Earnings summaries and quarterly performance for monday.com.

Research analysts who have asked questions during monday.com earnings calls.

Arjun Bhatia

William Blair

6 questions for MNDY

Brent Thill

Jefferies

6 questions for MNDY

David Hynes

Canaccord Genuity Group Inc.

6 questions for MNDY

Scott Berg

Needham & Company, LLC

6 questions for MNDY

Taylor McGinnis

UBS

6 questions for MNDY

Steven Enders

Citigroup Inc.

5 questions for MNDY

Allan Verkhovski

Scotiabank

4 questions for MNDY

Brent Bracelin

Piper Sandler Companies

4 questions for MNDY

Jackson Ader

KeyBanc Capital Markets

4 questions for MNDY

Matt Bullock

Bank of America Merrill Lynch

4 questions for MNDY

Aleksandr Zukin

Wolfe Research

3 questions for MNDY

Alex Zukin

Wolfe Research LLC

3 questions for MNDY

Josh Baer

Morgan Stanley

3 questions for MNDY

Michael Berg

Wells Fargo & Company

3 questions for MNDY

Pinjalim Bora

JPMorgan Chase & Co.

3 questions for MNDY

Billy Fitzsimmons

Jefferies

2 questions for MNDY

Connor Murphy

Capital One

2 questions for MNDY

Damon Coggin

Barclays

2 questions for MNDY

Gili Naftalovich

Goldman Sachs

2 questions for MNDY

Howard Ma

Guggenheim Securities, LLC

2 questions for MNDY

Ittai Kidron

Oppenheimer & Company

2 questions for MNDY

James Wood

TD Cowen

2 questions for MNDY

Mark Murphy

JPMorgan Chase & Co.

2 questions for MNDY

Mark Schappel

Loop Capital Markets

2 questions for MNDY

Michael Funk

Bank of America

2 questions for MNDY

Nate Ruiz

KeyBanc Capital Markets

2 questions for MNDY

Raimo Lenschow

Barclays

2 questions for MNDY

Robert Oliver

Robert W. Baird & Co.

2 questions for MNDY

Ryan MacWilliams

Barclays

2 questions for MNDY

Thomas Blakey

Cantor Fitzgerald

2 questions for MNDY

Cole

Jefferies

1 question for MNDY

Derek Wood

TD Cowen

1 question for MNDY

Derrick Wood

TD Cowen

1 question for MNDY

Kash Rangan

Goldman Sachs

1 question for MNDY

Kasthuri Rangan

Goldman Sachs

1 question for MNDY

Noah Kreisman

JPMorgan Chase & Co.

1 question for MNDY

Ryan McWilliams

Wells Fargo

1 question for MNDY

Steve Enders

Citigroup

1 question for MNDY

Tom Blakey

Cantor Fitzgerald

1 question for MNDY

Recent press releases and 8-K filings for MNDY.

- Levi & Korsinsky, LLP is investigating monday.com (MNDY) for potential securities law violations after the company's February 9, 2026 earnings release.

- The investigation stems from MNDY's FY2026 revenue guidance of $1.452–$1.462 billion, which was materially below the previously endorsed $1.5 billion consensus.

- Concurrently, monday.com withdrew its 2027 long-term financial targets, stating a need for greater visibility.

- Following these disclosures, MNDY shares experienced a decline of more than 20% on February 9, 2026.

- monday.com (MNDY) disclosed fiscal year 2026 revenue guidance of $1.452 billion to $1.462 billion, representing 18%–19% growth, which was materially below the Wall Street consensus of approximately $1.5 billion.

- This guidance shortfall, approximately $38–$48 million from the previously endorsed figure, contributed to a 13–14% stock decline on February 9, 2026, erasing over $1 billion in market capitalization.

- The company's management also announced it would no longer discuss its previously provided 2027 financial targets, amplifying investor concern about growth visibility.

- This event marks the fourth consecutive quarter where a "beat-and-guidance-miss" pattern has resulted in a significant share-price decline.

- Levi & Korsinsky, LLP is investigating monday.com for potential violations of federal securities laws in connection with this disclosure.

- monday.com announced significant expansions to its partner program, introducing new dedicated reseller and distributor programs to broaden its market reach and unlock AI opportunities.

- In 2025, the partner channel was a substantial contributor, accounting for 23% of gross added ARR and supported by 3,000 certified partner representatives.

- The company is accelerating AI adoption within its ecosystem through new initiatives, including a competitive incentive program for AI capabilities and an AI Genius specialization for top AI partners.

- Levi & Korsinsky, LLP is investigating monday.com (MNDY) regarding whether the company adequately disclosed known headwinds before embedding them in its reduced 2026 guidance.

