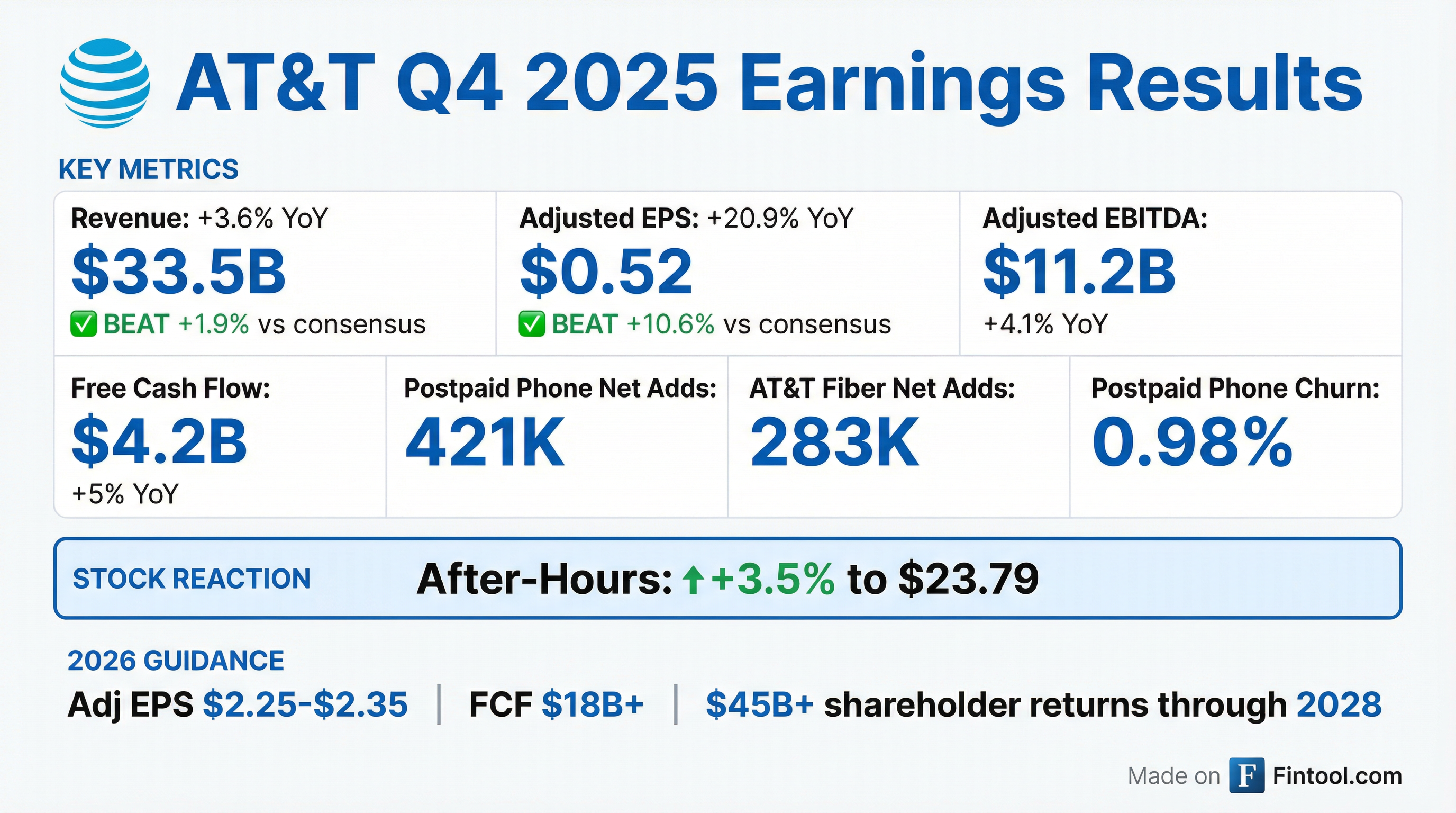

Earnings summaries and quarterly performance for AT&T.

Executive leadership at AT&T.

John Stankey

Chief Executive Officer

David McAtee

Senior Executive Vice President and General Counsel

Jeff McElfresh

Chief Operating Officer

Lori Lee

Global Marketing Officer and Senior Executive Vice President-HR and International

Pascal Desroches

Senior Executive Vice President and Chief Financial Officer

Board of directors at AT&T.

Research analysts who have asked questions during AT&T earnings calls.

