Earnings summaries and quarterly performance for Axalta Coating Systems.

Executive leadership at Axalta Coating Systems.

Chris Villavarayan

Chief Executive Officer and President

Alex Tablin-Wolf

Senior Vice President, General Counsel & Corporate Secretary

Carl D. Anderson II

Senior Vice President and Chief Financial Officer

Hadi H. Awada

President, Global Mobility Coatings

Mark Dixon

Senior Vice President, Chief Procurement Officer & Operational Excellence

Patricia Morschel

Senior Vice President, Chief Marketing Officer

Tim Bowes

President, Global Industrial Coatings

Troy D. Weaver

President, Global Refinish

Board of directors at Axalta Coating Systems.

Research analysts who have asked questions during Axalta Coating Systems earnings calls.

Aleksey Yefremov

KeyBanc Capital Markets

5 questions for AXTA

David Begleiter

Deutsche Bank

5 questions for AXTA

John McNulty

BMO Capital Markets

5 questions for AXTA

Kevin McCarthy

Vertical Research Partners

5 questions for AXTA

Vincent Andrews

Morgan Stanley

5 questions for AXTA

Chris Parkinson

Wolfe Research, LLC

4 questions for AXTA

John Ezekiel Roberts

Mizuho Securities

4 questions for AXTA

Michael Sison

Wells Fargo

4 questions for AXTA

Christopher Parkinson

Wolfe Research

3 questions for AXTA

Ghansham Panjabi

Robert W. Baird & Co.

3 questions for AXTA

Jeffrey Zekauskas

JPMorgan Chase & Co.

3 questions for AXTA

Laurent Favre

BNP Paribas

3 questions for AXTA

Lucas Beaumont

UBS Group AG

3 questions for AXTA

Michael Leithead

Barclays

3 questions for AXTA

Mike Harrison

Seaport Research Partners

3 questions for AXTA

Edlain Rodriguez

Mizuho Securities

2 questions for AXTA

Hakeem Olorun-Owe

Bank of America

2 questions for AXTA

Josh Vesely

Baird

2 questions for AXTA

Matthew Deyoe

Bank of America

2 questions for AXTA

Michael Harrison

Seaport Research Partners

2 questions for AXTA

Patrick Cunningham

Citigroup

2 questions for AXTA

Steve Byrne

Bank of America

2 questions for AXTA

Arun Viswanathan

RBC Capital Markets

1 question for AXTA

Duffy Fischer

Goldman Sachs

1 question for AXTA

Josh Spector

UBS Group

1 question for AXTA

Joshua Spector

UBS

1 question for AXTA

Josh Weesley

Baird

1 question for AXTA

Laurence Alexander

Jefferies

1 question for AXTA

Matthew Krueger

Baird

1 question for AXTA

Patrick Fischer

Goldman Sachs

1 question for AXTA

Rock Hoffman Blasko

Bank of America

1 question for AXTA

Ryan

B. Riley

1 question for AXTA

Recent press releases and 8-K filings for AXTA.