- On February 9, 2026, monday.com disclosed persistent weakness in its "no-touch" performance marketing channel and a 100-200 basis point foreign exchange drag as headwinds for its 2026 guidance. Management now views the no-touch weakness as structural, not temporary.

- The company is increasing investment in AI products, which is expected to cause gross margins to decline from 90% to the mid-to-high 80s in FY2026 and R&D spending to rise.

- These factors, combined with the withdrawal of 2027 financial targets, contribute to a deceleration in guided growth from 27% to 18-19%. The stock fell 13-14% on February 9, 2026.

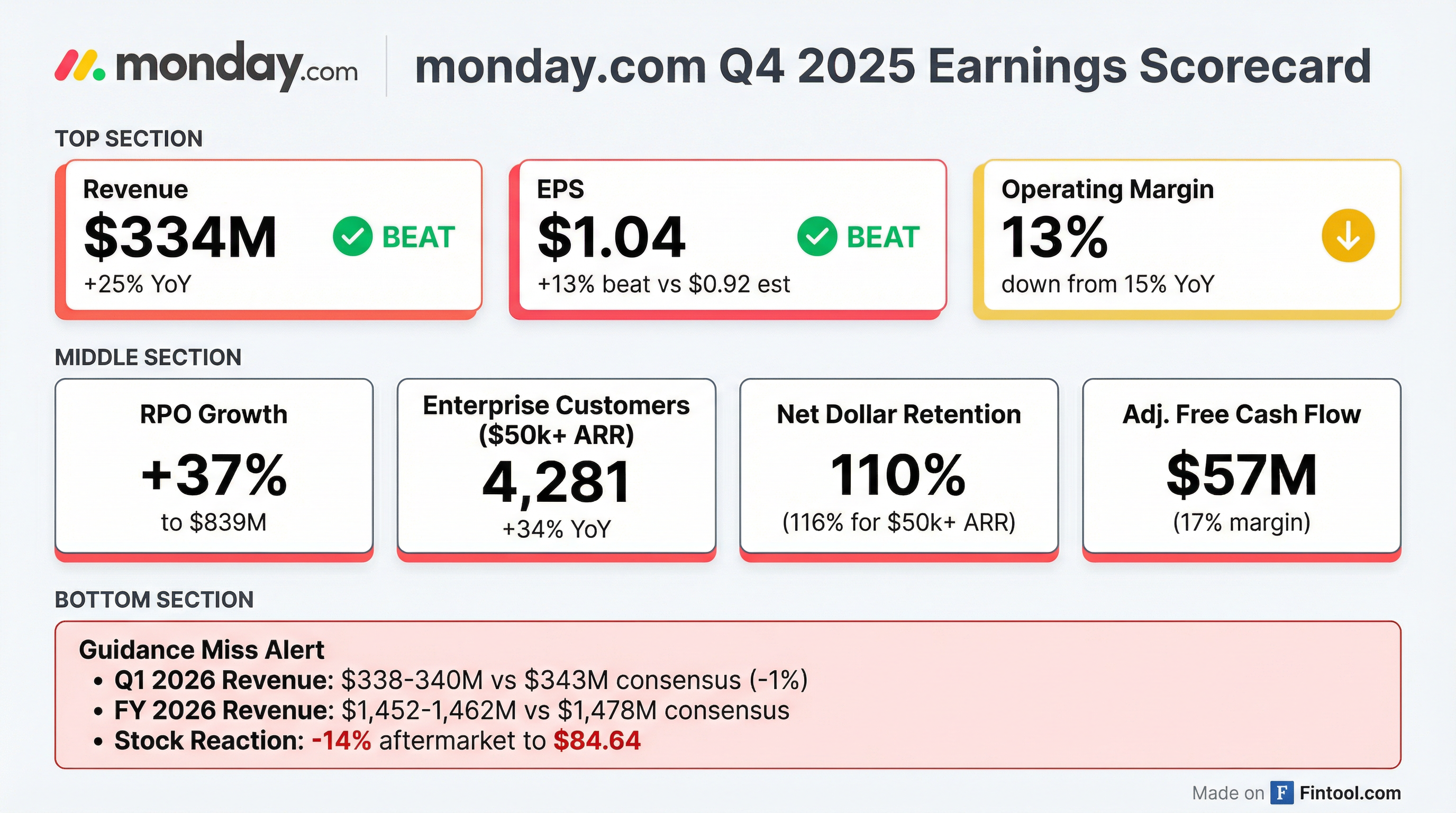

- monday.com reported strong fiscal year 2025 results, with revenue of $1.232 billion, up 27% year-over-year, and an operating margin of 14%. For Q4 2025, revenue was $334 million, up 25% year-over-year, with diluted net income per share of $1.04.

