Earnings summaries and quarterly performance for Freshpet.

Executive leadership at Freshpet.

Billy Cyr

Chief Executive Officer

Cathal Walsh

Senior Vice President, Managing Director of Europe

Ivan Garcia

Interim Chief Financial Officer

Lisa Alexander

General Counsel and Corporate Secretary

Nicola Baty

Chief Operating Officer

Nishu Patel

Chief Accounting Officer

Scott Morris

President

Thembeka Machaba

Chief Human Resources Officer

Board of directors at Freshpet.

Craig Steeneck

Director

Daryl Brewster

Director

David Biegger

Director

David West

Director

Jacki Kelley

Director

Joseph Scalzo

Director

Lauri Kien Kotcher

Director

Leta Priest

Director

Olu Beck

Director

Timothy McLevish

Director

Walter George III

Chair of the Board

Research analysts who have asked questions during Freshpet earnings calls.

Brian Holland

D.A. Davidson

7 questions for FRPT

Michael Lavery

Piper Sandler & Co.

7 questions for FRPT

Peter Benedict

Robert W. Baird & Co.

7 questions for FRPT

Robert Moskow

TD Cowen

7 questions for FRPT

Rupesh Parikh

Oppenheimer & Co. Inc.

7 questions for FRPT

Jon Andersen

William Blair & Company

5 questions for FRPT

Kaumil Gajrawala

Jefferies

5 questions for FRPT

Thomas Palmer

Citigroup Inc.

5 questions for FRPT

Marc Torrente

Wells Fargo

4 questions for FRPT

Peter Galbo

Bank of America

4 questions for FRPT

Steve Powers

Deutsche Bank

4 questions for FRPT

Kenneth Goldman

JPMorgan Chase & Co.

3 questions for FRPT

Bill Chappell

Truist Securities

2 questions for FRPT

Bryan Spillane

Bank of America

2 questions for FRPT

James Salera

Stephens Inc.

2 questions for FRPT

Jim Salera

Stephens Inc.

2 questions for FRPT

John Lawrence

The Benchmark Company

2 questions for FRPT

Mark Astrachan

Stifel

2 questions for FRPT

Stephen Powers

Deutsche Bank

1 question for FRPT

Stephen Robert Powers

Deutsche Bank

1 question for FRPT

William Chappell

Truist Securities

1 question for FRPT

Recent press releases and 8-K filings for FRPT.

- Freshpet is targeting a 48% gross margin by 2027, driven by significant operational efficiency gains, including reducing logistics costs from 11.5% to 5.5% of sales and quality costs from over 6% to around 2% of sales.

- The company's new manufacturing technology, developed over seven years, is set to begin shipping product next month, with the goal of producing the highest quality bag products at the lowest cost.

- Despite a category slowdown due to economic uncertainty impacting new dog acquisitions and consumer "trade-up," Freshpet is outperforming, growing household penetration and market share faster than competitors. The company is focused on expanding its reach to 7.5 million potential Most Valuable Pet (MVP) households from the current 2.3 million.

- Freshpet achieved free cash flow positive status this year, demonstrating improved returns on invested capital and a strong, insulated business model built on manufacturing scale and distribution.

- Capital expenditures for the upcoming year are projected to be consistent with the current year, primarily funding long-term capacity expansion for facilities in Texas (late 2027/early 2028) and Ennis (2029/2030).

- Freshpet has achieved significant operational efficiency improvements, with logistics costs decreasing from 11.5% to 5.5% of sales and quality costs from over 6% to around 2% of sales, expecting continued gross margin improvement and G&A leverage.

- The company is in the commissioning phase for its new production technology, which is anticipated to deliver higher quality products at the lowest cost, with shipping expected to commence in December 2025.

- Freshpet's e-commerce business grew 45% in Q3, and the company is expanding its digital ordering channels, including DTC, Walmart, and Amazon same-day fresh grocery delivery, to capture further growth.

- Current installed capacity is sufficient to support a $1.5 billion business, with CapEx for next year projected to be in line with the current year, potentially increasing with accelerated rollouts of island fridges or new production technology.

- Freshpet is implementing significant operational improvements, including the Freshpet Performance Excellence Program, to drive efficiencies and gross margin expansion, targeting 48% gross margin by 2027.

- The pet food category has experienced a slowdown, particularly in dog food, due to consumer economic uncertainty and a halt in "trade-up" behavior. Freshpet is responding by emphasizing value, optimizing media spend, and focusing retail investments on high-traffic areas, alongside new product innovations like the Complete Nutrition bag.

