Earnings summaries and quarterly performance for Zeta Global Holdings.

Executive leadership at Zeta Global Holdings.

Board of directors at Zeta Global Holdings.

Research analysts who have asked questions during Zeta Global Holdings earnings calls.

Arjun Bhatia

William Blair

9 questions for ZETA

Jason Kreyer

Craig-Hallum Capital Group LLC

9 questions for ZETA

Richard Baldry

ROTH MKM

9 questions for ZETA

Zach Cummins

B. Riley Securities

9 questions for ZETA

Koji Ikeda

Bank of America

7 questions for ZETA

Matthew Swanson

RBC Capital Markets

7 questions for ZETA

Terrell Tillman

Truist Securities

7 questions for ZETA

Clark Wright

D.A. Davidson & Co.

6 questions for ZETA

Jackson Ader

KeyBanc Capital Markets

6 questions for ZETA

Brian Schwartz

Oppenheimer & Co.

4 questions for ZETA

David Hynes

Canaccord Genuity Group Inc.

4 questions for ZETA

Elizabeth Porter

Morgan Stanley

4 questions for ZETA

Gabriela Borges

Goldman Sachs

4 questions for ZETA

Ryan MacDonald

Needham & Company

4 questions for ZETA

DJ Hynes

Canaccord Genuity

3 questions for ZETA

Callie Valenti

Goldman Sachs

2 questions for ZETA

D.J. Hynes

Canaccord Genuity

2 questions for ZETA

Elizabeth Elliott

Morgan Stanley

2 questions for ZETA

George McGreehan

Bank of America

2 questions for ZETA

Jack Nichols

KeyBanc Capital Markets Inc.

2 questions for ZETA

Lucas Metcalf

Needham & Company

2 questions for ZETA

Matt Swanson

RBC Capital Markets, LLC

2 questions for ZETA

Ryan MacWilliams

Barclays

2 questions for ZETA

Terry Tillman

Truist Financial Corporation

2 questions for ZETA

Eamon Coughlin

Barclays

1 question for ZETA

Jackson Nichols

KeyBanc Capital Markets

1 question for ZETA

Kathleen Alexis Keyser

Morgan Stanley

1 question for ZETA

Katie Keezer

Morgan Stanley

1 question for ZETA

Katie Keyser

Morgan Stanley

1 question for ZETA

Kelly Valentini

Goldman Sachs

1 question for ZETA

Scott Berg

Needham & Company, LLC

1 question for ZETA

Recent press releases and 8-K filings for ZETA.

