Earnings summaries and quarterly performance for Spotify Technology.

Research analysts who have asked questions during Spotify Technology earnings calls.

Justin Patterson

KeyBanc Capital Markets

8 questions for SPOT

Richard Greenfield

LightShed Partners

7 questions for SPOT

Eric Sheridan

Goldman Sachs

6 questions for SPOT

Jessica Reif Ehrlich

Bank of America Securities

6 questions for SPOT

Douglas Anmuth

JPMorgan Chase & Co.

4 questions for SPOT

Batya Levi

UBS

3 questions for SPOT

Michael Morris

Guggenheim Partners

3 questions for SPOT

Richard Kramer

Arete Research

3 questions for SPOT

Benjamin Black

Deutsche Bank AG

2 questions for SPOT

Benjamin Swinburne

Morgan Stanley

2 questions for SPOT

Doug Anmuth

J.P. Morgan

2 questions for SPOT

Jason Helfstein

Oppenheimer & Co. Inc.

2 questions for SPOT

Maria Ripps

Morgan Stanley

2 questions for SPOT

Matt Thornton

SunTrust Robinson Humphrey

2 questions for SPOT

Steven Cahall

Wells Fargo & Company

2 questions for SPOT

Ben Black

Deutsche Bank

1 question for SPOT

Bhatia Levy

BofA Securities

1 question for SPOT

Bryan Kraft

Deutsche Bank AG

1 question for SPOT

Deepak Madhavanan

UBS

1 question for SPOT

Deepak Mathivan

Wolfe Research

1 question for SPOT

Deepak Mathivanan

Cantor Fitzgerald

1 question for SPOT

Eric Handler

Roth Capital Partners, LLC

1 question for SPOT

Jason Bazanay

RBC Capital Markets

1 question for SPOT

Jason Bazinet

Citigroup

1 question for SPOT

Jesperi Verlick

Wells Fargo Securities

1 question for SPOT

Jessica Riefer-Ehrlich

JPMorgan Chase & Co.

1 question for SPOT

Kannan Venkateshwar

Barclays PLC

1 question for SPOT

Mark Mahaney

Evercore ISI

1 question for SPOT

Michael Morris

Guggenheim Securities

1 question for SPOT

Stephen Ju

UBS

1 question for SPOT

Recent press releases and 8-K filings for SPOT.