- Despite current market conditions, Freshpet maintains a strong long-term outlook, aiming to expand its reach among "MVPs" (Most Valuable Pet parents) from 2.3 million to a potential 7.5 million households.

- Freshpet possesses installed capacity to support a $1.5 billion business, exceeding its current $1.1 billion guidance. Capital expenditures for 2026 are projected to remain consistent with 2025, primarily funding long-term capacity expansion, including new facilities in Texas and Ennis, with a new full-scale production line expected in Q2 2026.

- While e-commerce currently accounts for 14% of Freshpet's sales, significantly below the category average of 35-40%, its digital ordering business demonstrated 45% growth in Q3. The company is actively expanding its e-commerce presence across various platforms, including DTC, major retailers, and third-party delivery services.

- Freshpet anticipates achieving positive free cash flow this year, a year ahead of schedule.

- The company has significantly improved operational efficiency, evidenced by logistics costs decreasing from 11.5% to 5.5% of sales and quality costs from over 6% to approximately 2% of sales.

- Growth has been impacted by a pet food category slowdown, as consumers pause on pet adoption and "trading up" to premium products due to economic uncertainty.

- Freshpet is commissioning new manufacturing technology, which is showing promising results in product quality and innovation, with commercial shipments expected to begin next month.

- The company sees a substantial growth opportunity, currently reaching 14.9 million of 33 million addressable households and targeting an increase in "MVP" households from 2.3 million to 3-5 million.

- Freshpet (FRPT) is approaching $1.1 billion in trailing 12-month sales, guiding for approximately 13% sales growth this year, and has recently become free cash flow positive.

- The company has invested over $1.3 billion in capital since 2017, establishing a significant competitive moat through its three manufacturing facilities and advanced production technology, with a "light version" for retrofitting existing lines piloting in Q2 2026.

- Current manufacturing capacity can support $1.5 billion in sales, providing sufficient capacity through 2026 and 2027. CapEx for this year was reduced to $140 million from an initial $250 million, with next year's CapEx expected to be similar.

- Despite a recent slowdown in pet food demand, particularly in consumers' willingness to trade up, Freshpet maintains that the long-term drivers for pet ownership remain robust.

- Freshpet expects to achieve a 48% gross margin, primarily driven by operating effectiveness and new technology, while aiming for SG&A growth at about half the rate of sales growth.