Benjamin Swinburne

Morgan Stanley

7 questions for T

John Hodulik

UBS Group AG

7 questions for T

Michael Rollins

Citigroup

7 questions for T

Peter Supino

Wolfe Research

7 questions for T

Sebastiano Petti

JPMorgan Chase & Co.

7 questions for T

Michael Ng

Goldman Sachs

4 questions for T

David Barden

Bank of America

3 questions for T

Bryan Kraft

Deutsche Bank AG

2 questions for T

Drew McReynolds

RBC Capital Markets

2 questions for T

James Schneider

Goldman Sachs

2 questions for T

Jérome Dubreuil

Desjardins Group

2 questions for T

Kannan Venkateshwar

Barclays PLC

2 questions for T

Maher Yaghi

Scotiabank

2 questions for T

Michael Funk

Bank of America

2 questions for T

Samuel McHugh

BNP Paribas

2 questions for T

Stephanie Price

CIBC World Markets

2 questions for T

Vince Valentini

TD Securities

2 questions for T

John Hudlick

UBS

1 question for T

Timothy Horan

Oppenheimer & Co. Inc.

1 question for T

Recent press releases and 8-K filings for T.

- AT&T expanded its fiber footprint from 32 million to 36 million locations passed post-Lumen and expects to exceed 40 million by end-2026, driving higher ARPU and lower churn among converged wireless + fiber customers.

- Integration of Lumen's 4 million fiber passes (25% penetration, <20% convergence) is underway, with 2026 build plans of 4 million organic and 1 million Lumen locations, ramping to 5 million annual builds from 2027.

- Following the EchoStar spectrum acquisition (part of a $30 billion total investment with Lumen), AT&T is modernizing its network to deploy new spectrum by end-2027, with fixed wireless growth set to accelerate post-refresh.

- AT&T targets $4 billion in cost savings over 2026–2028 (vs prior $3 billion plan), expects free cash flow to improve sequentially after Q1 headwinds, and full EBITDA accretion from acquisitions by 2028.

- AT&T grew wireless service revenues >3% and broadband revenues mid-teens in 2025, with ARPU up modestly, underscoring its convergence strategy efficacy.

- The company ended 2025 with 32 million fiber locations passed, has risen to 36 million post-Lumen close, and targets >40 million by year-end 2026.

- In the Lumen footprint, convergence is under 20% versus over 40% in AT&T’s core markets; converged customers exhibit higher spending, loyalty and brand love.

- AT&T plans to ramp organic fiber builds to 4 million locations and Lumen builds to 1 million in 2026, totaling >8 million new passes this year and 5 million annually by 2027.

- The company aims to exit 30% of its wireline footprint and end legacy service offerings by end-2026, paving the way for real estate and copper monetization not yet in guidance.

- 2025 performance: wireless service revenues grew 3%, broadband revenues were up mid-teens, and ARPU rose modestly, reflecting AT&T’s focus on converged fiber and wireless offerings.

- Fiber expansion roadmap: post-Lumen, AT&T now passes 36 million fiber locations and expects to exceed 40 million by end-2026, with ~8 million net new builds this year and a run-rate of 5 million additions annually from 2027.

- Lumen acquisition integration: closed early February, adding 4 million passed locations at 25% penetration and < 20% convergence (vs. > 40% in AT&T’s core); equity partnership anticipated in 2H 2026.

- Legacy network decommissioning: with FCC approval to halt new legacy service, AT&T plans to exit 30% of its wireline footprint by end-2026, unlocking cost savings and future real estate/copper monetization (not yet factored into guidance).

- TELUS Digital will showcase production-ready AI-driven customer experience and network optimization solutions, featuring 20+ real-world use cases and a 90-minute session on March 4 to outline how to scale AI pilots to enterprise deployments with $100M+ value.

- In 2025, TELUS Digital processed over 2 trillion AI model tokens via its Fuel iX generative AI engine for TELUS, demonstrating enterprise-scale AI implementation.

- Key offerings include Fuel iX Agent Trainer for faster agent ramp-up, Fuel iX Fortify for automated AI application security testing, and AI-driven network design services, all battle-tested within TELUS before external deployment.

- As a wholly-owned subsidiary of TELUS Corporation (TSX: T, NYSE: TU) with 20+ years of telecom leadership, TELUS Digital leverages a “living laboratory” approach to refine AI solutions in real-world scenarios.

- Telus will retire CEO Darren Entwistle on June 30, 2026, with Victor Dodig appointed as his successor effective July 1, 2026.