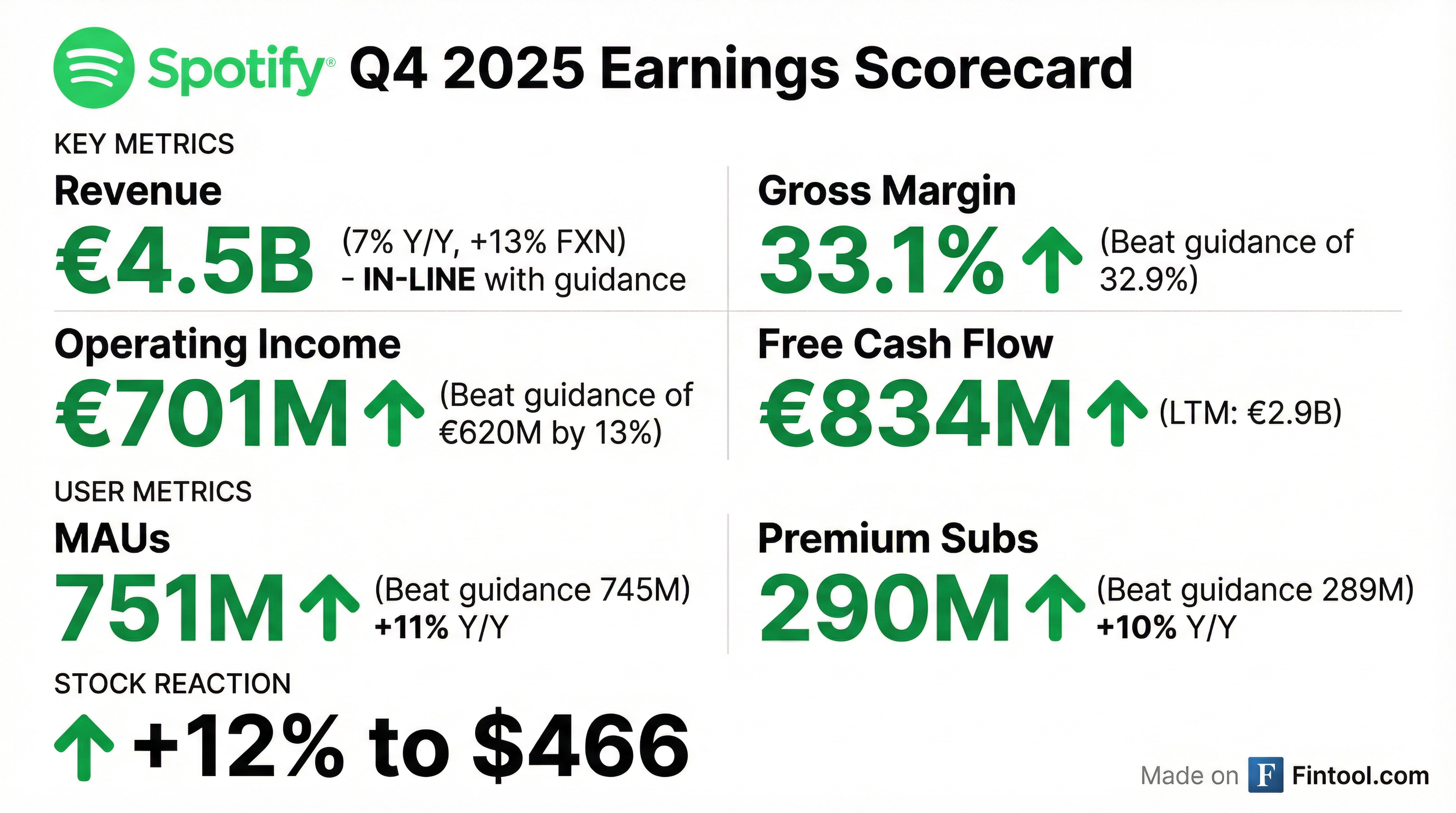

- Spotify reported Q4 2025 Total Revenue of €4,531 million, an increase of 7% year-over-year (or 13% on a constant currency basis), which was in-line with guidance.

- The company achieved a Gross Margin of 33.1% and Operating Income of €701 million in Q4 2025, with both metrics exceeding guidance.

- Monthly Active Users (MAUs) reached 751 million and Premium Subscribers grew to 290 million in Q4 2025, representing 11% and 10% year-over-year growth, respectively, and both surpassed guidance.

- Free Cash Flow for Q4 2025 was €834 million, contributing to a full-year 2025 Free Cash Flow of €2.9 billion.

- Spotify reported strong Q4 2025 results, with total revenue growing 13% to EUR 4.5 billion and operating income reaching EUR 701 million, exceeding forecasts. For full-year 2025, revenue grew 13%, gross profit grew 20%, and operating income increased over 50% to a 13% margin, with free cash flow improving to a record EUR 2.9 billion.

- The company issued Q1 2026 guidance, forecasting 759 million MAU, 293 million subscribers, and total revenue of EUR 4.5 billion, representing an improved growth rate of approximately 15%.

- Spotify repurchased $433 million worth of shares in Q4 2025 and EUR 510 million in buybacks for the full year, and plans to continue opportunistic share buybacks.

- Daniel Ek transitioned from CEO to Executive Chairman, with Alex Norström and Gustav Söderström becoming Co-CEOs, and the company highlighted its significant investment and focus on AI for product innovation and internal efficiency, including tools like Interactive DJ and Prompted Playlist.

- Spotify closed 2025 with a strong Q4, meeting or exceeding guidance across all key metrics, including a record high for MAU net additions, and its Wrapped campaign engaged over 300 million users.

- In 2025, the company paid out more than $11 billion to music rights holders, contributing to a total of nearly $70 billion since its founding, and anticipates improved gross and operating margins and meaningfully higher free cash flow in 2026.

- Spotify continues to advance its AI strategy, with 90 million subscribers having used AI DJ, driving over 4 billion hours of time spent, and recently launched Prompted Playlist, aiming to evolve into an intelligent, agentic media platform.