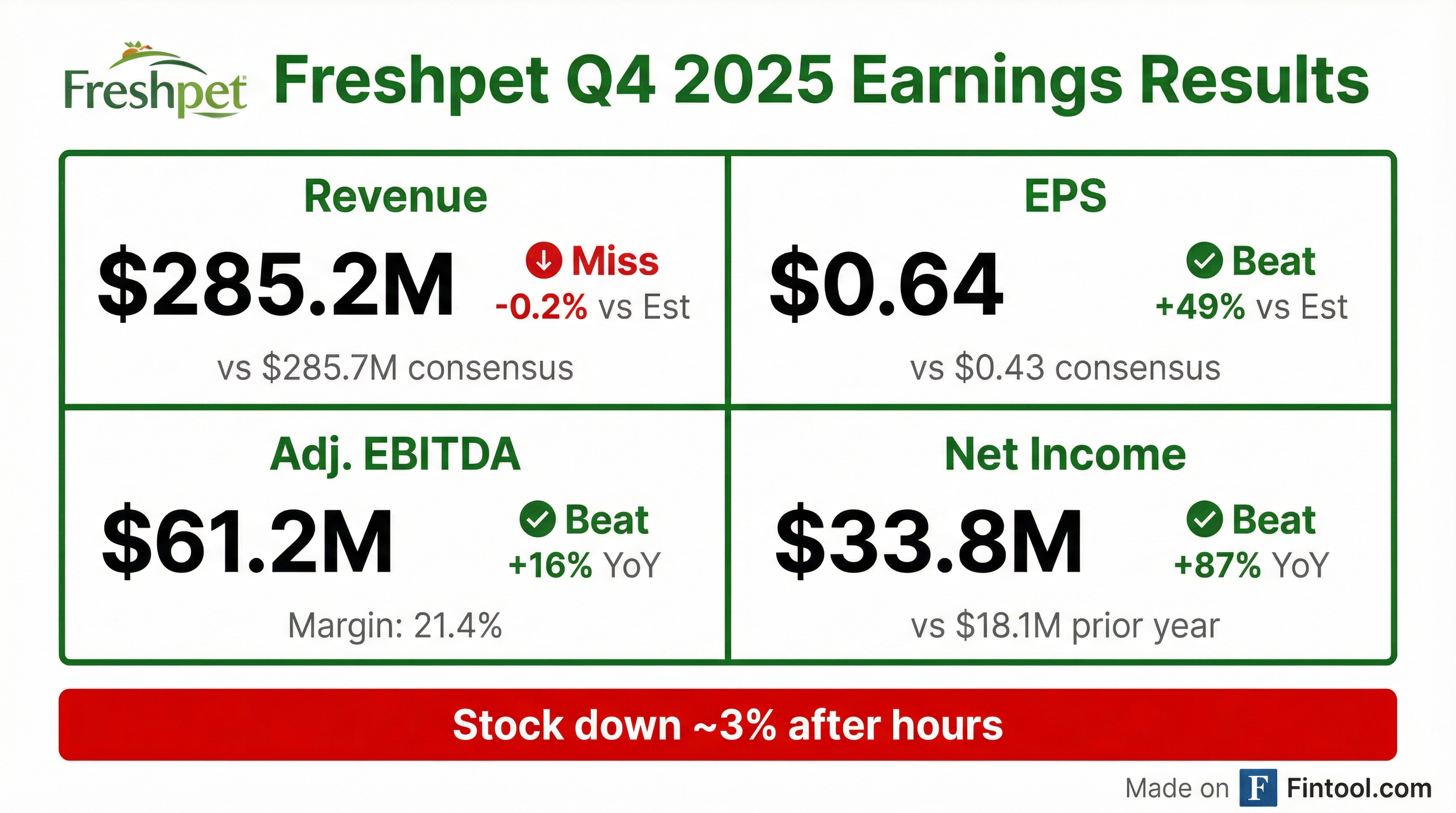

- Freshpet (FRPT) reported Q3 2025 net sales of $288.8 million, a 14% increase year over year, and adjusted EBITDA of $54.6 million, up 25% year over year. Net income was $101.7 million, significantly boosted by a $77.9 million deferred income tax benefit.

- The company achieved positive free cash flow in Q3 2025 and now expects to be free cash flow positive for the full year, which is one year ahead of its original 2026 target.

- Freshpet updated its full-year 2025 guidance, projecting net sales growth of approximately 13% and adjusted EBITDA between $190 million and $195 million. Capital expenditures guidance was reduced to approximately $140 million.

- Strategic initiatives include the installation of a new production technology line expected to produce saleable products in Q4, and the testing of new Fridge Islands in 16 stores of a large mass retailer. The company also saw 45% growth in e-commerce digital orders.

- Freshpet reported Net Sales of $288.8 million for Q3 2025, marking a 14.0% increase year-over-year, and achieved Adjusted EBITDA of $54.6 million, an increase of $11.1 million compared to the prior year. The Adjusted EBITDA Margin for the quarter was 18.9%, up 170 basis points.

- The company updated its FY 2025 guidance, expecting Net Sales Growth YoY of ~13% and Adjusted EBITDA in the range of $190 million to $195 million. Capital expenditures for 2025 are now projected to be ~$140 million, a reduction from the previous estimate of ~$175 million.

- Freshpet anticipates being free cash flow positive in 2025, which is a year earlier than originally expected, and reported $274.6 million of cash-on-hand as of September 30, 2025.

- Operational highlights include a 10% increase in total household penetration to 14.8 million in 2025 and an increase in store count to 29,745 by Q3 2025. The company is also testing new production technologies aimed at delivering higher quality products at lower costs.

- Freshpet, Inc. reported net sales of $288.8 million for Q3 2025, a 14.0% increase, and $816.8 million for the first nine months of 2025, a 14.6% increase.

- Net income for Q3 2025 was $101.7 million, including a $77.9 million tax benefit, compared to $11.9 million in the prior year period. Adjusted EBITDA for Q3 2025 increased to $54.6 million from $43.5 million in the prior year.

- The company achieved positive free cash flow in Q3 2025 and now expects to be free cash flow positive for the full fiscal year 2025, a year earlier than originally planned.

- Freshpet updated its full-year 2025 guidance, projecting net sales growth of ~13%, Adjusted EBITDA between $190 million and $195 million, and capital expenditures of ~$140 million.

Quarterly earnings call transcripts for Freshpet.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more