Earnings summaries and quarterly performance for GoDaddy.

Executive leadership at GoDaddy.

Board of directors at GoDaddy.

Research analysts who have asked questions during GoDaddy earnings calls.

Naved Khan

B. Riley Securities

6 questions for GDDY

Trevor Young

Barclays

6 questions for GDDY

Vikram Kesavabhotla

Robert W. Baird & Co.

6 questions for GDDY

Josh Beck

Raymond James

4 questions for GDDY

Mark Zgutowicz

The Benchmark Company

4 questions for GDDY

Sang-Jin Byun

Jefferies

4 questions for GDDY

Ygal Arounian

Citigroup

4 questions for GDDY

Brad Erickson

RBC Capital Markets

3 questions for GDDY

Elizabeth Elliott

Morgan Stanley

3 questions for GDDY

Hoi-Fung Wong

Oppenheimer & Co. Inc.

3 questions for GDDY

Ken Wong

Oppenheimer & Co. Inc.

3 questions for GDDY

Alec Brondolo

Wells Fargo

2 questions for GDDY

Alexei Gogolev

JPMorgan Chase & Co.

2 questions for GDDY

Arjun Bhatia

William Blair

2 questions for GDDY

Chao Zhang

Barclays

2 questions for GDDY

Eleanor Smith

JPMorgan Chase & Co.

2 questions for GDDY

James Michael

Citi

2 questions for GDDY

Robert Coolbrith

Evercore ISI

2 questions for GDDY

Willow Miller

William Blair & Company, L.L.C.

2 questions for GDDY

Aaron Kessler

Seaport Research Partners

1 question for GDDY

Alex Lavigne

The Benchmark Company, LLC

1 question for GDDY

Christopher Kuntarich

UBS

1 question for GDDY

Clarke Jeffries

Piper Sandler & Co.

1 question for GDDY

Deepak Mathivanan

Cantor Fitzgerald

1 question for GDDY

Elizabeth Porter

Morgan Stanley

1 question for GDDY

Ella

JPMorgan Chase & Co.

1 question for GDDY

John Byun

Jefferies Financial Group Inc.

1 question for GDDY

Katie Kaiser

Morgan Stanley

1 question for GDDY

Recent press releases and 8-K filings for GDDY.

