Earnings summaries and quarterly performance for CHIPOTLE MEXICAN GRILL.

Executive leadership at CHIPOTLE MEXICAN GRILL.

Scott Boatwright

Chief Executive Officer

Adam Rymer

Chief Financial Officer

Chris Brandt

President, Chief Brand Officer

Curt Garner

President, Chief Strategy and Technology Officer

Ilene Eskenazi

Chief Human Resources Officer

Jason Kidd

Chief Operating Officer

Laurie Schalow

Chief Corporate Affairs and Food Safety Officer

Matthew Bush

Principal Accounting Officer

Roger Theodoredis

Chief Legal Officer and General Counsel

Board of directors at CHIPOTLE MEXICAN GRILL.

Research analysts who have asked questions during CHIPOTLE MEXICAN GRILL earnings calls.

David Palmer

Evercore ISI

8 questions for CMG

Lauren Silberman

Deutsche Bank

8 questions for CMG

Sara Senatore

Bank of America

8 questions for CMG

Danilo Gargiulo

AllianceBernstein

7 questions for CMG

Dennis Geiger

UBS

7 questions for CMG

Sharon Zackfia

William Blair & Company

7 questions for CMG

Andrew Charles

TD Cowen

6 questions for CMG

David Tarantino

Robert W. Baird & Co.

6 questions for CMG

John Ivankoe

JPMorgan Chase & Co.

5 questions for CMG

Brian Bittner

Oppenheimer & Co.

4 questions for CMG

Brian Harbour

Morgan Stanley

4 questions for CMG

Chris O'cull

Stifel Financial Corp

3 questions for CMG

Christine Cho

Goldman Sachs Group

3 questions for CMG

Hyun Jin Cho

Goldman Sachs

3 questions for CMG

Andrew North

Robert W. Baird & Co.

2 questions for CMG

Anisha Datt

Barclays

2 questions for CMG

Brian Mullan

Piper Sandler

2 questions for CMG

Chris O'Cull

Stifel

2 questions for CMG

Jon Tower

Citigroup

2 questions for CMG

Zach Ogden

TD Cowen

2 questions for CMG

Christopher O'Cull

Stifel, Nicolaus & Company

1 question for CMG

Gregory Francfort

Guggenheim Securities

1 question for CMG

Jacob Aiken-Phillips

Melius Research

1 question for CMG

Jeffrey Bernstein

Barclays

1 question for CMG

Zachary Fadem

Wells Fargo

1 question for CMG

Recent press releases and 8-K filings for CMG.

