney.

Research analysts who have asked questions during Walt Disney earnings calls.

David Karnovsky

JPMorgan Chase & Co.

7 questions for DIS

Jessica Reif Ehrlich

Bank of America Securities

7 questions for DIS

Michael Morris

Guggenheim Partners

7 questions for DIS

Kannan Venkateshwar

Barclays PLC

6 questions for DIS

Robert Fishman

MoffettNathanson

6 questions for DIS

Benjamin Swinburne

Morgan Stanley

5 questions for DIS

John Hodulik

UBS Group AG

5 questions for DIS

Steven Cahall

Wells Fargo & Company

5 questions for DIS

Michael Ng

Goldman Sachs

3 questions for DIS

Bryan Kraft

Deutsche Bank AG

2 questions for DIS

Jason Bazinet

Citigroup

2 questions for DIS

Kutgun Maral

Evercore ISI

2 questions for DIS

Peter Supino

Wolfe Research

2 questions for DIS

Thomas Yeh

Morgan Stanley

2 questions for DIS

John Hedrick

UBS

1 question for DIS

Laurent Yoon

Bernstein

1 question for DIS

Peter

Wolfe Research

1 question for DIS

Robert Fishman

MoffettNathanson LLC

1 question for DIS

Steve Cahill

Wells Fargo

1 question for DIS

Tim Nollen

Macquarie Group

1 question for DIS

Recent press releases and 8-K filings for DIS.

- Flow network has surpassed 40 million unique user accounts and processed 950 million transactions

- Adopted by major brands including NBA, NFL, Disney & Ticketmaster, fueling mainstream adoption

- Integrated EVM equivalence to enhance developer accessibility and ecosystem compatibility

- Launched the Forte upgrade to provide advanced on-chain automation and expand into consumer finance in 2026

- Film studios delivered $6.5 billion at the global box office in 2025, Disney’s third-biggest year ever, with three $1 billion+ releases (Avatar: Fire and Ash; Zootopia 2; Lilo & Stitch) and Zootopia 2 becoming the highest-grossing animated film ever at $1.7 billion.

- Streaming revenue grew 12% in Q1 with over 50% earnings growth, driven by price increases, bundling, and technology improvements; Disney+ is on track for a 10% operating margin this fiscal year and pursuing double-digit revenue growth.

- Experiences segment posted record $10 billion+ quarterly revenue, with 5% full-year bookings growth and major expansions including the new World of Frozen at Disneyland Paris, Disney Destiny cruise ship, and the upcoming Disney Adventure home-ported in Asia.

- ESPN achieved its best college football ratings since 2011, Monday Night Football’s second-highest viewership in 20 years, and a top-three NBA season, and launched ESPN Unlimited with strong early adoption, alongside the acquisition of NFL Network and RedZone assets.

- Management highlighted an upcoming theatrical slate—Devil Wears Prada 2, Mandalorian & Grogu, Toy Story 5, live-action Moana, Avengers: Doomsday—and plans to introduce short-form Sora-generated content on Disney+ under a three-year OpenAI licensing agreement.

- Disney’s film studios achieved >$6.5 B at the global box office in CY 2025, its third-largest year and ninth consecutive year as No. 1, with three $1 B+ releases (Avatar: Fire and Ash; Zootopia 2; Lilo & Stitch) and Zootopia 2 becoming the highest-grossing animated film ever with >$1.7 B.

- Streaming subscription revenue grew 13% in Q1, driven by pricing, North American and international subscriber gains, and bundling; Q1 streaming delivered 12% revenue growth and >50% earnings growth, targeting a 10% operating margin for FY 2026.

- Experiences segment revenue topped $10 B for the first time in a quarter, with strong Walt Disney World attendance and pricing (benefiting from hurricane overlap), full-year parks bookings up 5%, and expansions including the World of Frozen land in Disneyland Paris opening in March and two new ships (Disney Destiny; Disney Adventure).

- Upcoming FY 2026 theatrical slate includes The Devil Wears Prada 2, The Mandalorian and Grogu, Toy Story 5, live-action Moana, and Avengers: Doomsday, supporting accelerated entertainment growth in the back half.

- Film studios generated $6.5 billion global box office in CY2025—their third-largest year ever and ninth consecutive year as industry leader—driven by three $1 billion+ releases, including Zootopia 2 with $1.7 billion (37 of 60 industry billion-dollar films).

- Q1 streaming subscription revenue grew 13%, led by pricing, North America & international expansion, and bundle adoption; streaming delivered 12% revenue growth and over 50% earnings growth, with a 10% margin target for FY2026.