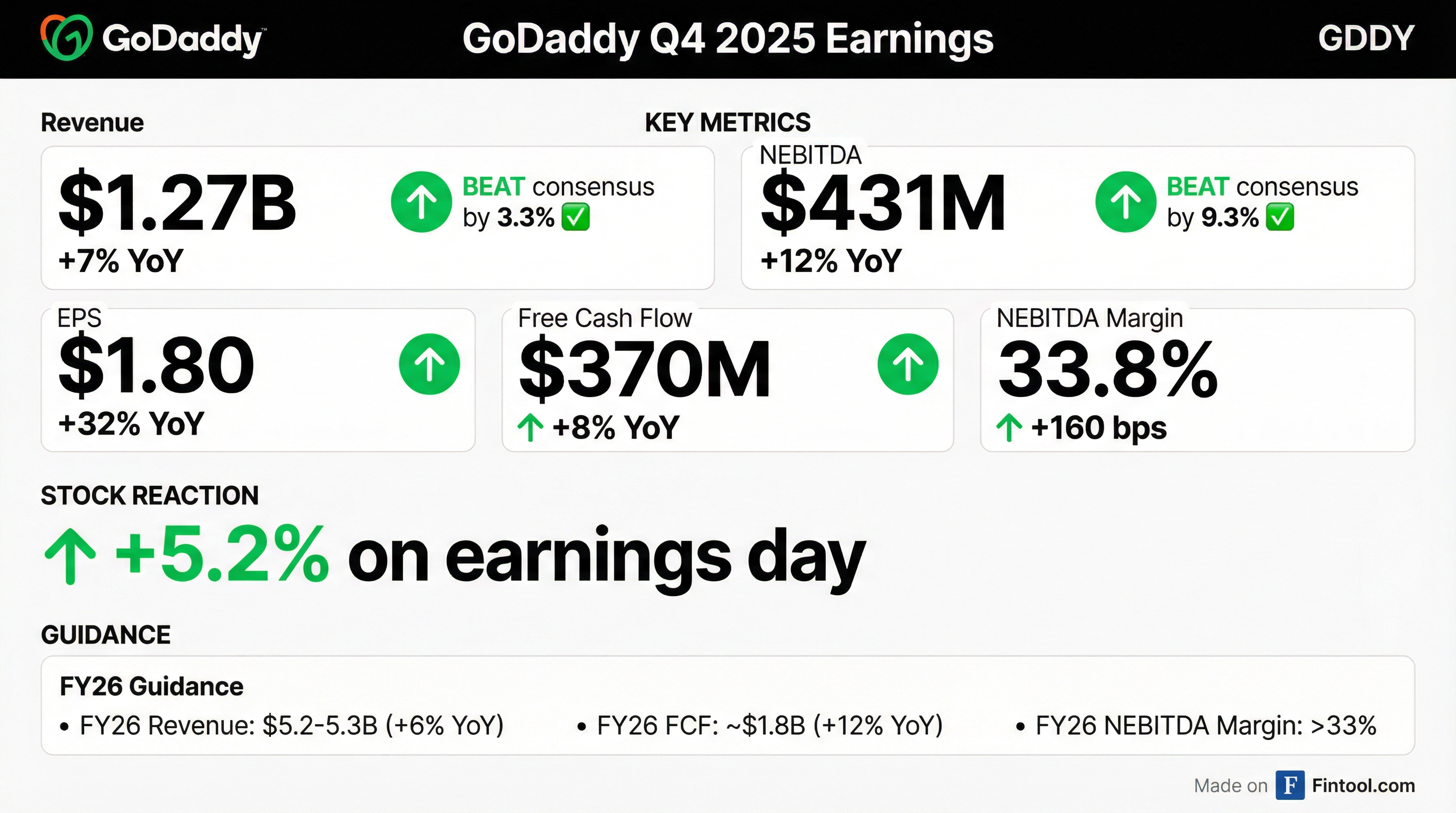

- Q4 2025 revenue grew 7% to $1.3 billion, normalized EBITDA increased 12% to $431 million (34% margin, +160 bps), and free cash flow rose 8% to $370 million.

- FY 2025 revenue was approximately $5 billion (8% YoY), normalized EBITDA reached $1.6 billion (32% margin), and free cash flow was $1.6 billion (19% growth).

- 2026 outlook: revenue of $5.195–5.275 billion (~6% growth), normalized EBITDA margin above 33%, and free cash flow of $1.8 billion with >1:1 conversion.

- Advanced AI strategy by launching Airo.ai beta with 25 live agents and introduced Agent Name Service (ANS) in partnership with MuleSoft for verifiable agent identities.

- Rolled out a promotional .com one-year domain offer to boost new customer acquisition, which increased volume but reduced initial bookings; the funnel and term mix are being optimized for long-term value.

- GoDaddy delivered 7% revenue growth in Q4 to $1.3 billion, with Normalized EBITDA up 12% to $431 million (34% margin) and 8% free cash flow growth to $370 million.

- For full-year 2025, revenue rose 8% to $5.0 billion, Normalized EBITDA grew 14% to $1.6 billion (32% margin), and free cash flow increased 19% to $1.6 billion, while net leverage stood at 1.6x and $1.6 billion was spent on share repurchases.

- 2026 guidance calls for $5.195–5.275 billion in revenue (+6%), >33% Normalized EBITDA margin, and ~$1.8 billion free cash flow; Q1 revenue of $1.25–1.27 billion (+6%) and 32% EBITDA margin.

- AI initiatives advanced with Airo.ai beta (25 live agents), an internal AI sales agent, and the Agent Name Service integration with MuleSoft, alongside a new AI-powered website builder for Websites + Marketing.

- Go-to-market evolution introduced a promotional one-year .com offering to expand the top of funnel, driving subscription unit growth but creating near-term bookings headwinds expected to normalize through 2026.

- Q4 revenue of $1.3 billion (up 7% YoY) with Normalized EBITDA of $431 million (34% margin, +160 bps) and free cash flow of $370 million (+8%).

- Full year 2025 revenue of $5.0 billion (+8% YoY), Normalized EBITDA of $1.6 billion (32% margin, +150 bps), and free cash flow of $1.6 billion (+19%).

- Returned 100% of free cash flow via repurchases of 10.2 million shares for $1.6 billion; year-end liquidity of $2.1 billion and net leverage of 1.6×.

- 2026 guidance calls for revenue of $5.195 billion–$5.275 billion (≈6% growth at midpoint), Normalized EBITDA margin >33%, and free cash flow of $1.8 billion; Q1 revenue of $1.25 billion–$1.27 billion at ~32% EBITDA margin.

- Launched Airo.ai in beta with 25 live agents, aiming to drive AI-native small-business experiences and monetize through growing adoption.

- Full-year 2025 revenue reached $5.0 billion, up 8% YoY; operating income was $1.1 billion (23% margin); net income totaled $875 million; free cash flow was $1.6 billion.

