Earnings summaries and quarterly performance for Doximity.

Executive leadership at Doximity.

Board of directors at Doximity.

Research analysts who have asked questions during Doximity earnings calls.

Allen Lutz

Bank of America

8 questions for DOCS

Elizabeth Anderson

Evercore ISI

8 questions for DOCS

Scott Schoenhaus

KeyBanc Capital Markets

8 questions for DOCS

Brian Peterson

Raymond James Financial

7 questions for DOCS

Craig Hettenbach

Morgan Stanley

7 questions for DOCS

Ryan MacDonald

Needham & Company

7 questions for DOCS

David Roman

Goldman Sachs Group Inc.

6 questions for DOCS

Michael Cherny

Leerink Partners

5 questions for DOCS

Stan Berenshteyn

Wells Fargo Securities

5 questions for DOCS

Richard Close

Canaccord Genuity Group

4 questions for DOCS

Ryan Daniels

William Blair & Company, L.L.C.

4 questions for DOCS

Steven Valiquette

Mizuho

4 questions for DOCS

Brian Tanquilut

Jefferies

3 questions for DOCS

Eric Percher

Nephron Research

3 questions for DOCS

Jailendra Singh

Truist Securities

3 questions for DOCS

David Larsen

BTIG

2 questions for DOCS

Glenn Santangelo

Barclays

2 questions for DOCS

Glen Santangelo

Jefferies

2 questions for DOCS

Jared Haase

William Blair & Company

2 questions for DOCS

Jeff Garro

Stephens

2 questions for DOCS

Jeffrey Garro

Stephens Inc.

2 questions for DOCS

Jenny Cao

Truist Securities

2 questions for DOCS

Jessica Tassan

Piper Sandler

2 questions for DOCS

Michael Turney

Leerink Partners

2 questions for DOCS

Ryan Halsted

RBC Capital Markets

2 questions for DOCS

Alexei Gogolev

JPMorgan Chase & Co.

1 question for DOCS

Anne McCormick

JPMorgan Chase & Co.

1 question for DOCS

Anne Samuel

JPMorgan Chase & Co.

1 question for DOCS

Daniel Christopher Clark

Leerink Partners

1 question for DOCS

Derek Gross

Piper Sandler Companies

1 question for DOCS

Jamie Perse

The Goldman Sachs Group, Inc.

1 question for DOCS

Jenny Shen

TD Cowen

1 question for DOCS

Johnathan McCary

Raymond James

1 question for DOCS

John Park

Morgan Stanley

1 question for DOCS

Nate Gross

Piper Sandler

1 question for DOCS

Scott Berg

Needham & Company, LLC

1 question for DOCS

Stanislav Berenshteyn

Wells Fargo

1 question for DOCS

Stephanie Davis

Barclays

1 question for DOCS

Vikram Kesavabhotla

Robert W. Baird & Co.

1 question for DOCS

Recent press releases and 8-K filings for DOCS.

