Earnings summaries and quarterly performance for LAS VEGAS SANDS.

Executive leadership at LAS VEGAS SANDS.

Board of directors at LAS VEGAS SANDS.

Research analysts who have asked questions during LAS VEGAS SANDS earnings calls.

Robin Farley

UBS

5 questions for LVS

Shaun Kelley

Bank of America Merrill Lynch

5 questions for LVS

Brandt Montour

Barclays PLC

4 questions for LVS

David Katz

Jefferies Financial Group Inc.

4 questions for LVS

George Choi

Citigroup Inc.

4 questions for LVS

Stephen Grambling

Morgan Stanley

4 questions for LVS

Steven Wieczynski

Stifel

4 questions for LVS

Carlo Santarelli

Deutsche Bank

3 questions for LVS

Chad Beynon

Macquarie

3 questions for LVS

Daniel Politzer

Wells Fargo

3 questions for LVS

Joseph Stauff

Susquehanna Financial Group, LLLP

3 questions for LVS

John DeCree

CBRE

2 questions for LVS

Lizzie Dove

Goldman Sachs

2 questions for LVS

Benjamin Chaiken

Mizuho Financial Group, Inc.

1 question for LVS

Brant Montour

Barclays

1 question for LVS

Colin Mansfield

CBRE Institutional Research

1 question for LVS

Daniel Politzer

JPMorgan Chase & Co.

1 question for LVS

George Troy

Citigroup

1 question for LVS

Joe Stauff

Susquehanna

1 question for LVS

Joseph Greff

JPMorgan Chase & Co.

1 question for LVS

Trey Bowers

Wells Fargo & Company

1 question for LVS

Vitaly Umansky

Seaport Research Partners

1 question for LVS

Recent press releases and 8-K filings for LVS.

- Q4 net revenue rose 16.4% YoY to US$2.05 billion, while net income fell to US$213 million from US$237 million and adjusted property EBITDA was US$608 million, missing consensus.

- EBITDA margin declined 260 bps to 28.9%, the weakest since COVID, driven by a shift toward VIP play and higher operating and reinvestment expenses.

- Full-year 2025 net revenue reached US$7.44 billion (+5.1% YoY), net income was US$901 million (down from US$1.05 billion), and adjusted property EBITDA remained flat at US$2.31 billion.

- Management is pursuing heavy capital spending in Macau and Singapore and continues to target US$2.7 billion in annualized EBITDA over the long term.