- ESPN achieved record Q1 ratings—most-watched college football since 2011, ABC’s best season since 2006, MNF’s second-highest viewership in 20 years, and third most-watched NBA season—while closing acquisition of NFL Network & RedZone.

- Experiences revenue topped $10 billion for the first time; Walt Disney World saw strong attendance & pricing, full-year bookings up 5% (back-half weighted), with World of Frozen Paris and Disney Destiny cruise expanding capacity.

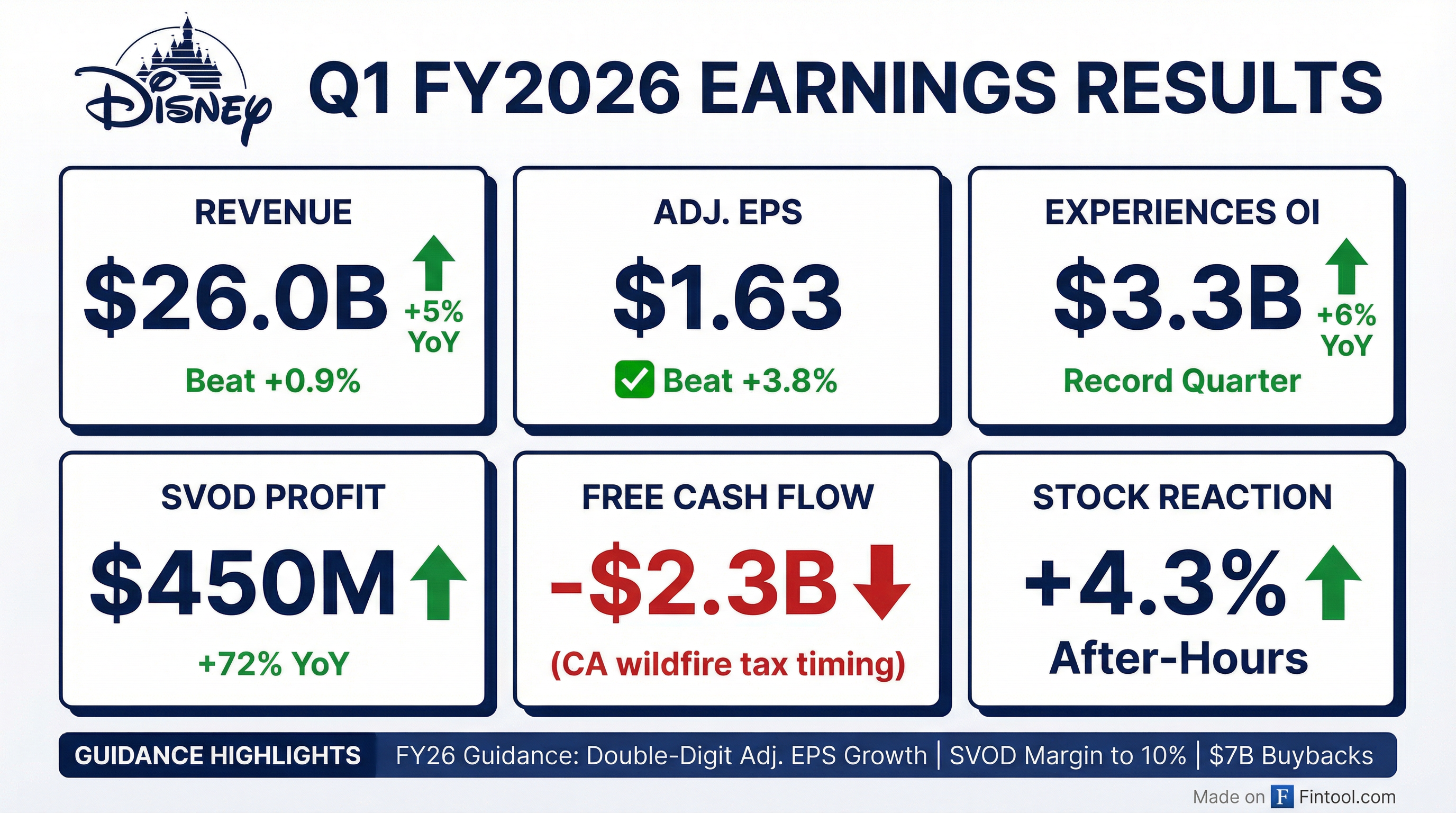

- The Walt Disney Company reported $26.0 billion in revenues for Q1 FY 2026, a 5% increase year-over-year, with diluted EPS of $1.34 and adjusted EPS of $1.63.