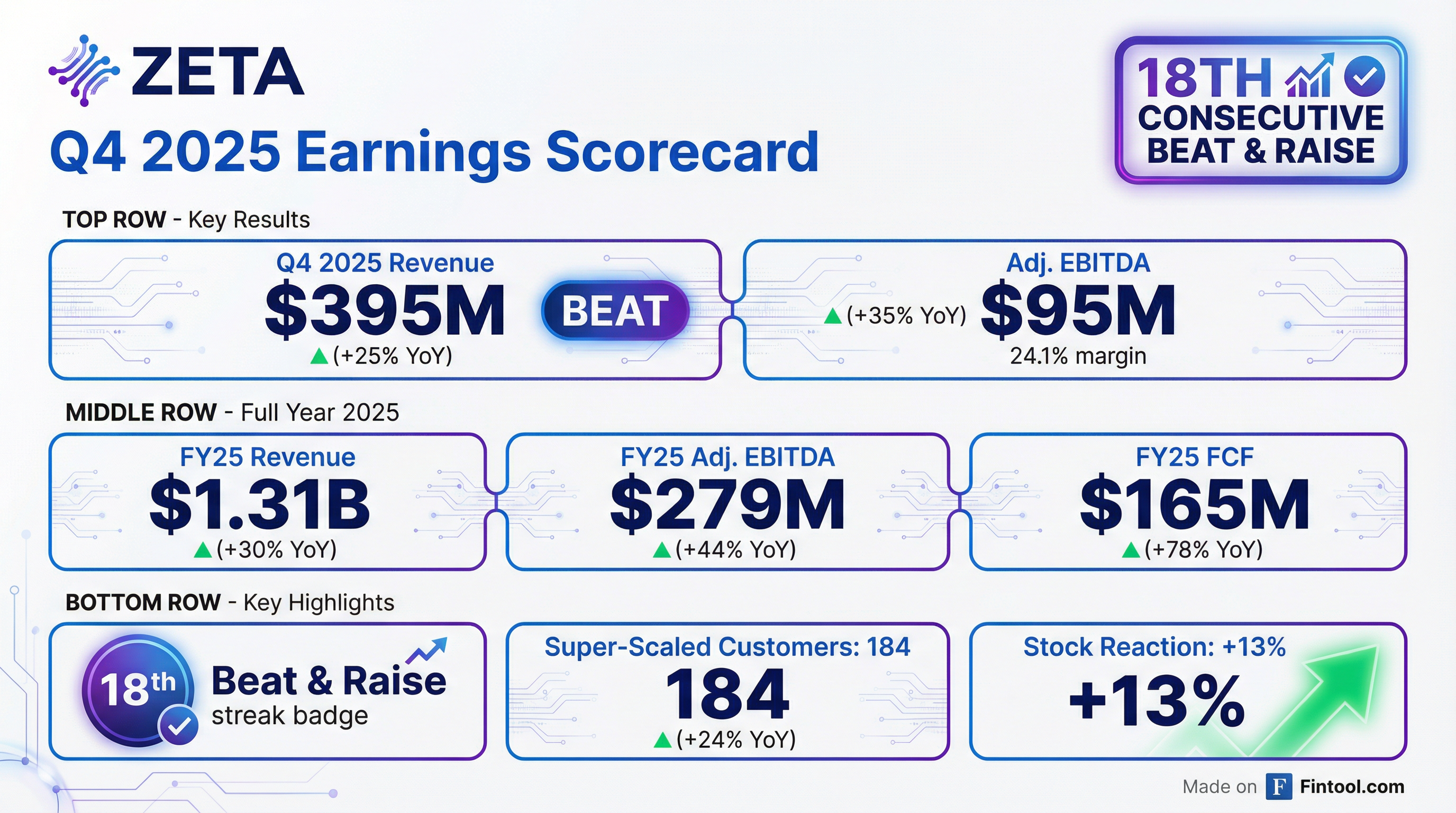

- Zeta Global reported strong Q4 2025 revenue of $395 million, a 28% year-over-year increase (excluding acquisitions and political candidate), and Adjusted EBITDA of $95.1 million, up 35% year-over-year, achieving positive GAAP earnings for the quarter. For the full year 2025, revenue was $1,305 million, up 30% year-over-year, with Adjusted EBITDA of $279 million and $165 million in free cash flow.

- The company raised its 2026 guidance, with the midpoint for revenue now at $1.755 billion (a 35% year-over-year growth rate), Adjusted EBITDA at $391 million (a 40% increase), and free cash flow at $231 million (a 40% increase).

- Net Revenue Retention hit a record high of 120% in 2025, up from 114% in 2024, driven by the success of the OneZeta initiative, which saw scaled customers using more than one use case increase by over 80% year-over-year in Q4 2025.

- Zeta is on track to make its new AI-powered agent, Athena, generally available by the end of Q1 2026, and the Marigold acquisition is progressing well, expected to contribute at least $190 million in 2026 revenue and be accretive to free cash flow and Adjusted EBITDA in its first year.

- The company repurchased 1.9 million shares for $35 million in Q4 2025, totaling 7.9 million shares for $120 million in 2025, with an additional 1.5 million shares for $25 million repurchased since January 1, 2026, up to mid-February.

- Zeta Global Holdings reported its 18th consecutive "beat and raise" quarter in Q4 2025, with FY25 revenue growing 30% to $1,305 million and Adjusted EBITDA increasing 44% to $279 million.

- The company issued FY26 guidance projecting total revenue of $1,755 million (35% Y/Y growth) and Adjusted EBITDA of $391.0 million (40% Y/Y growth) at the midpoint, and expects to achieve GAAP Net Income positive for the full year.