- The company expanded its audiobook catalog to over 500,000 titles across 14 global markets and is exploring the physical book market, while recent US price increases implemented in January 2026 have resulted in low churn as expected.

- Spotify executed EUR 510 million in share buybacks in 2025 and plans to settle EUR 1.5 billion in convertible notes in cash in March.

- Spotify reported strong financial performance for Q4 2025, with Total Revenue reaching €4,531 million, a 7% year-over-year increase (or 13% on a constant currency basis), and Operating Income of €701 million. The Gross Margin expanded to 33.1%, up 83 basis points year-over-year.

- The company demonstrated robust user growth, ending Q4 2025 with 751 million Total Monthly Active Users (MAUs), an 11% year-over-year increase, and 290 million Premium Subscribers, up 10% year-over-year. This was driven by record Q4 MAU net additions of 38 million.

- Spotify generated €834 million in Free Cash Flow for Q4 2025, contributing to a full-year 2025 total of €2.9 billion. The company also repurchased $433 million in shares during the quarter, bringing the full-year 2025 repurchase activity to $510 million.

- For Q1 2026, Spotify provided guidance expecting Total MAUs of 759 million, Total Premium Subscribers of 293 million, and Total Revenue of €4.5 billion. The outlook also projects a Gross Margin of 32.8% and Operating Income of €660 million.

- Spotify reported a blowout Q4 2025, achieving record operating income of €701 million and net income of €1.17 billion.

- The company's financial performance included adjusted EPS of roughly $5.16 and revenue of about $5.27 billion.

- Monthly active users reached 751 million and premium subscribers grew approximately 10% year-over-year to 290 million.

- Gross margin improved by 83 basis points year-over-year to a historic high of 33.1%.

- Despite the strong quarterly results, Spotify shares had declined about 28.6% year-to-date prior to the report.

- Citi upgraded Spotify (SPOT) to a Buy rating with an unchanged $650 price target, citing attractive valuation due to recent share weakness and forecasting revenue and adjusted EBITDA modestly above consensus.

- Key catalysts for the upgrade include potential EU price hikes, competitor price increases, and accelerated share buybacks.

- Analysts caution about risks such as Spotify using cash for AI-music acquisitions instead of buybacks, and competitors not raising prices, which could impact margins.

- Major institutional investors, including State Street Corp and Capital World Investors, have recently increased their holdings in Spotify.

- Spotify has expanded its AI-powered "Prompted Playlist" to Premium users in the U.S. and Canada, enabling them to create highly specific music mixes from conversational prompts.

- This feature is marketed as a premium perk to help convert free users to paid subscribers and supports a $1 U.S. price increase to $12.99 starting in February.

- Following the announcement, Spotify's shares slipped approximately 1.5%, and analysts like Barclays trimmed price targets (e.g., to $625 from $700) while maintaining constructive ratings, reflecting investor debate over growth versus margin pressure.

- Spotify announced Premium price increases in the U.S., Estonia, and Latvia, with U.S. Individual plans rising from $11.99 to $12.99, an approximate 8% increase, effective February billing dates.

- The company aims for sustained profitability, having achieved its first full year of operating profit in 2024, and reported 281 million Premium subscribers and €582 million in quarterly operating income as of Q3 2025.

- Alongside the price adjustments, Spotify formalized leadership changes, with co-founder Daniel Ek becoming executive chairman and Gustav Söderström and Alex Norström appointed as co-CEOs.

- Spotify's new co-CEOs Alex Norström and Gustav Söderström began 2026 by emphasizing continuity, a renewed creative responsibility, and a product-first approach, while the company supports a global creator ecosystem across 184 countries.

- Wall Street sentiment in early January 2026 was broadly positive but mixed, with Citizens and Bank of America reiterating Buy ratings and high price targets, while Cantor Fitzgerald maintained a Hold rating and trimmed its target.

- Analysts highlight Spotify's more than 600 million monthly active users, diversified revenue mix, and product innovation as key drivers for long-term growth, with an expected advertising/programmatic inflection in late 2026.

Fintool News

In-depth analysis and coverage of Spotify Technology.

Quarterly earnings call transcripts for Spotify Technology.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more