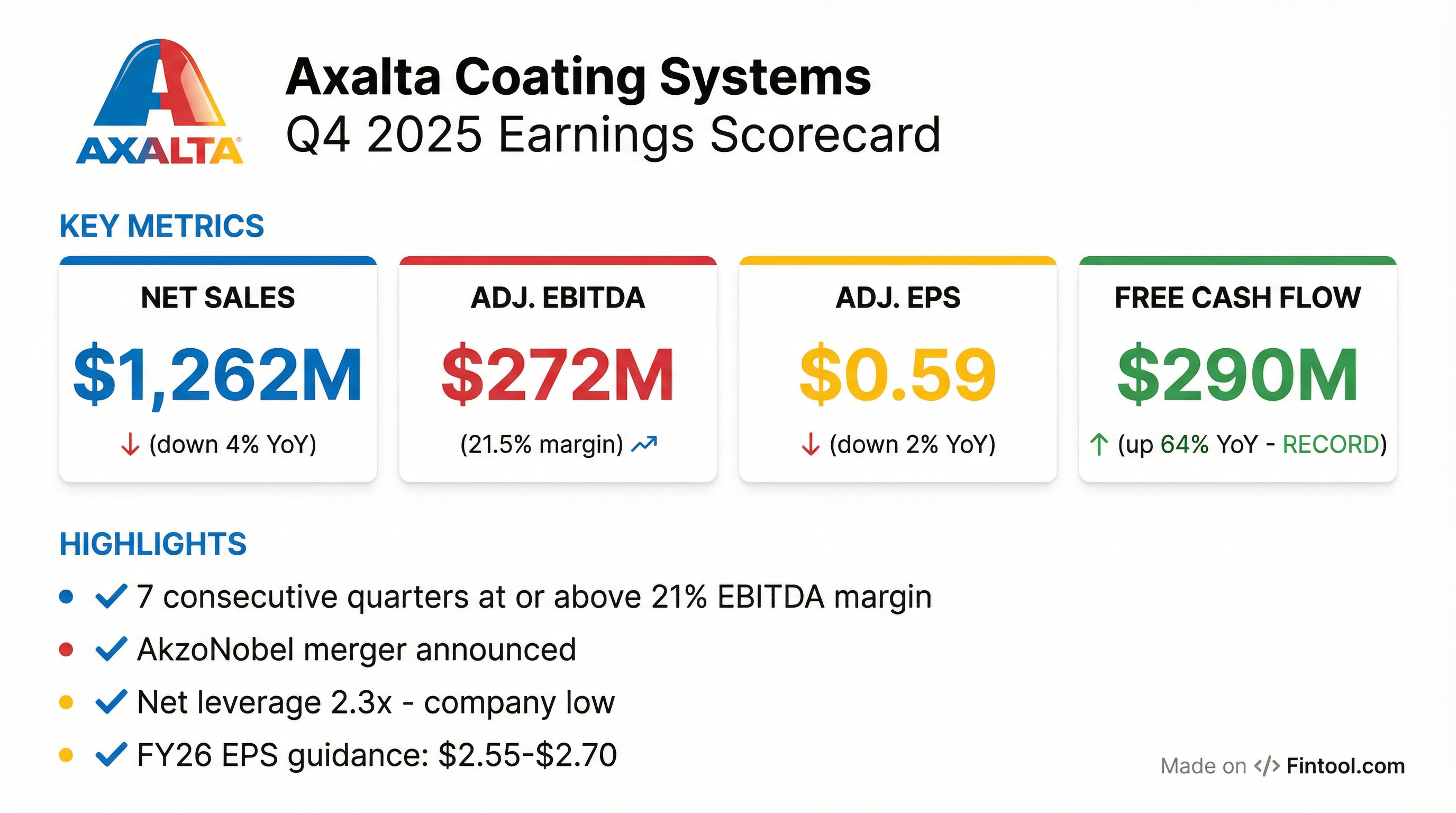

- Axalta Coating Systems achieved record financial results for full-year 2025, with Adjusted EBITDA of $1.13 billion (22% margin) and free cash flow of $466 million. For Q4 2025, net sales were $1.3 billion, Adjusted EBITDA was $272 million (21.5% margin), and Adjusted diluted EPS was $0.59.

- The company issued full-year 2026 guidance, projecting low single-digit revenue growth, Adjusted EBITDA between $1,140 million and $1,170 million, Adjusted diluted EPS between $2.55 and $2.70, and free cash flow greater than $500 million.

- Axalta announced a merger of equals with AkzoNobel in November 2025, anticipating $600 million in synergy potential and aiming for EBITDA margins approaching 20% for the combined entity.

- Despite ongoing macro headwinds in North America and lower volumes in Performance Coatings, management expects a recovery in the second half of 2026, driven by factors like interest rate reductions and easing insurance costs.

- Axalta reported Q4 2025 Net Sales of $1,262 million and Adjusted EBITDA of $272 million, while achieving a record fourth quarter for free cash flow of $290 million, a 64% increase year-over-year.

- For the full year 2025, the company delivered record Adjusted EBITDA of $1,128 million and record Adjusted Diluted EPS of $2.49, alongside a $230 million gross debt reduction and its lowest total net leverage ratio of 2.3x.

- Axalta announced a merger of equals with AkzoNobel, which is expected to generate approximately $600 million in cost synergies and lead to EPS accretion for shareholders.

- The company issued 2026 guidance, forecasting Adjusted EBITDA between $1,140 million and $1,170 million, Adjusted Diluted EPS between $2.55 and $2.70, and Free Cash Flow greater than $500 million.

- Axalta delivered net sales of approximately $1.3 billion in Q4 2025 and achieved record full-year Adjusted EBITDA of $1.13 billion with a 22% margin. Full-year Adjusted diluted EPS reached $2.49, a 6% increase over 2024, and free cash flow was $466 million.

- For 2026, the company projects low single-digit revenue growth, Adjusted EBITDA between $1,140 million and $1,170 million, and Adjusted diluted EPS between $2.55 and $2.70. Full-year free cash flow is expected to be greater than $500 million.

- Despite ongoing macro headwinds, particularly in North America, Axalta demonstrated strong operational execution, including over $300 million in variable cost reductions and a 40% reduction in injuries since 2024.

- Axalta announced a merger of equals with AkzoNobel in November 2025, anticipating $600 million in synergy potential and aiming to create a global leader with significant free cash flow generation.

- Axalta Coating Systems achieved record full-year 2025 financial results, including Adjusted EBITDA of $1.13 billion and Adjusted diluted EPS of $2.49, with net sales declining 3% year-over-year to $5,117 million.

- In Q4 2025, the company reported net sales of approximately $1.3 billion, Adjusted EBITDA of $272 million, and Adjusted diluted EPS of $0.59, alongside record cash generation.