- In Q4, Telus achieved 377,000 total telecom customer net additions, contributing to 1.1 million combined mobile and fixed net additions for 2025.

- Telus delivered a record CAD 2.2 billion in free cash flow for FY 2025, up 11% year-over-year, alongside industry-leading full-year postpaid mobile phone churn of 0.97%.

- For 2026, Telus targets 2–4% consolidated service revenue and adjusted EBITDA growth, CAD 2.3 billion in capital expenditures, and approximately CAD 2.45 billion in free cash flow.

- TELUS delivered $5.3 billion in consolidated operating revenues and other income in Q4 2025, with service revenue up 1% year-over-year.

- Net customer additions in the quarter totaled 377,000, including 50,000 mobile phones, 287,000 connected devices and 35,000 internet connections.

- For full-year 2025, basic EPS grew 9%, net income attributable to common shares rose 12%, cash from operations was $4.9 billion and free cash flow reached $2.2 billion, up 11%.

- Executing on deleveraging, TELUS ended 2025 with Net Debt/Adjusted EBITDA of 3.4×, targeting ≤3.3× by year-end 2026 and ~3.0× by end 2027.

- 2026 financial targets include 2–4% growth in consolidated service revenues and Adjusted EBITDA, approximately $2.3 billion in capex (–10%), and $2.45 billion in free cash flow (+10%).

- Legrand’s 2025 revenue rose to €9.48 billion, up 9.6% (7.7% organic), with data centres now generating about €2.4 billion or just over a quarter of sales.

- Adjusted operating profit increased by 10.5% to €1.96 billion, yielding an adjusted margin of around 20.6–20.7%.

- Net profit grew approximately 6.7% to €1.245 billion, with EPS at €4.705, while reported operating profit climbed to €1.809 billion.

- The board has proposed raising the dividend to €2.38 per share (∼50% payout), pending approval at the AGM on May 27, 2026.

- Legrand targets 10–15% sales growth in 2026 (constant currency) with a 20.5–21% margin, aims for €15 billion in sales by 2030, and announced two data-centre tuck-ins: Green4T (~€45 million revenue) and Kratos Industries (~US$100 million revenue).

- Founders Gabriel René and Dan Mapes have resigned, and David T. Scott has been appointed Interim Chief Executive Officer.

- The Board has launched a search for a permanent CEO, and Chief Accounting Officer Kevin Wilson has exited the company.

- The company will focus on converting its R&D into commercial products with an initial emphasis on financial services revenue.

- Near-term initiatives include cost-reduction and operational-efficiency efforts to support commercialization goals.

- On February 5, 2026, AT&T closed issuance of $6.5 billion aggregate principal of Global Notes: $1.5 billion 4.400% due 2031; $1.25 billion 4.750% due 2033; $1.25 billion 5.125% due 2036; $850 million 5.850% due 2046; and $1.65 billion 6.000% due 2056.

- The Notes were issued under the Indenture dated May 15, 2013, and registered under a Form S-3 (No. 333-285413), as supplemented by a prospectus supplement dated January 29, 2026.

- BofA Securities, Deutsche Bank Securities, Morgan Stanley & Co., MUFG Securities Americas, TD Securities (USA) and Wells Fargo Securities served as representatives of the underwriting syndicate.

- On Feb. 4, 2026, AT&T announced a fiber-to-space partnership with Amazon combining AT&T’s terrestrial fiber with Amazon Leo satellite connectivity and AWS cloud services.

- The deal will migrate major AT&T workloads to AWS hybrid cloud, link AWS data centers with high-capacity AT&T fiber, expand fixed broadband and enterprise services, and enhance FirstNet public-safety resilience.

- Amazon Leo plans to launch 32 satellites on Feb. 12 and ultimately grow its constellation to 3,236 satellites, positioning the network as a counterweight to SpaceX’s Starlink.

- AT&T serves roughly 74 million postpaid and 17 million prepaid phone customers, with its wireless segment driving nearly 70% of revenue, though analyses flagged an Altman Z-Score of ~0.99.

Fintool News

In-depth analysis and coverage of AT&T.

AT&T CFO Lays Out Fiber-First Playbook at Barclays: 60M Locations by 2030, Accretion in 2028

AT&T and Amazon Forge 'Fiber-to-Space' Alliance to Challenge Starlink Dominance

AT&T Abandons Downtown Dallas for Suburban Plano in $2.7 Billion Property Value Shock

Quarterly earnings call transcripts for AT&T.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more