- Q4 2025 revenue was $1.3 billion, up 7% YoY; operating income was $317 million (25% margin); net income amounted to $245.1 million; free cash flow was $370.3 million.

- For FY 2026, GoDaddy targets $5.195–5.275 billion in revenue (+6% YoY at midpoint), a NEBITDA margin of over 33%, and free cash flow of about $1.8 billion.

- D3 Global named Bob Mountain as Chief Commercial & Revenue Officer to lead business development, sales, partnerships, and operations.

- Mountain brings nearly 20 years of domain industry experience, having served as VP of Global Strategic Partnerships at GoDaddy and Chief Revenue Officer at Afternic.com.

- D3’s Doma Protocol mainnet, launched in November 2025, has onboarded registrar partnerships representing 30 million domains and distribution channels reaching 150 million Web3 users across Base and Solana.

- Since mainnet launch, D3 has issued tokens for 35 + premium domains, generating 1.2 million transactions and $27 million in trading volume, underscoring strong market demand.

- GoDaddy launched Airo.AI, its new agentic AI surface in beta, expanding from five to over two dozen agents to deliver outcome-driven “business-in-a-box” solutions for microbusinesses.

- Unveiled Agent Name Service (ANS) to register, validate and secure interactions between AI agents, extending DNS infrastructure and leveraging GoDaddy’s certificate trust roots for an open-internet standard.

- Emphasized monetization via higher average order sizes, premium subscriptions and strategic paywalls, with free cash flow per share as the North Star informed by two years of AI integration.

- Reported sequentially positive customer growth, driven by strong top-of-funnel traffic, increased $500+ customer cohorts, and resilient SMB demand evidenced by upbeat survey optimism and near-perfect retention.

- GoDaddy launched Airo.AI, a new agentic AI surface in beta featuring over two dozen agents tailored to different SMB personas, attracting natural traffic without paid promotion.

- Introduced Agent Name Service (ANS), an open‐standard extension of DNS to register and authenticate AI agents, enabling secure agent-to-agent collaboration beyond GoDaddy’s platform.

- Achieved sequentially positive customer growth, driven by strong top-of-funnel demand, higher-intent sign-ups, and increased attach rates, while SMB customers remain optimistic about their business prospects.

- Maintains a disciplined capital allocation strategy prioritizing free cash flow, with ongoing share repurchases and M&A opportunities evaluated against strategic and integration criteria.

- Three AI pillars: Airo consumer-facing agentic platform; internal AI-driven development writing 46% of all code in October; and Agent Name Service (ANS) to create an open agent ecosystem.

- Co-Founder Agent launching within two weeks to provide market analysis, business plans, and end-to-end setup (domains, websites, logos) for SMBs.

- Airo.ai drawing a distinct technical SMB cohort (e.g., sites in Arabic), demonstrating incremental customer segments and market potential.

- Rapid agent rollout: Expanded from 6 to 11 agents within 2.5 weeks, targeting 22 agents in one month under Airo Plus, focusing on seamless experiences before marketing investments.

- GoDaddy's AI strategy comprises three pillars: Airo, an agentic consumer platform; internal AI, with 46% of code written by AI as of October 2025; and ANS, an open Agentic Name Service for decentralized agents.

- GoDaddy will launch a Co-Founder Agent within two weeks to generate end-to-end business plans and autonomously execute tasks like website, domain, and branding creation under the Airo Plus bundle.

- Airo.ai has organically attracted a distinct, more technical customer cohort, with use cases such as full Arabic right-to-left e-commerce site creation, indicating it reaches new segments beyond GoDaddy.com.

- The rollout includes an initial six agents announced on October 30, scaling to 22 agents by late November, focusing on seamless end-to-end experiences and high-quality telemetry-driven signal collection for value-based pricing.

- GoDaddy emphasizes its data advantage, proprietary SSL, domain, and hosting infrastructure, and plans to enable third-party agents via ANS to expand agentic technology adoption on an open internet.

- GoDaddy detailed its three AI pillars: consumer-facing Airo (now agentic via Airo.ai), internal AI-driven development (46% of code AI-written), and the open-agent standard Agentic Name Service (ANS).

- A Co-Founder Agent will launch within two weeks to automate business ideation, competitive analysis, pricing strategy, and full online presence creation, all bundled under Airo Plus.

- Since announcing on October 30, GoDaddy has deployed 6 agents and plans to expand to 22 end-to-end agents within a month, prioritizing seamless user experiences before scaling marketing efforts.

- AI-driven offerings on Airo.ai are being experimented with as incremental pay-wall features, with learnings funneled into GoDaddy.com’s value-based pricing and bundling framework.

Quarterly earnings call transcripts for GoDaddy.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more