- Segment operating income declined 9% to $4.6 billion, driven by a 35% drop in Entertainment OI despite 7% revenue growth to $11.6 billion, while Experiences achieved record Q1 revenue of $10.0 billion and OI of $3.3 billion; Sports OI fell to $191 million on higher rights costs.

- SVOD revenue rose 11% to $5.3 billion, with SVOD operating income up 72% to $450 million, yielding an 8.4% margin.

- For Q2 FY 2026, Disney expects SVOD operating income of approximately $500 million, flat Entertainment OI, modest Experiences OI growth and FY 2026 guidance of double-digit adjusted EPS growth, a 10% SVOD margin, $19 billion cash from operations and $7 billion in share repurchases.

- Q1 FY26 revenue rose 5% to $26.0 billion, while total segment operating income fell 9% to $4.6 billion; diluted EPS declined to $1.34 and adjusted EPS to $1.63.

- SVOD revenue grew 11%, driving SVOD operating income up to $450 million with an 8.4% margin.

- Experiences delivered a record $10.0 billion in quarterly revenue and $3.3 billion in operating income; domestic Parks & Experiences OI was up 8%, with attendance +1% and per capita spending +4%.

- FY26 guidance calls for double-digit segment OI growth, a 10% SVOD operating margin, double-digit adjusted EPS growth and on-track share repurchases of $7 billion.

- Disney reported $26.0 billion in Q1 FY2026 revenue (up ~5% YoY), with adjusted EPS of $1.63 and diluted EPS of $1.34.

- Overall segment operating income declined ~9% to $4.6 billion, with income before taxes at $3.7 billion.

- Experiences segment posted a record quarter: $10.0 billion in revenue and $3.3 billion in operating income.

- Entertainment operating income fell to $1.1 billion, while streaming revenue reached $5.3 billion (streaming operating income ~$450 million).

- Disney provided guidance for next quarter: flat Entertainment operating income, $500 million in streaming-TV profit (up ~$200 million YoY) and modest parks growth.

- Bob Iger will step back from daily management and exit the CEO role before his Dec. 31, 2026 contract expires, with the board set to vote on a successor next week and an announcement expected early 2026

- Succession candidates narrowed to Josh D’Amaro (widely viewed as the favorite) and Dana Walden, with Iger remaining several months post-announcement to mentor the new leader

- Iger’s 2025 total compensation was $45.8 million (an 11.5% increase), including $2.59 million in other compensation; he stands for re-election to the board on March 18, 2026

- Disney is directing a $60 billion investment push into its Parks & Experiences business under D’Amaro, underscoring the strategic stakes of the CEO succession

- smart entered 10 new international markets in 2025, bringing its total presence to 39 countries and regions worldwide.

- The brand’s global retail network increased 25% to 688 outlets, with a 130% surge in new‐market outlets and 43% growth in China.

- Every smart model earned 5-star Euro NCAP safety ratings and Red Dot Design Awards, and the smart #5 was named Norway’s Car of the Year 2026.

- smart’s 2026 product roadmap includes two strategic launches—the #2 city two-seater in late 2026 and the #6 EHD fastback sedan by mid-2026.

- Disney and OpenAI entered a three-year licensing deal covering over 200 characters from Disney, Marvel, Pixar and Star Wars for AI-generated short videos

- Disney will make a $1 billion equity investment in OpenAI, receive warrants and become a major customer of OpenAI’s APIs

- The license covers animated characters, costumes, props, vehicles and environments but excludes talent likenesses and voices; some generated shorts will stream on Disney+

- The partnership aims to extend AI-driven storytelling and leverage OpenAI’s Sora platform and ChatGPT for internal and consumer-facing products

- Disney shares rose by 1.7% intraday following the deal announcement

Fintool News

In-depth analysis and coverage of Walt Disney.

It's Official: Josh D'Amaro Named Disney CEO, Dana Walden Gets Historic Creative Role

Josh D'Amaro Named Disney CEO, Ending Bob Iger's Historic Tenure

Disney Parks Cross $10 Billion as Streaming Profits Surge 72%

Disney Board Set to Name Parks Chief Josh D'Amaro as Next CEO

ESPN Closes Billion-Dollar NFL Network Deal, League Takes 10% Stake

Disney Board Set to Choose Iger's Successor Within Days

Quarterly earnings call transcripts for Walt Disney.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more