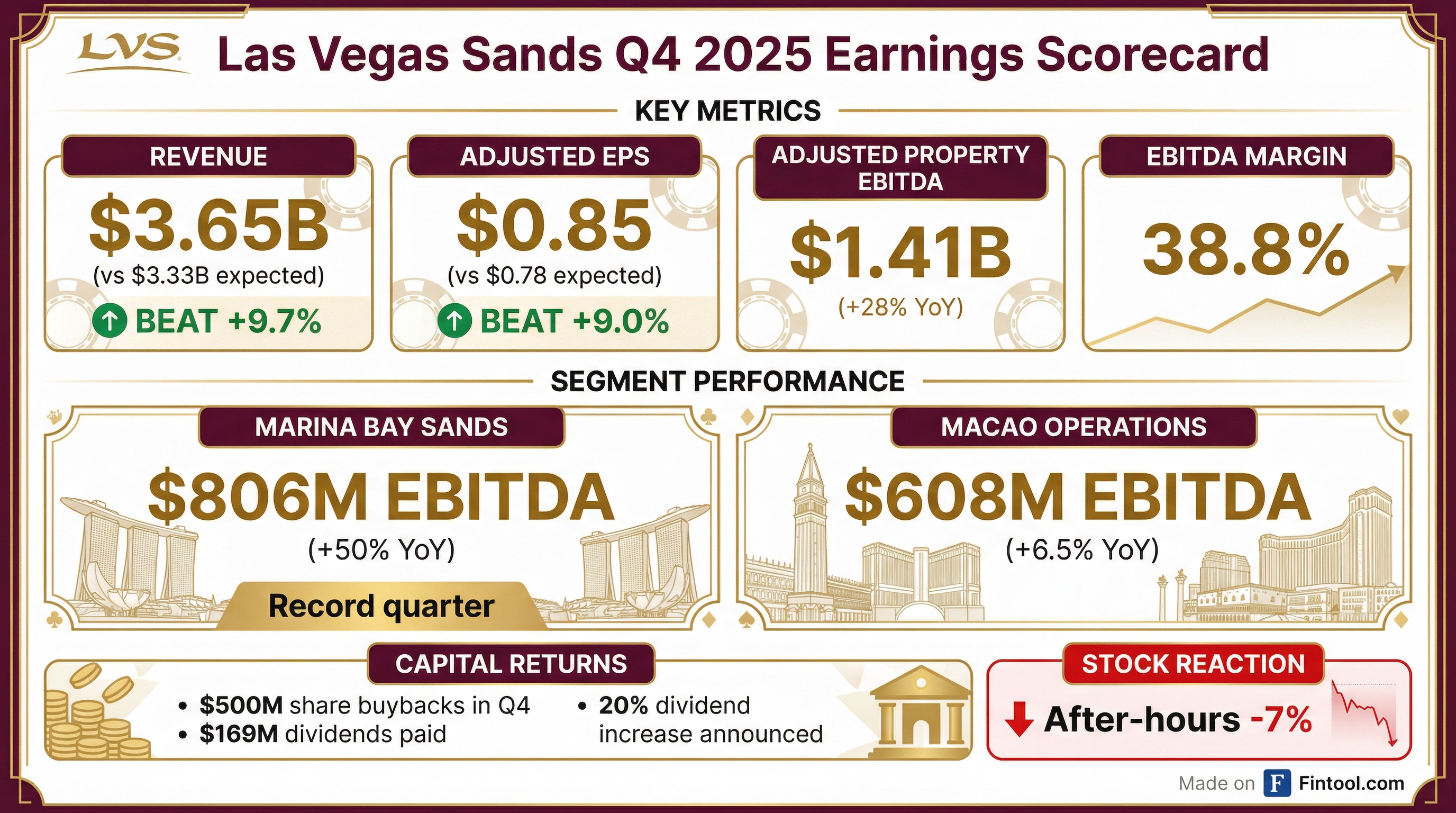

- Net revenue of $3.649 billion in Q4 2025, up $753 million y-o-y; net income attributable to LVS of $395 million and diluted EPS of $0.58 per share.

- Adjusted net income attributable to LVS of $579 million and adjusted diluted EPS of $0.85, compared with $387 million and $0.54 in Q4 2024.

- Adjusted Property EBITDA rose 27.6% to $1.414 billion with a margin of 38.8%; Macao operations EBITDA was $608 million (+6.5%) and Marina Bay Sands EBITDA reached $806 million (+50.1%).

- Returned capital via $500 million share repurchase and dividends of $0.25 per share in Q4 2025; board approved a 20% bump in the 2026 annual dividend to $1.20 per share, and increased LVS’s SCL stake to 74.8% after $66 million of acquisitions.

- Marina Bay Sands delivered record Q4 EBITDA of $806 million with a 50.3% margin, and full-year 2025 EBITDA topped $2.9 billion.

- Sands China (Macau) achieved $608 million EBITDA in Q4; hold-adjusted portfolio margin was 28.9% (–390 bps YoY), with Venetian at 32.3% and Londoner at 28.8%.

- Returned capital via a $500 million share repurchase, $0.25/share dividend, and increased Sands China stake to 74.8% with a $66 million SCL buy.

- CEO Rob Goldstein transitions to Senior Advisor role for two years, marking a significant management change.