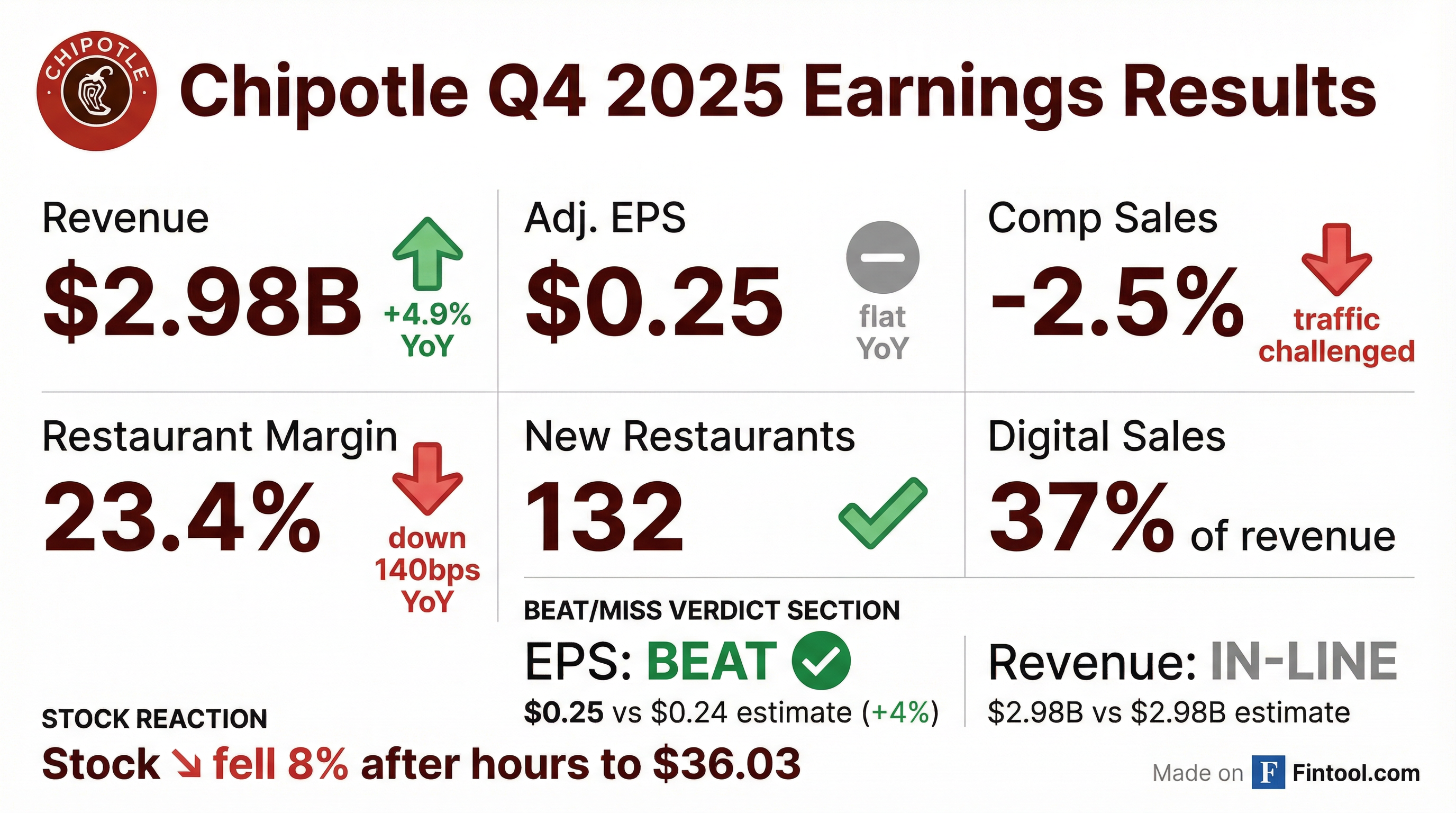

- Q4 sales rose 4.9% to $3.0 billion with comparable restaurant sales down 2.5%, digital channels representing 37.2% of sales, and adjusted EPS flat at $0.25.

- Full-year 2025 revenue grew 5.4% year-over-year (comps down 1.7%), adjusted EPS increased 4.5% to $1.17, and the company opened 334 new restaurants.

- For 2026, Chipotle expects full-year comparable sales to be flat, with Q1 comps of –1% to –2%, pricing to contribute ~70 bps versus mid-single-digit inflation, and early-year margin headwinds.

- In Q4, the company repurchased $742 million of stock at an average price of $34.14, totaling $2.4 billion in 2025, with $1.7 billion remaining under its buyback authorization.

- 2025 full-year revenue rose 5.4% YoY (comps –1.7%), and adj. diluted EPS increased 4.5% to $1.17; opened 334 company-owned and 11 international partner restaurants

- Q4 sales grew 4.9% to $3.0 B (comps –2.5%), with digital at 37.2%, restaurant-level margin of 23.4% (–140 bps), and adj. EPS of $0.25; added 132 restaurants (97 company, 7 partners)

- 2026 guidance: full-year comps ~flat; Q1 pricing to add ~70 bps vs mid-single-digit inflation; Q1 cost of sales mid-30%, labor high-25%, marketing mid-3%, and non-GAAP G&A ~$203 M

- Balance sheet & buyback: $1.3 B cash, no debt; repurchased $742 M in Q4 (avg $34.14) and $2.4 B in 2025 (avg $42.54); $1.7 B remaining under $1.8 B authorization

- Strategic initiatives: rolling out high-efficiency equipment to boost throughput (350 stores now, 2,000 by YE), launching high-protein menu & LTOs, and global expansion with a record 345 new restaurants (+9% growth)

- Chipotle reports Q4 2025 revenue of $3.0 B (+4.9% YoY), comparable restaurant sales down 2.5%, and adjusted EPS of $0.25.

- For FY 2025, revenues reached $11.9 B (+5.4% YoY), comps declined 1.7%, and adjusted EPS was $1.17.

- Opened 132 company-owned restaurants in Q4 (total 334 in 2025), driving record expansion with over 4,000 locations globally.

- Returned capital via $742 M share buyback in Q4 (avg. price $34.14) and $2.4 B for the year; ended 2025 with $1.3 B cash and no debt.

- Full-year 2025 revenue grew 5.4% year-over-year, with comparable sales down 1.7%, and adjusted diluted EPS of $1.17 (+4.5% yoy); opened a record 334 new company-owned and 11 international partner-operated restaurants.