- Zeta updated its 2028 targets, raising Total Zeta Revenue to $2.3 billion, Adjusted EBITDA to $573 million, and Free Cash Flow to $371 million.

- Scaled customer count grew 14% year-over-year to 602 in Q4 2025, while super-scaled customers increased 24% year-over-year to 184.

- Zeta Global Holdings reported Q4 2025 revenue of $395 million, marking a 28% year-over-year increase (excluding acquisition and political candidate), and full-year 2025 revenue of $1,305 million, up 30% year-over-year. The company achieved positive GAAP net income of $6.5 million in Q4 2025 and anticipates remaining net income positive in 2026.

- Adjusted EBITDA for Q4 2025 was $95.1 million, a 35% year-over-year increase, with free cash flow reaching $55.8 million, up 76% year-over-year. Full-year 2025 Adjusted EBITDA was $279 million and free cash flow was $165 million.

- The company raised its 2026 full-year revenue guidance to $1.755 billion (midpoint), reflecting 35% growth, and increased its Adjusted EBITDA guidance to $391 million and free cash flow guidance to $231 million.

- Net Revenue Retention reached a record high of 120% in 2025, an increase from 114% in 2024. Zeta also repurchased 1.9 million shares for $35 million in Q4 2025, contributing to $120 million in share repurchases for the full year 2025.

- Zeta Global reported Q4 2025 revenue of $395 million and full-year 2025 revenue of $1,305 million, exceeding its initial revenue guidance by 5% and marking the sixth consecutive year of over 20% revenue growth.

- The company achieved positive GAAP net income of $6.5 million in Q4 2025 and generated $165 million in free cash flow for the full year, representing a 12.6% margin and a 78% increase year-over-year.

- For 2026, Zeta Global raised its guidance, projecting full-year revenue of $1.755 billion and adjusted EBITDA of $391 million, representing 35% and 40% year-over-year growth, respectively.

- Strategic initiatives include the upcoming general availability of its AI product Athena by the end of Q1 2026 and the continued success of its One Zeta strategy, which saw scaled customers using multiple use cases increase by 80% year-over-year in Q4 2025, contributing to a 120% net retention rate for 2025.

- Zeta Global repurchased $120 million worth of shares in 2025 and an additional $25 million in early 2026, with approximately $139 million remaining on its share repurchase authorization.

- Zeta Global reported record full year 2025 revenue of $1,305 million, a 30% increase year-over-year, and Q4 2025 revenue of $395 million, up 25% year-over-year.

- For full year 2025, the company achieved net cash provided by operating activities of $199 million (up 49% Y/Y) and free cash flow of $165 million (up 78% Y/Y), with positive GAAP net income of $6.5 million in Q4 2025.

- The company increased its full year 2026 revenue guidance to $1,749 million to $1,762 million and adjusted EBITDA guidance to $389.9 million to $392.1 million, while also guiding to positive GAAP Net Income for the full year.

- Additionally, Zeta Global raised its 2028 revenue target to at least $2.3 billion and its adjusted EBITDA expectation to at least $573 million.

- Zeta Global differentiates itself with a proprietary data set of over 245 million U.S. adults and 525 million globally, enabling omnichannel marketing and serving customer retention, growth, and acquisition use cases, unlike competitors focused solely on retention.

- The company introduced Athena, an AI agent designed to enhance efficiency by reducing workflow times from hours to minutes, leveraging Zeta's Data Cloud and Identity Graph for intelligent recommendations and seamless campaign management. Athena's monetization strategy focuses on driving use case adoption, which historically increases revenue per customer by three to five times.

- Zeta has a strategic partnership with OpenAI, embedding OpenAI's conversational tool into Athena and exploring joint go-to-market opportunities, with TKO serving as an early adopter and public testimonial.

- Recent acquisitions include LiveIntent, adding a new Publisher Cloud channel for targeted advertising in digital newsletters , and Marigold, a competitor acquisition expected to contribute at least $190 million in standalone revenue for calendar 2026. The Marigold acquisition aims to cross-sell Zeta's growth and acquisition use cases to Marigold's 30-50 large enterprise customers.