- For fiscal year 2026, the company expects revenue between $1.452 billion and $1.462 billion, representing 18%-19% year-over-year growth, and non-GAAP operating income of $165 million-$175 million. This guidance reflects continued choppiness in the no-touch demand environment and a significant negative impact from the appreciation of the Israeli shekel on margins and free cash flow.

- The company is focusing on upmarket and enterprise customer expansion, with customers over $50,000 in ARR now representing 41% of total ARR, and is seeing strong momentum in its AI-powered products like Monday Vibe, which surpassed $1 million of ARR faster than any other product.

- monday.com also executed a $135 million share repurchase in Q4 2025, with $735 million remaining under its existing authorization program.

- monday.com reported Q4 2025 revenue of $334 million, an increase of 25% year-over-year, and fiscal year 2025 revenue of $1.232 billion, up 27% year-over-year, with a 14% operating margin for the full year.

- For fiscal year 2026, the company expects revenue to be between $1.452 billion and $1.462 billion, representing 18%-19% year-over-year growth, and non-GAAP operating income between $165 million and $175 million, with an operating margin of 11%-12%.

- The company is experiencing a choppy demand environment in its no-touch channels, particularly among smaller customers, which is expected to persist in 2026, leading to a strategic shift in investment towards higher ROI opportunities with larger customers.

- monday.com is advancing its AI-powered work execution platform, with Monday Vibe becoming the fastest product to surpass $1 million of ARR, and executed a $135 million share repurchase during Q4 2025.

- monday.com reported $334 million in revenue for Q4 2025, marking a 25% year-over-year growth.

- The company achieved a Non-GAAP gross margin of 89% and adjusted free cash flow of $56.7 million, representing 17% of revenue for Q4 2025.

- Customers with $50k+ ARR increased by 34% year-over-year to 4,281, and those with $100k+ ARR grew by 45% year-over-year to 1,756 as of Q4 2025.

- Total Remaining Performance Obligations (RPOs) increased 37% year-over-year to $839 million by the end of Q4 2025.

- monday.com reported Q4 2025 revenue of $333.9 million, a 25% year-over-year increase, and Fiscal Year 2025 revenue of $1,232.0 million, up 27% year-over-year.

- For Fiscal Year 2025, the company achieved a 14% non-GAAP operating margin and non-GAAP diluted net income per share of $4.40.

- The number of paid customers with more than $50,000 in ARR grew 34% to 4,281, and those with more than $100,000 in ARR grew 45% to 1,756 as of December 31, 2025. These larger customers now represent 41% of total ARR.

- The company repurchased approximately 884,000 ordinary shares for $135 million during Q4 2025 as part of its share repurchase program.

- For the full year 2026, monday.com expects total revenue of $1,452 million to $1,462 million (18% to 19% year-over-year growth) and non-GAAP operating income of $165 million to $175 million (11% to 12% operating margin).

- Fourth quarter 2025 revenue reached $333.9 million, a 25% increase year-over-year, contributing to a fiscal year 2025 revenue of $1,232.0 million, up 27% year-over-year.

- Non-GAAP operating income for fiscal year 2025 was $175.3 million, achieving a 14% non-GAAP operating margin.

- The company reported record net adds of customers with more than $100,000 in ARR and noted that customers with over $50,000 in ARR now comprise 41% of total ARR.

- For the first quarter of fiscal year 2026, total revenue is expected to be between $338 million and $340 million, representing approximately 20% year-over-year growth.

- monday.com repurchased approximately 884,000 ordinary shares for $135 million as part of its share repurchase program.

- monday.com projects to achieve $1.8 billion in revenue by fiscal year 2027 , building on a projected $1.2 billion in revenue for fiscal year 2025. The company also announced its first-ever share repurchase program of up to $870 million.

- The company is making a significant strategic shift, amplifying its vision from "managing work" to "doing the work" for customers using AI. This includes embedding AI across its product suite and launching new AI-powered products like Monday Sidekick, MondayVibe, and Monday Magic.

- monday.com is evolving its monetization model to a hybrid pricing approach for existing products (seats plus AI consumption) and 100% consumption-based pricing for new AI products like MondayVibe and Monday Agents.

- The company continues to focus on upmarket expansion, with accounts over $500,000 in ARR growing to 68 from 5 in 2021 , and maintains a Net Dollar Retention (NDR) of around 111% for all customers.

- monday.com emphasizes efficient growth, achieving a Rule of 60 and projecting long-term operating margins of 20% to 25% and adjusted free cash flow of around 30%.

Fintool News

In-depth analysis and coverage of monday.com.

Quarterly earnings call transcripts for monday.com.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more