- Marina Bay Sands posted a record quarter with $806 million EBITDA and > $2.9 billion in FY 2025 EBITDA; mass gaming GGR in Singapore rose 118% vs. Q4 2019

- Macau portfolio delivered $608 million EBITDA, with an adjusted EBITDA margin of 28.9% (down 390 bps vs. Q4 2024) amid a premium-segment mix and higher hold

- Capital return initiatives included $500 million of LVS share repurchases, a $0.25 per-share quarterly dividend, and $66 million of SCL stock bought to raise ownership to 74.8%

- VIP rolling chip volume in Macau surged 60% Y/Y, reflecting strategic commercial adjustments and success in attracting foreign high-value players

- Marina Bay Sands delivered a record Q4 EBITDA of $806 million at a 50.3% margin, driven by high-quality investments and growth in high-value tourism.

- Macau properties generated $608 million in EBITDA, with a hold-adjusted margin of 28.9%, reflecting higher-than-expected rolling hold and segment mix shifts.

- Returned capital via a $500 million share repurchase and paid a $0.25 per share dividend, while increasing Sands China Ltd. ownership to 74.8% through $66 million of stock purchases.

- CEO Rob Goldstein transitions to a senior advisor role after 30 years of leadership, marking a key management change.

- Las Vegas Sands reported Q4 net revenue of $3.65 billion and net income of $448 million, or $0.58 diluted EPS.

- Consolidated Adjusted Property EBITDA rose to $1.41 billion in Q4 2025, up from $1.11 billion a year earlier.

- Marina Bay Sands and Macao operations delivered Adjusted Property EBITDA of $806 million and $608 million, respectively, benefiting from high hold.

- The company repurchased $500 million of common stock and paid a quarterly dividend of $0.25 per share during the quarter.

- For the full year 2025, net income attributable to LVS was $1.63 billion ($2.35 per diluted share), versus $1.45 billion ($1.96) in 2024.

- Net revenue of $3.65 billion and net income of $448 million in the quarter ended December 31, 2025, up from $2.90 billion and $392 million in Q4 2024.

- Consolidated adjusted property EBITDA of $1.41 billion, compared to $1.11 billion in the prior-year quarter.

- Repurchased $500 million of common stock during Q4, leaving $1.56 billion available under the share buyback program as of year-end.

- Full-year 2025 net income attributable to Las Vegas Sands of $1.63 billion ( $2.35 per diluted share), versus $1.45 billion ( $1.96 per share) in 2024.

- Q4 revenue of $3.65 billion, operating income of $707 million, net income of $448 million, and adjusted property EBITDA of $1.41 billion; FY net income was $1.63 billion ($2.35 per diluted share).

- Marina Bay Sands delivered record quarterly adjusted property EBITDA of $806 million (50.3% margin), aided by a $45 million high-hold impact.

- Macau generated $608 million of EBITDA but saw a 390 basis-point decline in portfolio margins due to higher operating expenses, promotional investment, and a shift toward lower-margin business.

- Returned capital with a $500 million share repurchase and a $0.25 quarterly dividend; increased Sands China stake to 74.8% after a $66 million share purchase.

- Net revenue of $3.33 billion and net income of $491 million for Q3 2025, compared to $2.68 billion and $353 million in Q3 2024.

- Consolidated adjusted property EBITDA increased to $1.34 billion (Q3 2024: $991 million), with Macao contributing $601 million and Marina Bay Sands $743 million.

- Repurchased $500 million of common stock; board authorized raising remaining buyback capacity to $2.0 billion and approved a $0.20 per share quarterly dividend increase for 2026, bringing the annual dividend to $1.20 per share.

- Sands China Ltd. GAAP net revenues rose 7.5% to $1.90 billion, and net income was $272 million for the quarter.

- Net revenue of $3.33 billion and net income of $491 million; consolidated adjusted property EBITDA of $1.34 billion, up from $991 million in Q3 2024

- Macao Adjusted Property EBITDA of $601 million and Marina Bay Sands EBITDA of $743 million, with hold positively impacting MBS EBITDA by $43 million

- Repurchased $500 million of common stock in Q3 2025 and board increased repurchase authorization to $2.0 billion

- Board raised the annual dividend by $0.20 to $1.20 per share for 2026 ($0.30 per quarter)

Fintool News

In-depth analysis and coverage of LAS VEGAS SANDS.

Quarterly earnings call transcripts for LAS VEGAS SANDS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more