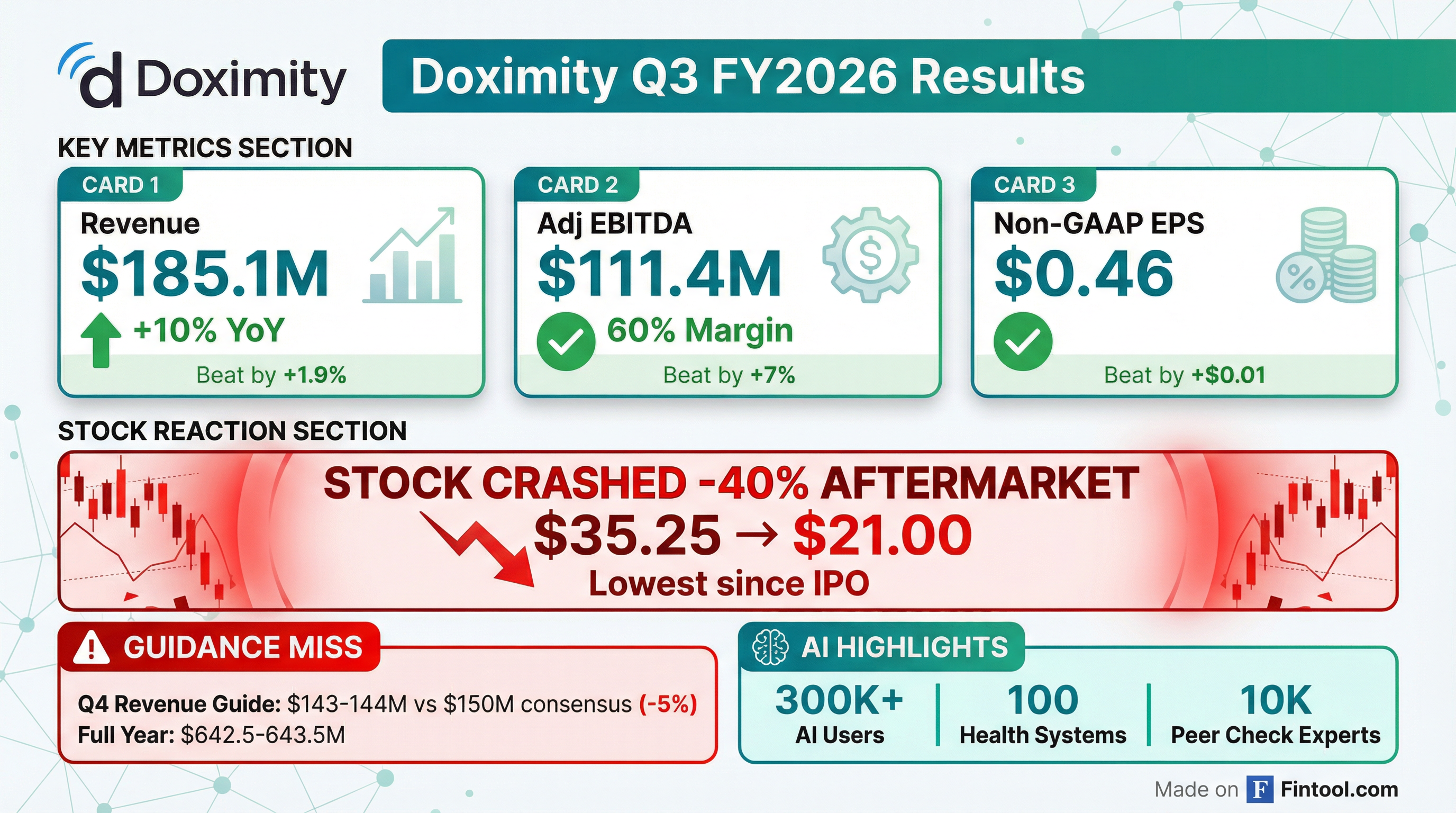

- Doximity reported strong fiscal Q3 2026 results, with revenue of $185 million, a 10% year-over-year increase, and an Adjusted EBITDA margin of 60%.

- For fiscal Q4 2026, the company expects revenue between $143 million and $144 million and Adjusted EBITDA between $63.5 million and $64.5 million. The full fiscal year 2026 revenue guidance is $642.5 million to $643.5 million, with an Adjusted EBITDA margin of 55%.

- CFO Anna Bryson is on medical leave, with Audit Committee Chair Tim Cabral assisting with financials.

- Doximity saw significant adoption of its AI products, with over 300,000 unique prescribers using them and over 100 top health systems purchasing its AI suite. The company also repurchased $196.8 million in shares and authorized a new $500 million open-ended repurchase program.

- The annual selling season was impacted by policy headwinds, specifically Most Favored Nation (MFN) deals with top pharma companies, leading to delayed bookings and lower upfront budget deployment, which affected Q4 revenue expectations.

- Doximity reported Q3 2026 revenue of $185 million, a 10% year-on-year growth, and an adjusted EBITDA margin of 60%, exceeding the high end of guidance for both metrics.

- The company issued Q4 FY2026 revenue guidance of $143 million-$144 million and full FY2026 revenue guidance of $642.5 million-$643.5 million, noting that the annual outlook midpoint remained consistent due to lower Q4 expectations and increased AI infrastructure investments.

- Over 300,000 unique prescribers used Doximity's AI products in Q3 2026, and 100 top health systems purchased its AI suite for over 180,000 prescribers.

- Doximity repurchased $196.8 million worth of shares in Q3 2026 and announced a new $500 million open-ended share repurchase authorization.

- CFO Anna Bryson is on medical leave, with Audit Committee Chair Tim Cabral stepping in to discuss financials.

- Doximity reported strong Q3 2026 revenue of $185 million, marking 10% year-on-year growth, and an Adjusted EBITDA margin of 60%, or $111 million.

- The company announced a new $500 million open-ended share repurchase authorization, supplementing the $83 million remaining from the existing program, after repurchasing $196.8 million in Q3.

- For Q4 2026, Doximity expects revenue between $143 million and $144 million (4% growth at midpoint), and full fiscal year 2026 revenue guidance is set at $642.5 million to $643.5 million (13% growth at midpoint).

- Despite Q3 outperformance, Q4 revenue expectations are lower due to policy headwinds, including Most Favored Nation agreements impacting pharma client budget deployment, though the company anticipates exiting calendar year 2026 as a double-digit grower.

- AI product adoption is significant, with 300,000 unique prescribers using AI tools in Q3 and over 100 health systems purchasing the AI suite for 180,000 prescribers, with commercial AI products expected later in the year but no AI revenue currently in guidance.

- Doximity reported Q3 Fiscal 2026 revenue of $185.1 million, a 10% increase year-over-year, with net income of $61.6 million and adjusted EBITDA of $111.4 million for the quarter ended December 31, 2025.

- The company provided Q4 Fiscal 2026 revenue guidance between $143 million and $144 million and adjusted EBITDA guidance between $63.5 million and $64.5 million.