- Zeta maintains strong growth and profitability by rigorously redistributing resources, focusing on coding and sales, and operating with an "ultra lean" middle layer, aiming for approximately 20% organic growth with 30% margins and 70% Free Cash Flow conversion by 2028/2030.

- Zeta Global operates a marketing cloud for Chief Marketing Officers, distinguished by its proprietary data set of over 245 million U.S. adults and 525 million globally, omnichannel marketing capabilities, and ability to serve customer retention, growth, and acquisition use cases.

- The company introduced Athena, an AI agent designed to enhance efficiency and effectiveness for customers by reducing manual workflow time, leveraging its proprietary Data Cloud and Identity Graph. Zeta has also partnered with OpenAI, embedding its conversational tool into Athena and exploring joint go-to-market strategies.

- Zeta recently acquired Marigold (closed end of 2023), a competitor, primarily to cross-sell Zeta's growth and acquisition use cases to Marigold's 30 to 50 large enterprise customers. The company guided to at least $190 million in standalone Marigold revenue for 2026, incorporating conservative assumptions regarding attrition and non-strategic product support.

- Zeta aims for approximately 20% organic growth with 30% margins and 70% Free Cash Flow conversion by 2028/2030, driven by a strategy of rigorous resource redistribution to focus on code creation and sales, while maintaining an "ultra lean" middle layer.

- Zeta Global highlighted its differentiated marketing cloud, featuring a proprietary data set of over 245 million U.S. adults and 525 million globally, omnichannel capabilities, and support for customer acquisition, growth, and retention use cases.

- The company introduced Athena, an AI agent aimed at significantly improving customer efficiency by automating complex workflows and reducing task times from hours to minutes, thereby driving increased platform utilization and use case adoption.

- Zeta detailed its strategic partnership with OpenAI, which involves embedding OpenAI's conversational tool into Athena and exploring a future joint go-to-market strategy for enterprise clients.

- The recent acquisition of Marigold (closed end of 2023) is anticipated to expand Zeta's product portfolio with a loyalty offering and provide access to 30-50 large enterprise customers for cross-selling. Zeta projects at least $190 million in standalone Marigold revenue for 2026, with a conservative estimate accounting for historical attrition.

- Zeta Global affirmed its long-term financial targets of approximately 20% organic growth and 30% Free Cash Flow conversion margins by 2028/2030, driven by strategic resource allocation focused on high-value functions.

- Zeta Global announced a strategic collaboration with OpenAI to power the conversational intelligence and agentic applications behind Athena by Zeta™, its superintelligent agent for enterprise marketing.

- This partnership will involve a deeper technical collaboration, aligning Athena's product roadmap with advances in OpenAI models, and providing Zeta with early access to new OpenAI models and features.

- Athena's first two agentic applications, Insights and Advisor, have entered beta, with TKO Group Holdings, Inc. already reporting positive impact from the Early Access Program.

- Zeta plans to launch Athena to all customers by the end of Q1 2026.

- Zeta Global reported strong Q3 2025 results, with revenue of $337 million (up 28% year-over-year excluding political and LiveIntent), Adjusted EBITDA of $78 million (up 46%), and Free Cash Flow of $47 million (up 83%), marking its highest free cash flow margin ever achieved.

- The company raised its full-year 2025 guidance, increasing the midpoint of revenue guidance by $11 million to $1.275 billion, Adjusted EBITDA to $273.7 million, and Free Cash Flow to $157.4 million.

- Zeta Global provided an initial organic-only outlook for 2026, projecting revenue of $1.54 billion (21% growth), Adjusted EBITDA of $354 million (23% margin), and Free Cash Flow of $209 million (14% margin).

- The company launched Athena, an AI conversational super intelligent agent, which is in internal beta and expected to be production-ready by the end of Q1 2026. The acquisition of Marigold's enterprise software business remains on track to close by the end of 2025, though its contributions are not included in current 2025 guidance.

Quarterly earnings call transcripts for Zeta Global Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more