- For 2026, Axalta projects revenue to be up low single digits, Adjusted diluted EPS between $2.55 and $2.70 per share, and Adjusted EBITDA between $1,140 million and $1,170 million, with free cash flow greater than $500 million.

- The company announced a merger of equals with AkzoNobel in November, expecting $600 million in synergy potential and aiming to create a global leader with strong financial metrics.

- Management anticipates a slower start to 2026 in Q1 due to market pressures, with recovery expected to begin in Q2 and gain momentum in the second half of the year.

- Axalta Coating Systems Ltd. reported record full year 2025 Adjusted EBITDA of $1,128 million and record Adjusted Diluted EPS of $2.49, with full year net sales of $5,117 million. For Q4 2025, net sales were $1,262 million, Adjusted EBITDA was $272 million, and Adjusted Diluted EPS was $0.59.

- The company achieved record full year cash provided by operating activities of $649 million and $466 million in free cash flow for 2025, ending the year with its lowest net debt to LTM Adjusted EBITDA ratio at 2.3x.

- In November 2025, Axalta announced a definitive agreement for an all-stock merger of equals with AkzoNobel, which is anticipated to close in late 2026 or early 2027.

- For Q1 2026, Axalta projects Adjusted EBITDA between $240 million and $250 million and Adjusted Diluted EPS of ~$0.50. Full year 2026 guidance includes Adjusted EBITDA of $1,140 million to $1,170 million and Adjusted Diluted EPS of $2.55 to $2.70.

- Axalta Coating Systems reported record earnings for full year 2025, with Adjusted EBITDA of $1,128 million and Adjusted Diluted EPS of $2.49.

- For the fourth quarter of 2025, net sales were $1,262 million and Adjusted EBITDA was $272 million.

- The company announced an all-stock merger of equals with AkzoNobel in November 2025, anticipated to close in late 2026 or early 2027.

- Axalta provided financial guidance for Q1 2026, projecting Adjusted EBITDA between $240 million and $250 million and Adjusted Diluted EPS of approximately $0.50.

- AkzoNobel's fourth-quarter net profit surged to €598 million from €21 million a year earlier, primarily driven by the €922 million divestment of Akzo Nobel India.

- For fiscal 2025, adjusted EBITDA slipped to €1.44 billion and full-year revenue decreased by approximately 5% to €10.16 billion.

- The company expects adjusted EBITDA for fiscal 2026 to be at or above €1.47 billion, but warns of weak end-market demand and a muted recovery, particularly in the first half.

- The planned merger with Axalta is anticipated to close in late 2026 or early 2027, pending approvals.

- Axalta Coating Systems Ltd. entered into a merger agreement with AkzoNobel N.V. on November 18, 2025, for a combination of the two companies.

- In connection with this merger, the Compensation Committee approved cash retention bonuses for certain employees, including named executive officers, on December 15, 2025.

- The retention bonuses for the named executive officers are: Carl D. Anderson II (Senior Vice President and Chief Financial Officer) $1,360,009, Hadi H. Awada (President, Global Mobility Coatings) $1,040,130, and Troy D. Weaver (President, Global Refinish) $1,084,837.

- These bonuses will vest and be payable in full six months following the closing of the merger, contingent on the applicable executive's continued employment through that date.

- Axalta announced a transformational merger with AkzoNobel, creating a combined entity projected to have approximately $17 billion in revenue, over $3 billion in EBITDA, and over $1.5 billion in free cash flow.

- The merger is anticipated to generate over 75% value for Axalta shareholders, driven by a minimum of $600 million in annual cost synergies and over 30% EPS accretion.

- Axalta will hold a 45% ownership stake in the new company, with a special dividend of around EUR 2 billion distributed to Axalta shareholders to balance ownership.

- The combined entity will adopt a U.S.-style governance structure, with Rakesh Sachdev as Chair, Gregoire Poux-Guillaume as CEO, and Carl Anderson as CFO, with the deal expected to close in 12-15 months.

- In current business trends, Axalta notes North America auto production is experiencing downtime in Q4 2025, and 2026 Class 8 commercial vehicle production forecasts are significantly below replacement levels.

- Axalta announced a transformational merger with AkzoNobel, forming a combined entity projected to achieve $17 billion in revenue, over $3 billion in EBITDA, and generate over $1.5 billion of free cash flow.

- Axalta will hold a 45% ownership stake in the new company, an increase of 10% over historical market cap trading levels, which is expected to create an additional $1.4 billion in value for Axalta shareholders.

- The merger is anticipated to deliver a minimum of $600 million in annual cost synergies and is projected to be over 30% EPS accretive for Axalta.

- Carl Anderson, Axalta's SVP and CFO, will assume the role of CFO for the new combined company.

- In current business trends, Axalta's North American mobility segment is experiencing softness, while the refinish business remains stable at a lower level, with destocking issues expected to subside after Q1.

Quarterly earnings call transcripts for Axalta Coating Systems.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more