- For the full fiscal year ending March 31, 2026, Doximity updated its revenue guidance to be between $642.5 million and $643.5 million and adjusted EBITDA guidance to be between $355.5 million and $356.5 million.

- Doximity's board of directors authorized a new program to repurchase up to $500 million of its Class A common stock.

- Doximity reported fiscal 2026 third quarter revenue of $185.1 million, marking a 10% increase year-over-year, with net income of $61.6 million and Adjusted EBITDA of $111.4 million.

- Diluted net income per share for the quarter was $0.31, while non-GAAP diluted net income per share was $0.46.

- The company provided fiscal fourth quarter 2026 revenue guidance between $143 million and $144 million and updated its full fiscal year 2026 revenue guidance to between $642.5 million and $643.5 million.

- Doximity's board of directors authorized a new stock repurchase program of up to $500 million of its Class A common stock.

- Doximity reported strong financial results for the second quarter of fiscal 2026, with revenues rising 23.2% year over year to $168.5 million and adjusted earnings per share increasing 50% year over year to 45 cents.

- The company experienced significant operational growth, including over 50% growth in AI Scribe and DoxGPT users and an expanded user base of 650,000 prescribers, contributing to $159.5 million in subscription revenues.

- Doximity maintains a strong financial position with $169.2 million in cash and cash equivalents and projects fiscal year 2026 revenue between $640 million and $646 million and adjusted EBITDA between $351 million and $357 million.

- DOCS reported strong Q2 2026 financial results with revenue of $168.5 million, a 23% year-over-year increase, and an adjusted EBITDA of $100.8 million, achieving a 60% margin.

- The company raised its full fiscal year 2026 guidance, now expecting revenue between $640 million and $646 million and adjusted EBITDA between $351 million and $357 million, primarily due to the outperformance of its pharma business.

- AI product adoption saw significant growth, with quarterly active prescribers of AI tools increasing over 50% from the prior quarter, and Doximity Scribe users nearly tripling versus Q1. The recent Pathway acquisition was fully integrated, enhancing Docs GPT with drug reference and access to over 2,000 medical journals.

- AI-optimized integrated programs now account for over 40% of Q2 bookings, a substantial increase from less than 5% a year ago, leading to a more consistent and strategic upsell cycle.

- For the second quarter of fiscal year 2026, DOCS reported $168.5 million in revenue, representing 23% year-on-year growth, and an adjusted EBITDA of $100.8 million, with a 60% margin. Free cash flow increased 37% year-on-year to $91.6 million.

- The company's AI initiatives saw significant progress, with the Pathway acquisition fully integrated into Docs GPT within seven weeks, enhancing its drug reference and medical journal access capabilities. Quarterly active users for AI Scribe nearly tripled versus Q1.

- DOCS provided guidance for Q3 2026, expecting revenue between $180 million and $181 million and adjusted EBITDA between $103 million and $104 million. For the full fiscal year 2026, revenue is projected to be between $640 million and $646 million, with adjusted EBITDA between $351 million and $357 million.

- Integrated programs, which are AI-optimized, represented over 40% of bookings in Q2, a significant increase from less than 5% a year ago, contributing to a stronger than typical Q2 and a more evenly distributed upsell cycle.

- DOCS continued to gain market share, growing at about two times the market growth rate for calendar year 2025, with a 15% growth rate compared to an estimated market growth of 5% to 7%.

- Doximity (DOCS) reported Q2 FY2026 revenue of $169 million, a 23% year-on-year increase, and an Adjusted EBITDA of $101 million, achieving a 60% margin.

- The company raised its full fiscal year 2026 revenue guidance to a range of $640 million to $646 million and Adjusted EBITDA guidance to $351 million to $357 million.

- Key growth drivers include AI-optimized integrated programs, which comprised over 40% of Q2 bookings (up from less than 5% a year ago), and a 100% year-over-year growth in SMB bookings.

- Operational success was marked by a 50% increase in quarterly active prescribers utilizing AI tools and a nearly tripled number of quarterly active users for AI Scribe compared to Q1.

- Doximity maintained a strong financial position with $878 million in cash, cash equivalents, and marketable securities and repurchased $21.9 million in shares during the quarter.

- Doximity reported total revenues of $168.5 million for its fiscal second quarter ended September 30, 2025, representing a 23% increase year-over-year.

- Operating cash flow for Q2 2026 was $93.9 million, and free cash flow was $91.6 million, both up 37% year-over-year.

- Adjusted EBITDA for the quarter increased 32% year-over-year to $100.8 million, achieving a 59.8% margin.

- For fiscal Q3 2026, Doximity expects revenue between $180 million and $181 million and adjusted EBITDA between $103 million and $104 million.

- The company updated its fiscal year 2026 guidance, projecting revenue between $640 million and $646 million and adjusted EBITDA between $351 million and $357 million.

Fintool News

In-depth analysis and coverage of Doximity.

Quarterly earnings call transcripts for Doximity.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more