- Q4 2025 sales reached $3.0 billion (+4.9%), with a comp sales decline of 2.5%, digital sales at 37.2%, restaurant-level margin of 23.4% (−140 bps yoy), and adjusted EPS of $0.25.

- Added 334 new company-owned restaurants (surpassing 4,000 total in North America) and 11 partner-operated units in 2025; Canada openings rose 38% and scaling in Europe and the Middle East continues.

- 2026 guidance calls for flat full-year comparable sales, a pricing impact of ~70 bps vs. inflation approaching mid-single digits in Q1, and continued investments in menu innovation, technology upgrades, rewards program enhancement, and global expansion.

- Chipotle reported Q4 total revenue of $3.0 billion (+4.9% YoY) with comparable restaurant sales down 2.5%

- Q4 operating margin was 14.1% (vs. 14.6%) and restaurant-level margin was 23.4% (vs. 24.8%)

- Q4 diluted EPS was $0.25 (+4.2% YoY); adjusted diluted EPS remained $0.25

- Full-year 2025 revenue was $11.9 billion (+5.4% YoY); full-year diluted EPS was $1.14 (+2.7%) and adjusted EPS was $1.17 (+4.5%)

- For 2026, the company expects flat comparable sales, 350–370 new restaurants, and an effective tax rate of 24–26%

- Leadership changes: executive departures were dated January 13, 2026, with interim marketing leadership and menu/loyalty initiatives stabilizing execution.

- Analyst forecasts: investors expect Q1 revenue of $2.96–2.97 billion and $0.24 EPS, implying a modest earnings decline despite revenue growth.

- Demand outlook: Oppenheimer projects comparable-store sales to decline ~3% YoY this quarter, though with minimal risk to restaurant-level margins.

- Expansion plan: management aims to open 350–370 new restaurants in FY 2026, underpinning long-term unit growth but potentially pressuring margins.

- Valuation view: a model assuming 8.8% revenue growth, 16.4% operating margins, and a 33.0x exit multiple yields a $52.82 target (~37% upside) versus current trading below $39.

- Chipotle inaugurated its 4,000th restaurant in Manhattan, Kansas, marking a key rollout milestone for the brand.

- Since 2017, restaurant count has risen from ~2,300 to 4,000, a 70% increase over eight years.

- Company plans to open 315–345 new locations in 2025 (≥80% with Chipotlane) and 350–370 in 2026 (including 10–15 international partner sites).

- International footprint exceeds 100 restaurants (75 Canada, 28 Europe, 11 Middle East); first Chipotlane outside North America launched in Kuwait, with expansion deals in Mexico, South Korea and Singapore set for 2026.

- Computer Modelling Group Ltd. (TSX: CMG) has launched a 12-month NCIB to repurchase up to 4,136,475 common shares (5% of its outstanding shares as of November 3, 2025) from November 14, 2025, to November 13, 2026.

- Daily purchases are capped at 53,297 shares (25% of its six-month average daily trading volume of 213,191 shares), excluding permitted block trades.

- All repurchased shares will be acquired on the TSX or alternative Canadian trading systems at market prices and will be cancelled, increasing the equity interest of remaining shareholders.

- The NCIB is supported by an automatic share purchase plan pre-cleared by the TSX to allow repurchases during blackout periods, reflecting the Board’s view that the market price may not fully reflect CMG’s value.

- Reported Q3 2025 revenue of $42.0 million, up 68% year-over-year

- Raised full-year 2025 revenue outlook to $165 – $180 million

- Ended Q3 with $269 million in cash and cash equivalents and no debt

- GAAP net loss of $109.3 million; non-GAAP net loss of $13.0 million

- Sales grew 7.5% to $3.0 billion, with comps up 0.3%, digital sales comprising 36.7% of total, restaurant-level margin down 100 bps to 24.5%, and adjusted EPS of $0.29; opened 84 new restaurants (64 Chipotlanes)

- Consumer demand pressures led management to lower full-year comp guidance to a low single-digit decline, and inflation is expected in the mid-single-digit range in 2026, with no planned full offset via pricing

- Q3 cost of sales improved 60 bps to 30% despite tariffs (~30 bps); labor rose to 25.2%, and marketing increased to 3% of sales; Q4 outlook: cost of sales high-30s%, labor high-25%, marketing ~3%

- Repurchased $687 million of stock in Q3 (YTD $1.67 billion), with $652 million remaining authorization

Fintool News

In-depth analysis and coverage of CHIPOTLE MEXICAN GRILL.

Quarterly earnings call transcripts for CHIPOTLE MEXICAN GRILL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more